Bitcoin’s value has held regular round $108,100 as of Saturday afternoon after huge holders shipped out a large load of cash.

Primarily based on reviews, whales—these early adopters and massive miners—offered over 500,000 BTC up to now 12 months. At immediately’s charges, that stash is value north of $50 billion. Establishments grabbed virtually each coin they let go. It’s an enormous shift in who actually owns Bitcoin.

Whales Cross The Torch

Based on Bloomberg’s evaluate of 10x Analysis knowledge, wallets holding between 1,000–10,000 BTC noticed their balances slip from over 4.5 million cash in January 2023 to about 4.47 million in July 2025.

On the identical time, addresses with 100–1,000 BTC jumped from almost 4 million to 4.77 million. That shift reveals huge gamers trimming again whereas medium‑measurement holders, typically funds or rich shoppers, construct their stacks. It’s occurring quietly by means of in‑sort transfers and personal offers that skip public exchanges.

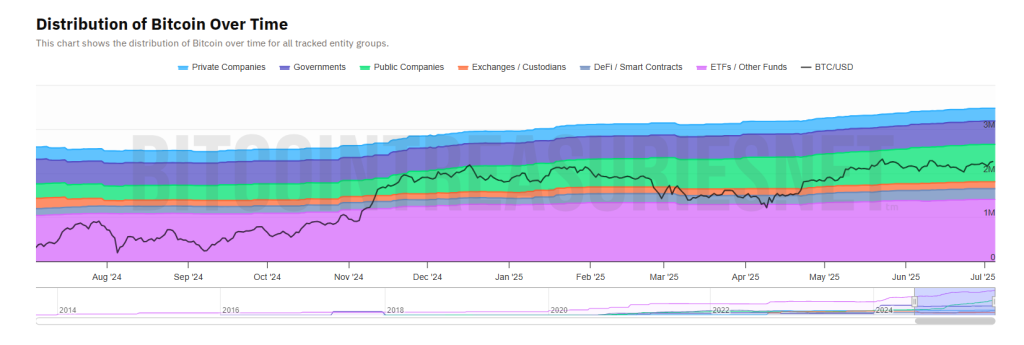

Supply: Bitcoin Treasuries

Establishments Ramp Up Their Stakes

Funds, ETFs and company treasuries have scooped up virtually each coin dropped by whales. Knowledge from Bitcoin Treasuries reveals personal corporations boosted their holdings from 279,374 BTC in July 2024 to 290,883 BTC immediately.

Public corporations climbed from 325,400 BTC to 848,600 BTC. ETFs led the cost, elevating their stability from 1,039,000 BTC to 1,405,480 BTC. In complete, these teams added 899,198 BTC—about $96 billion—over the previous yr. That purchasing energy has helped maintain the market in stability as whales step again.

Shift In On-Chain Holdings

Medium-sized wallets are rising whereas the most important ones shrink. That development suggests new forms of traders are transferring in.

Edward Chin, co‑founding father of Parataxis Capital, stated in‑sort transfers let cash transfer from nameless holders to regulated corporations with out public trades. This quiet pipeline boosts on‑chain exercise and brings extra oversight to huge Bitcoin trades.

Volatility Hits Two-Yr Low

As institutional flows rise, value swings have dulled. The Deribit 30‑day volatility gauge sits at its lowest stage in two years. Jeff Dorman, CIO at Arca, in contrast immediately’s Bitcoin to a gradual dividend payer which may ship annual beneficial properties within the 10–20% vary.

That’s a far cry from the 1,400% surge seen in 2017. For lengthy‑time period savers, steadier returns look extra engaging than wild rallies.

In the meantime, Fred Thiel, CEO of miner MARA Holdings, stated his firm nonetheless holds each coin it mines. However he warned that if whale promoting picks up once more and institutional urge for food fades, costs may lurch decrease.

Featured picture from Meta, chart from TradingView

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.