On Wednesday, the value of bitcoin plummeted under the $100,000 mark, hitting an intraday low of $99,997 per coin. The entire crypto market has taken successful, dropping 5.74% up to now 24 hours, with quite a few cash feeling the sting of heavy losses.

Bitcoin’s Rollercoaster Week: From Report Excessive to Sub-$100K Slide

It appears like solely yesterday when bitcoin soared to its all-time peak of $108,364. And guess what? It was! However then, the very subsequent day on Wednesday afternoon, bitcoin slid into the $105K vary. After the U.S. Federal Reserve’s Federal Open Market Committee (FOMC) assembly, bitcoin took one other nosedive because the central financial institution hinted at a slower tempo for future charge reductions.

BTC/USD 1H chart by way of Bitstamp on Dec. 18, 2024 when bitcoin dropped under the $100,000 vary.

In the long run, BTC dipped below the $100K threshold, only a hair’s breadth away at $99,997 per coin, and as of 8 p.m. ET on Dec. 18, it’s cruising at $100,563 per coin. Bitcoin took a 4.8% tumble towards the U.S. greenback, whereas ethereum (ETH) skidded by 5.5%. Though many main cash solely confronted minor setbacks, meme coin property took a a lot steeper plunge. The infamous meme coin peanut the squirrel (PNUT) plummeted by 19.24%, and popcat (POPCAT) wasn’t far behind, dropping 18.80%.

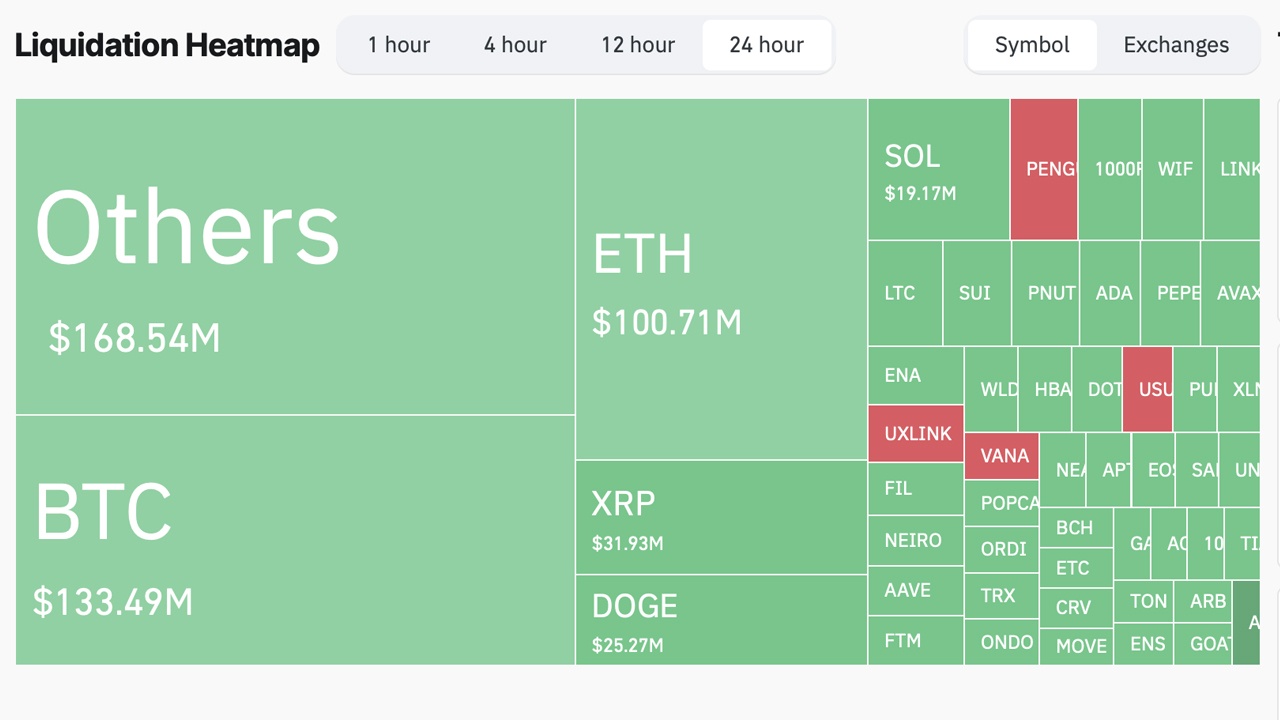

Past the slew of meme cash, fantom (FTM) slid down 12.52%, thorchain (RUNE) misplaced 12.47%, and theta token (THETA) was hit with a 12.33% decline. Regardless of the overall droop within the crypto markets, world buying and selling quantity has jumped by 31%, reaching $248.41 billion within the final day. Tether (USDT), bitcoin (BTC), and ethereum (ETH) lead the pack in day by day buying and selling volumes. In the meantime, over within the derivatives markets, $671.52 million in positions had been worn out in simply 24 hours. Most of those liquidations had been for lengthy positions in BTC, ETH, XRP, DOGE, SOL, and LTC, based on coinglass.com metrics.

The newest dip available in the market is a stark reminder that the bull run’s latest pleasure can, every so often, be as fragile as a home of playing cards, with even the slightest trace of macroeconomic change inflicting wild swings. As bitcoin bounces again simply over the $100,000 threshold, the general market’s response exhibits us simply how whimsically investor temper swings with outdoors forces. Meme cash and those that guess large on leverage felt the ache probably the most, spotlighting the rollercoaster nature of this market cycle.