Bitcoin steadied close to $90,000 on Thursday as contemporary U.S. labor knowledge strengthened a well-recognized 2026 theme: fewer layoffs, fewer hires, and a cooling financial system that refuses to crack.

Abstract

- Bitcoin worth has retreated by over 5.

- Stephen Miran, a high Fed official, helps 150 foundation factors rate of interest cuts this 12 months. Such a price lower can be extremely bullish for Bitcoin and different cryptocurrencies.

- Jobless claims knowledge counsel the U.S. labor market has settled right into a “low-hire, low-fire” equilibrium, the place employers are reluctant to put off staff however equally hesitant so as to add new ones.

Preliminary jobless claims edged up solely modestly within the first week of the 12 months, with 208,000 People submitting for unemployment advantages within the week ended Jan. 3, up from 200,000 every week earlier, the Labor Division mentioned. The determine got here in under economists’ expectations of 210,000, underscoring the labor market’s resilience whilst development momentum fades.

Bitcoin (BTC) was buying and selling round $90,464, up 1.2%, across the time of the discharge and briefly fell to its lowest degree since January 3 — over 5% from its highest degree this week.

The drop comes as American traders proceed promoting ETFs. Knowledge present that spot Bitcoin ETFs misplaced greater than $486 million on Wednesday, following a lack of greater than $243 million the day earlier than.

These ETFs have had cumulative inflows of $57 billion, down from final 12 months’s excessive of over $65 billion. They now maintain over $118 billion in belongings, equal to six.5% of their market capitalization.

Jobless claims

Persevering with claims, which observe folks receiving advantages past an preliminary week, rose to 1.91 million within the week via Dec. 27 from 1.86 million, indicating rising issue to find new work. Seasonal distortions across the holidays have added volatility to the info, however claims stay close to the low finish of their vary over the previous 12 months.

Different indicators paint a much less tranquil image. A report from Challenger, Grey & Christmas confirmed U.S. employers introduced 1.206 million job cuts in 2025, a 58% improve from the prior 12 months and the very best whole in 5 years, pushed largely by federal companies and know-how corporations restructuring round AI. Hiring plans fell 34% to their lowest degree since 2010.

Job openings have additionally thinned, falling to a 14-month low in November, with simply 0.91 openings per unemployed employee — the weakest ratio since March 2021. Consideration now turns to Friday’s nonfarm payrolls report, the place economists count on job development of 73,000 and an unemployment price of 4.5%, a key check of whether or not the labor market is stabilizing or slipping additional into slowdown.

Fed officers say…

Stephen Miran, a senior Federal Reserve official, continued to make the case for extra cuts this 12 months. He hopes that the opposite officers will conform to 150 foundation factors cuts to spice up the labor market. He mentioned:

“I’m on the lookout for a few level and a half of cuts. A number of that’s pushed by my view of inflation. Underlying inflation is working throughout the noise of our goal, and that’s an excellent indication of the place total inflation goes to be going within the medium time period.”

Miran, whom President Donald Trump appointed, has develop into one of the vital dovish central financial institution officers, supporting 50-basis-point cuts at every of the three conferences.

You may additionally like: Zcash worth breaks down under key trendline assist, eyes drop to $300

Nonetheless, it’s unclear whether or not Miran’s request for extra cuts will develop into a actuality, as extra officers have been reluctant to implement them. The dot plot from the final assembly confirmed that officers count on to ship another lower this 12 months.

Miran’s 150 foundation level cuts can be bullish for Bitcoin worth because it usually does effectively in an period of simple cash. Moreover, the lower will come because the U.S. authorities delivers additional stimulus, significantly within the type of tax refunds.

The typical tax refund for people can be about $3,167, up from $3,138 in 2024. Extra refunds, tax cuts, and the rising M2 cash provide can be bullish for Bitcoin and different altcoins

Bitcoin worth technical evaluation factors to extra beneficial properties

BTC worth chart |Supply: crypto.information

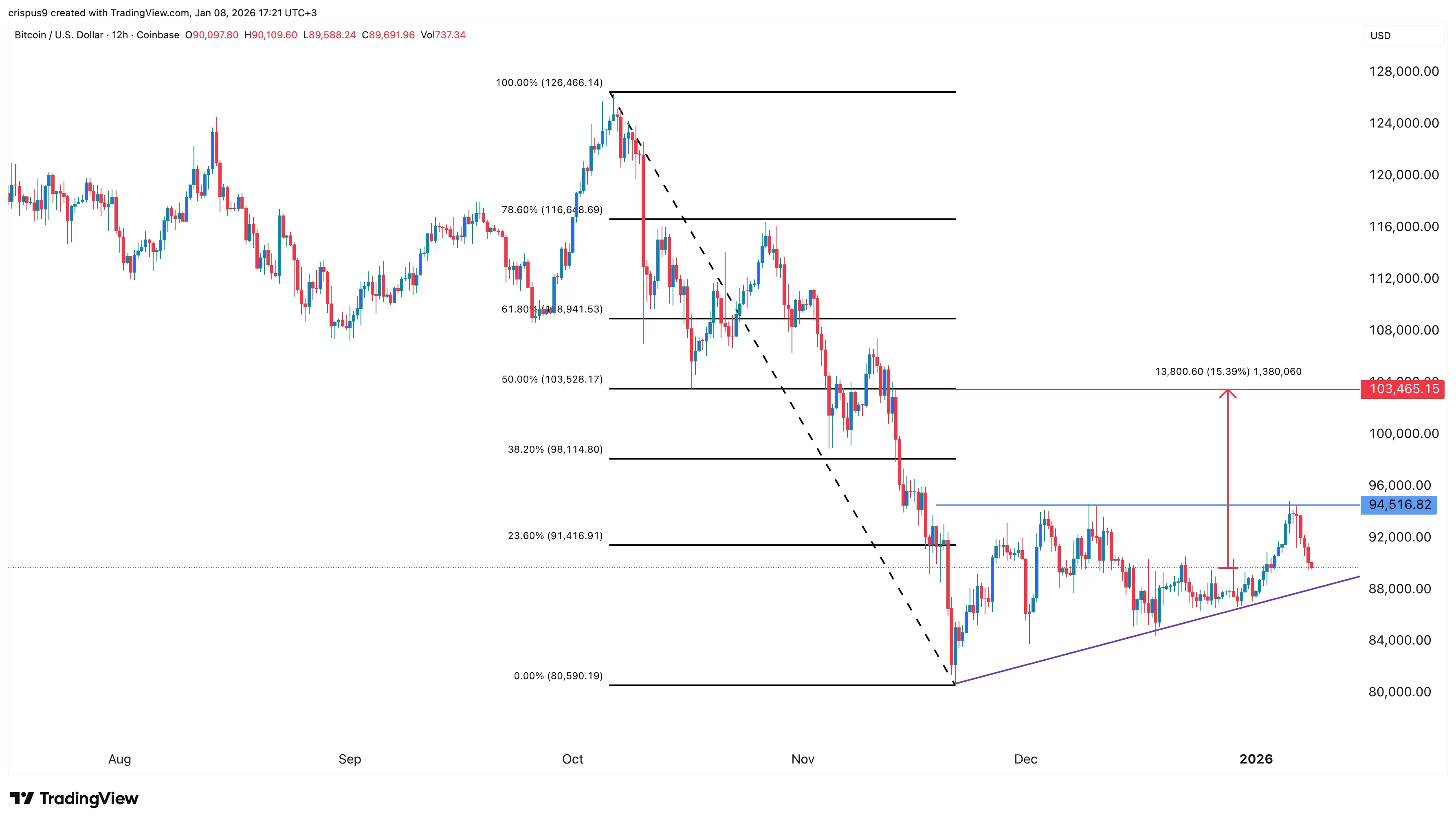

The 12-hour chart exhibits that Bitcoin worth has continued rising previously few months, transferring from a low of $80,590 in November to a excessive of $94,516.

It has now fashioned an ascending triangle sample, whose resistance degree is at $94,516, and the diagonal trendline connects the bottom swings since November.

Due to this fact, the more than likely BTC worth prediction is bullish, with the subsequent key goal being at $103,465, the 50% Fibonacci Retracement degree. This goal is about 15% above the present degree.

You may additionally like: XRP ETFs log first outflow after 36‑day influx streak, SoSoValue knowledge exhibits