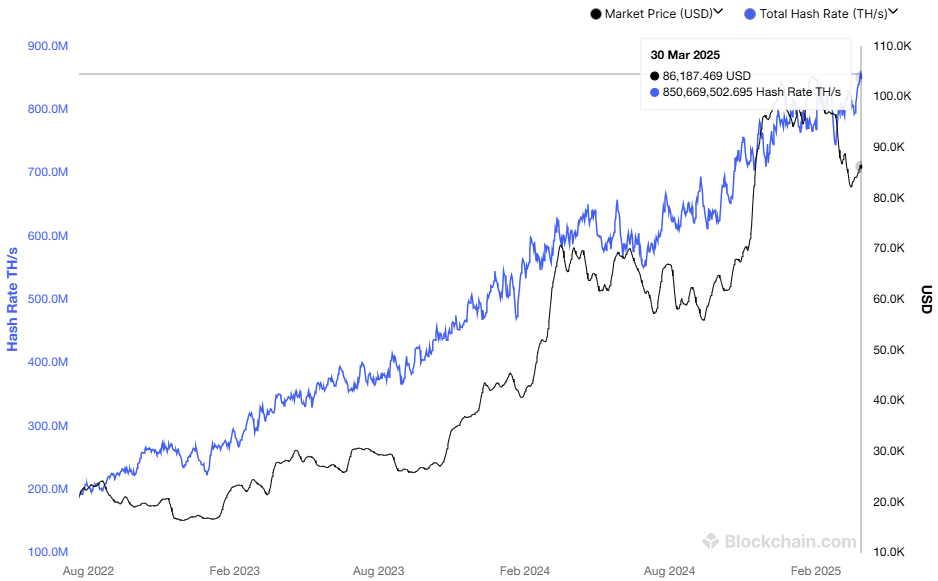

The Bitcoin mining trade is changing into more and more aggressive because the community’s hashrate reaches an all-time excessive (ATH). On the finish of March 2025, Bitcoin’s hashrate hit 850 million TH/s.

Nonetheless, alongside this spectacular development, the trade is battling rising manufacturing prices and new tariff obstacles, significantly within the US. These elements are placing vital stress on mining firms and will reshape the sector’s future.

Hashrate Surges, Mining Prices Soar

Bitcoin’s hashrate measures the full computing energy utilized by miners to safe the community and validate transactions. It’s expressed in terahashes per second (TH/s), representing the variety of hash calculations the community performs each second.

In accordance with Blockchain.com, Bitcoin’s hashrate surpassed 850 million TH/s in March. This enhance displays an increase in miners becoming a member of the community and rising confidence in Bitcoin’s worth and safety.

Bitcoin Hashrate. Supply: Blockchain.com

“Every time the community will get stronger, Bitcoin turns into tougher to assault, tougher to disregard, and extra justified in commanding a better valuation. This isn’t simply code. It’s financial gravity. Bitcoin has develop into probably the most safe financial community humanity has ever seen. And it’s solely getting stronger.” — Thomas Jeegers, CFO & COO of Relai commented.

Regardless of this surge in hashrate, mining income will not be rising accordingly. In accordance with a report from Macromicro, the price of mining one Bitcoin has doubled since early 2024, now reaching $87,000. The principle drivers behind this enhance are rising electrical energy costs and the excessive operational prices of specialised mining {hardware} (ASICs).

With Bitcoin’s value fluctuating, many mining firms danger working at a loss except they optimize their effectivity. This problem is especially extreme for smaller miners, who lack the size benefits or entry to low cost electrical energy that bigger companies take pleasure in.

Tariff Challenges and Dependence on Chinese language {Hardware}

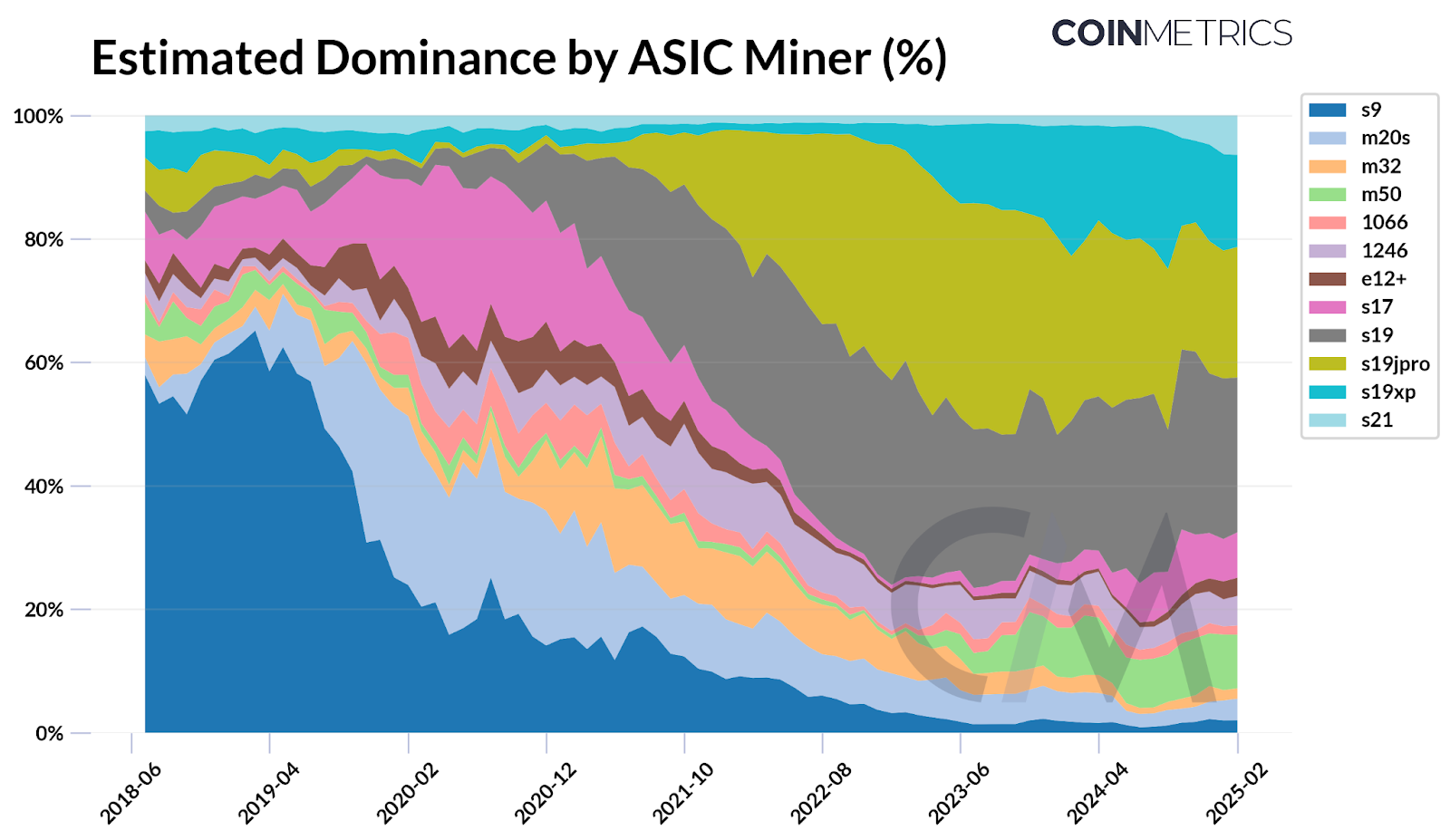

One other main impediment for Bitcoin miners is commerce restrictions, significantly within the US. In accordance with CoinMetrics, ASIC miners produced by Bitmain, a Chinese language firm, account for about 59%–76% of Bitcoin’s whole hashrate.

Estimated Dominance by ASIC Mainer. Supply: CoinMetrics.

Bitmain has lengthy been a dominant participant in mining {hardware}, with well-liked fashions just like the Antminer S19 and S21 identified for his or her excessive effectivity. Nonetheless, in early 2025, some US mining firms skilled delays in receiving Bitmain shipments on account of tighter customs controls and new tariffs on Chinese language imports.

“With Bitmain accounting for a majority of Bitcoin’s community hashrate, reliance on a single producer, regardless of having distributed provide chains, presents a possible danger. Since Bitmain is based totally in China, its dominance highlights how geopolitical dependencies can have an effect on the steadiness of mining operations,” CoinMetrics reported.

These tariffs will not be new. In accordance with SCMP, the US has imposed duties of as much as 27.6% on imported mining tools from China since 2018.

Nonetheless, latest measures point out growing regulatory scrutiny and commerce pressures, additional elevating import prices for mining {hardware}. This inflates operational bills for US-based miners and disrupts provide chains, limiting their potential to scale as international hashrate rises.

Just lately, Hut 8 Corp., a Bitcoin mining and high-performance computing infrastructure agency, partnered with Eric Trump and Donald Trump Jr. to ascertain American Bitcoin Corp.

The corporate goals to develop into the biggest and most effective pure-play Bitcoin mining operation globally whereas constructing a powerful strategic Bitcoin reserve. This transfer highlights the growing curiosity from US institutional traders within the aggressive mining trade.