- Bitcoin value hovers round $95,00 on Monday after falling almost 3% over the weekend.

- President Trump acknowledged a doable recession however goals to announce at the very least one commerce deal this week, the Wall Road Journal studies.

- On-chain information reveals that BTC holders are realizing income, growing the downward strain on value.

Bitcoin (BTC) value is hovering round $95,000 on the time of writing on Monday after going through a pullback of almost 3% over the weekend. US President Donald Trump acknowledged a doable recession however goals to announce at the very least one commerce deal this week, the Wall Road Journal studies. On-chain information reveals that BTC holders are realizing income, growing the downward strain on value.

Combined alerts on the financial system, commerce offers increase risk-off sentiment

A Wall Road Journal (WSJ) report on Sunday stated President Trump is downplaying issues a couple of potential financial downturn whereas pursuing aggressive commerce and financial insurance policies.

The report explains that, in accordance with a senior administration official, the White Home goals to announce at the very least one take care of a rustic searching for to flee increased tariffs within the coming week.

Regardless of inner and exterior criticism from Warren Buffett, Trump continues to make use of tariffs as leverage to spice up home manufacturing. The legendary investor and chairperson of Berkshire Hathaway, breaking his tariff silence, criticized protectionist insurance policies over the weekend.

“Commerce shouldn’t be a weapon,” Buffett stated at Berkshire Hathaway’s annual assembly.

In the meantime, Congress is engaged on a tax-and-spending invoice that might supply some stability, although tensions with China and unsure financial alerts stay. Furthermore, in an interview that aired Sunday, Trump acknowledged a doable recession however claimed his insurance policies would drive a increase within the US, distancing present financial traits from former US President Biden’s legacy.

Whereas there are indicators of market resilience, like current inventory market good points and better-than-expected US employment numbers in April, suggesting the financial system is holding up effectively, economists are nonetheless involved that the continued commerce insurance policies and tariffs might ultimately trigger the financial system to decelerate.

This uncertainty enhance means risk-off sentiment out there, which doesn’t bode effectively for dangerous property like Bitcoin. Because the financial system weakens, traders might pull again from unstable property like Bitcoin in favor of safer choices like Gold.

Bitcoin holders notice revenue and enhance promoting strain

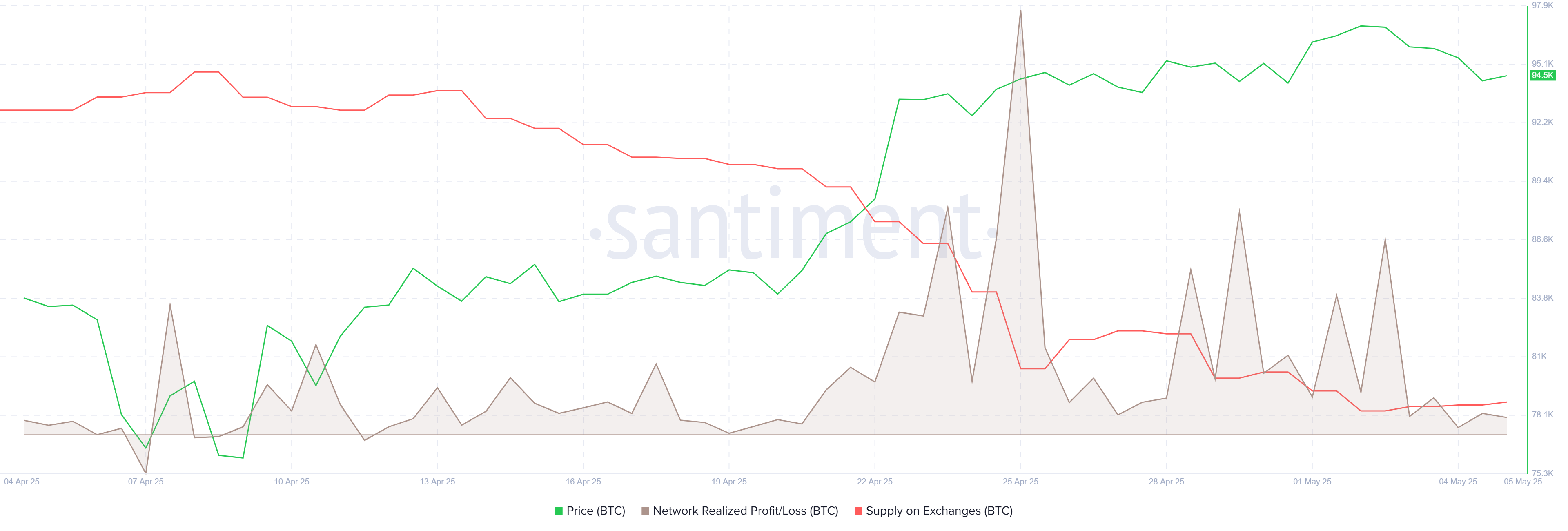

Bitcoin’s on-chain metrics present that BTC holders are reserving some income, in accordance with Santiments’ Community Realized Revenue/Loss (NPL), which computes a every day network-level Return On Funding (ROI) primarily based on the coin’s on-chain transaction quantity.

Sturdy spikes in a coin’s NPL point out that its holders are, on common, promoting their baggage at a major revenue. Alternatively, robust dips indicate that the coin’s holders are, on common, realizing losses, suggesting panic sell-offs and investor capitulation.

The metric confirmed a number of spikes final week, indicating that holders are, on common, promoting their baggage at a major revenue and growing the promoting strain.

BTC NPL chart. Supply: Santiment.

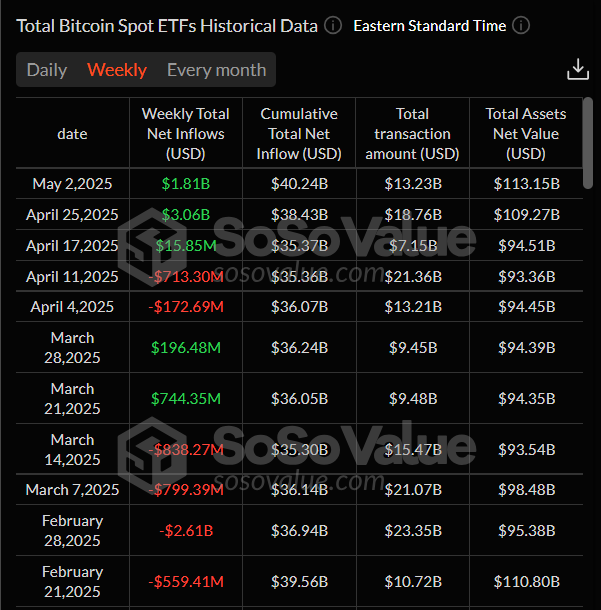

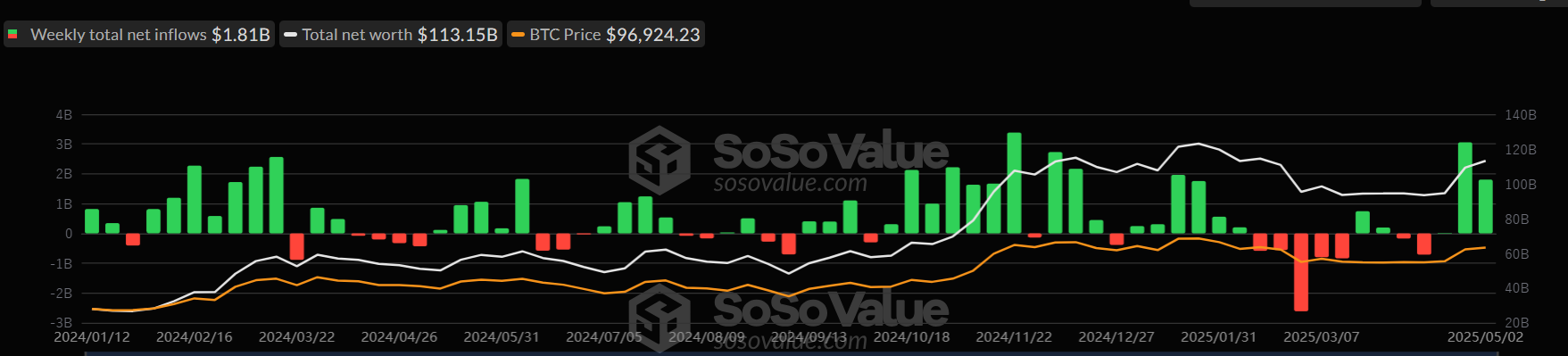

Nonetheless, institutional traders strongly demand Bitcoin regardless of holders reserving a revenue. In line with SoSoValue information, the US spot Bitcoin Change Traded Funds (ETF) recorded a complete influx of $1.81 billion final week after an influx of $3.06 billion the earlier one. If these inflows proceed and intensify, Bitcoin costs might rally additional.

Whole Bitcoin Spot ETFs weekly chart. Supply: SoSoValue

Bitcoin’s technical outlook suggests bearish divergence within the brief time period

Bitcoin value motion on the 4-hour chart reveals weak spot within the Relative Power Index (RSI) momentum indicator. The upper excessive within the BTC value fashioned on Friday doesn’t mirror the RSI’s decrease excessive for a similar interval. This improvement is termed a bearish divergence, usually resulting in a development reversal or short-term pullback. Furthermore, the Superior Oscillator indicator additionally moved under its impartial zero on Sunday, suggesting a bearish development forward.

If BTC continues its downward transfer, it might prolong the decline to retest the subsequent 4-hour assist degree of round $92,580.

BTC/USDT 4-hour chart

Trying on the every day chart, Bitcoin value retested and was rejected round its every day resistance degree of $97,700 on Friday. It then declined almost 3% over the subsequent two days. On the time of writing on Monday, BTC trades at round $95,000.

If BTC continues to right, it might prolong the decline to retest its subsequent key assist degree at $90,000.

The RSI on the every day chart reads 60 after being rejected from its overbought degree of 70 on Friday, indicating fading bullish momentum. If the RSI slips under its impartial degree of fifty, it might counsel a bearish momentum and a fall in Bitcoin’s value. Furthermore, the Shifting Common Convergence Divergence (MACD) is about to flip a bearish crossover, and if it happens, it might give a promoting sign and point out a downward development.

BTC/USDT every day chart

Nonetheless, if BTC recovers and breaks above its every day resistance at $97,700, it might prolong the good points to retest its psychological resistance at $100,000.