- Bitcoin hovers round $82,500 on Wednesday after recovering 5.52% the day gone by.

- A K33 report highlights heavy sell-offs in equities and crypto markets amid rising issues over a fragile world economic system.

- Merchants ought to stay cautious because the upcoming US macro information releases may convey extra volatility in dangerous belongings like Bitcoin.

Bitcoin (BTC) value hovers round $82,500 on Wednesday after recovering 5.52% the day gone by. A K33 report highlights heavy sell-offs in equities and crypto markets amid rising issues over a fragile world economic system. Merchants ought to stay cautious because the upcoming US macro information releases may convey extra volatility in dangerous belongings like Bitcoin.

Crypto markets see heavy sell-offs amid heightened world financial issues — K33 studies

Tuesday’s K33 Analysis ‘Forward of the Curve’ report explains that equities and crypto markets have been hit with heavy sell-offs as issues a couple of fragile world economic system have heightened.

Elevated recession fears, US President Donald Trump’s dedication to reducing 10-year bond yields, and the primary swings of a effervescent commerce conflict have pushed the S&P 500 and Nasdaq to lows not seen since mid-September. Equally, BTC reached new yearly lows of $76,555 and noticed a weekly return of -5%.

The report continues that whereas many Trump measures have contributed to spooking the market into heavy de-risking, the President has delivered his crypto guarantees by establishing a crypto working group and launching a US BTC reserve final week. This justifies BTC’s relative outperformance in comparison with fairness indices for the reason that election.

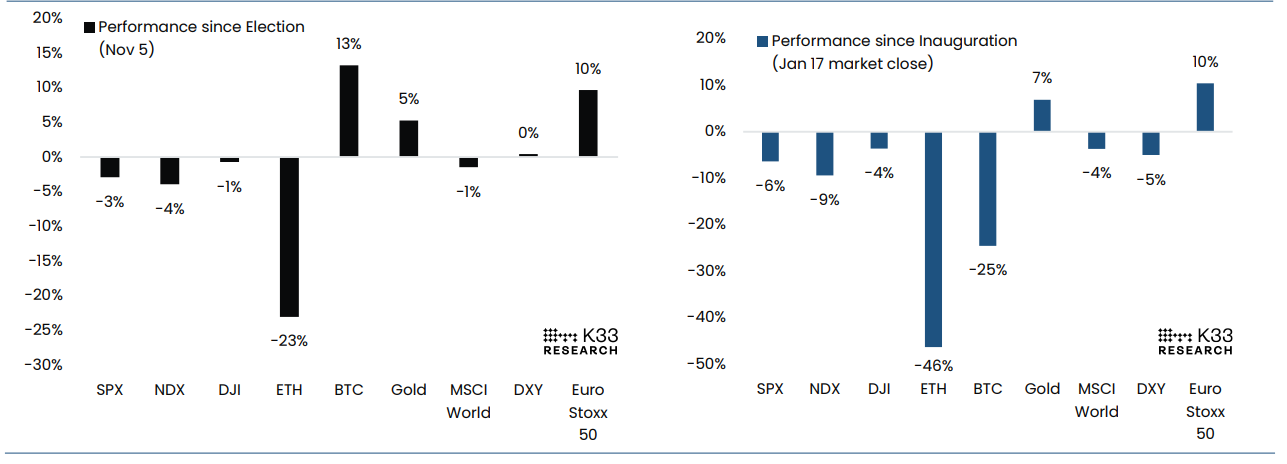

The graph under exhibits the main asset returns for the reason that election (left) and the inauguration day (proper). Because the election, BTC’s efficiency has been 13%, outperforming different asset lessons. Nonetheless, its efficiency for the reason that inauguration (January 13 market shut) has been adverse 25%, the second worst-performing asset (Ethereum is -46%).

Main asset returns: Since election vs. inauguration chart. Supply: K33 Analysis

“We basically disagree with pundits attributing the current sell-off to an underwhelming US reserve,” studies a K33 analyst.

The analyst continues, “This reserve is a watershed second for Bitcoin. The US authorities has dedicated to carry seized belongings and even discover paths to accumulate extra BTC available in the market. This can be a large leap ahead in legitimizing BTC as a worldwide retailer of worth and is an enormous disconnect from its current efficiency pushed by different market forces. Whereas world market uncertainties might have time to be resolved, we understand present value ranges and the interval forward as a stable alternative to purchase and maintain BTC long-term.”

In an unique interview with FXStreet, Ian Balina, CEO of Token Metrics, defined that Bitcoin’s decline, regardless of favorable rules and rising BTC reserves, is essentially pushed by macroeconomic issues, notably tariff disputes between america, Canada, India, and different international locations. He famous that this has prompted a shift in the direction of liquidity, with ‘buyers taking earnings and adopting a extra cautious stance.’

Balina additionally predicted continued volatility, highlighting the $70,000 help stage however warning that the prevailing bearish and risk-off sentiment leaves room for additional draw back.

Bitcoin value may count on volatility across the upcoming FOMC assembly

Merchants and buyers are intently watching the US macroeconomic information releases – the Shopper Worth Index (CPI) on Wednesday and the Producer Worth Index (PPI) on Thursday – which may convey extra volatility for dangerous belongings like Bitcoin and form the path of equities and digital belongings forward of the Federal Reserve (Fed) rate of interest determination on March 19.

In an unique interview, Ryan Lee, Chief Analyst at Bitget Analysis, advised FXStreet, “The FOMC assembly this week will probably consequence within the Federal Reserve preserving charges at 4.25%-4.50%, with a neutral-to-cautious tone.”

Lee continued although a hawkish shift may emerge if inflation issues resurface. Crypto costs like Bitcoin would possibly stagnate or drop from their present $83,000-$76,000 vary, particularly if a hawkish end result strengthens the US Greenback (USD) and yields, pressuring danger belongings.

“Even a dovish shock like a fee reduce could fail to ignite a sustained rally, given potential market skepticism and overriding macro uncertainties. On the identical time, the tip of quantitative tightening presents solely modest help at greatest,” Lee defined.

Bitcoin Worth Forecast: RSI bounces off oversold situations

Bitcoin value broke under its 200-day EMA at $85,664 on Sunday and declined 9.14% till the subsequent day. Nonetheless, BTC pushed decrease, discovered help across the $76,600 stage, and recovered 5.52% on Tuesday. On the time of writing on Wednesday, it hovers at round $82,500.

If BTC continues to right and closes under $78,258 (February 28 low), it may lengthen the decline to retest its subsequent help stage at $73,072.

The Relative Power Index (RSI) on the every day chart reads 39, pointing upwards after bouncing off from 30 on Monday, indicating fading bearish momentum and a possible shift from oversold situations. Nonetheless, the RSI should transfer above its impartial stage of fifty for the restoration rally to be sustained.

BTC/USDT every day chart

If bullish momentum mounts, BTC may lengthen the restoration to $85,000.