Bitcoin is hovering as soon as once more, however Bitcoin.com CEO Corbin Fraser needs to remind everybody that with its distinctive set of driving forces, bitcoin is on a long-term trajectory to reshape the worldwide economic system

Bitcoin Nears Historic Highs however Enormous Progress Is Nonetheless Forward

Bitcoin’s latest value motion has been spectacular, with the cryptocurrency approaching its all-time excessive. As of penning this, bitcoin is buying and selling round $72k, exhibiting sturdy momentum out there. Whereas the present short-term value motion is thrilling, it’s vital to keep in mind that it doesn’t matter what occurs over the subsequent weeks and months, over the long run bitcoin goes a lot, a lot larger. How excessive? Let’s stroll via it.

Over the previous decade, bitcoin has been the best-performing asset. With an astounding common annual development fee of 59%, it has far outpaced conventional investments:

• Shares: 15% common annual development

• Commodities: 12%

• Gold: 9.4%

• Actual Property: 5.6%

• Rising Markets: 2.6%

• Bonds: 0.78%

A number of key elements contribute to bitcoin’s sustained power: rising adoption and integration, inherent shortage, and macroeconomic circumstances formed by authorities insurance policies.

Institutional demand for bitcoin continues to develop. The bitcoin exchange-traded funds (ETFs) have attracted substantial curiosity from main monetary establishments. The U.S. Bitcoin ETF is probably the most profitable launch of an ETF in historical past, with inflows over $20 billion up to now this 12 months. This demand will improve by orders of magnitude as all establishments incorporate BTC, and bitcoin is built-in into new merchandise such because the monstrously giant choices advanced.

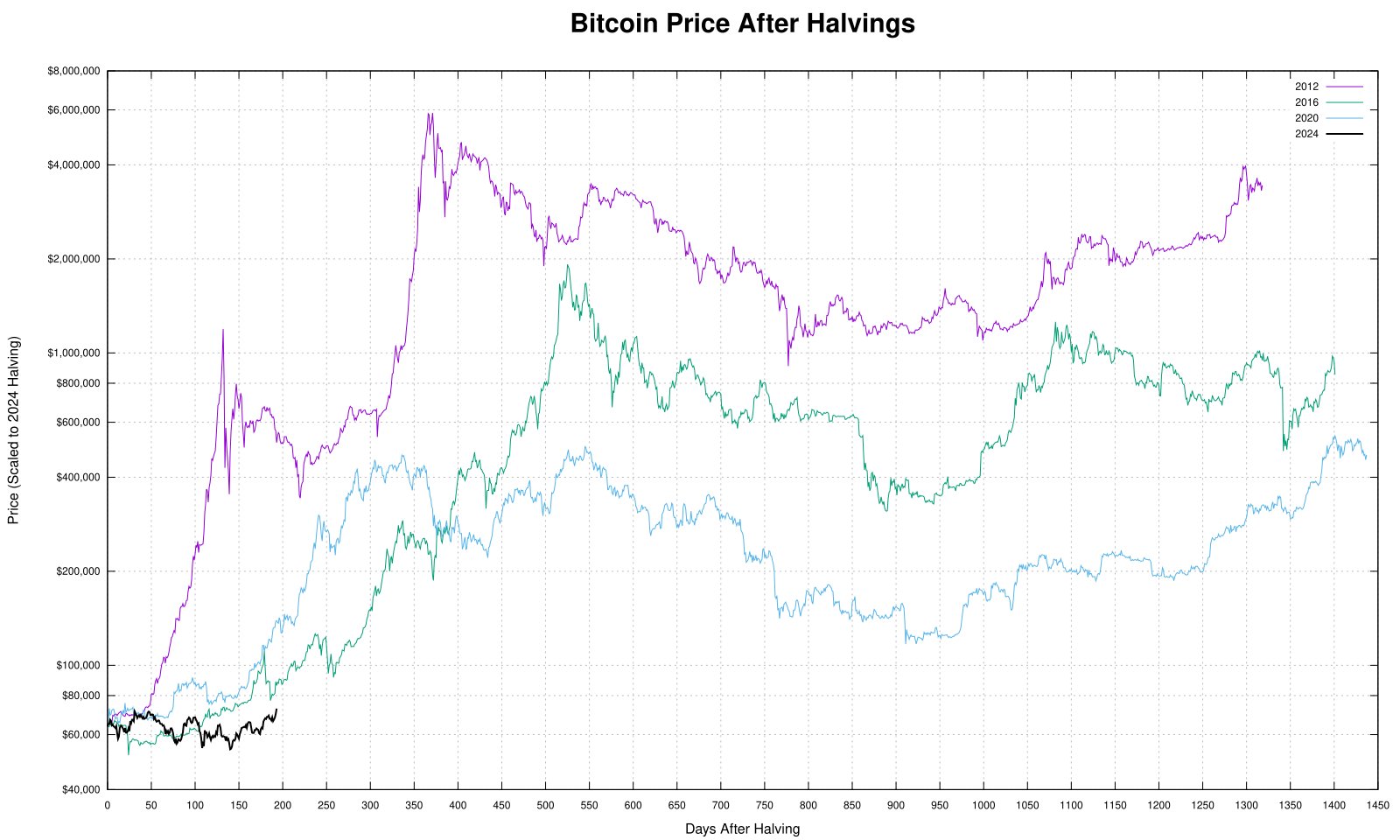

The shortage of bitcoin is one other important issue. With a hard and fast provide of 21 million cash and a reducing fee of latest coin issuance via halving occasions. The halving occasion that befell earlier within the 12 months is little question partially accountable for the present upward stress on bitcoin’s value. Traditionally, halvings have been adopted by vital value will increase with a 100+ day time lag.

Halving Tracker

Halving Tracker

Macroeconomic elements additionally play a big function. Central banks around the globe have engaged in unprecedented cash printing, resulting in inflation. Governments, companies, and individuals are all looking for belongings that may function a hedge in opposition to forex debasement, and bitcoin suits this function higher than the standard hedge, gold. The Fed, the U.S. central financial institution, had been in a tightening cycle, however just lately began reducing rates of interest signaling the start of an easing cycle. Now that the U.S. has signaled easing, governments around the globe will journey over themselves to ease much more.

Don’t’ consider me? One week after the U.S. introduced its reduce, China unleashed its largest injection of cash into its dying economic system in 4 years. They promised extra to come back. China gained’t be the one one doing this.

One other macroeconomic issue is the development of de-dollarization. The U.S. greenback, whereas nonetheless the dominant international reserve forex, has seen its share slowly decline—a long-term development averaging a 0.52 proportion level drop per 12 months since 1999. Components driving this shift embody the idiotic weaponization of the greenback (e.g., as a instrument for sanctions), which motivates nations to hunt various reserves, and the rise of different currencies like China’s renminbi in worldwide commerce. The web result’s the U.S. greenback weakens, and belongings resembling gold and bitcoin strengthen. It will solely speed up sooner or later.

These elements mix to make sure bitcoin’s worth will rise considerably sooner or later. At present, bitcoin’s market capitalization is round $1.2 trillion and rising, making it corresponding to main firms and a few commodities. To place this into perspective, if bitcoin’s market cap have been to match that of silver (roughly $1.8 trillion), one bitcoin could possibly be price round $108,020.

- Silver: $108,020

- Gold: $873,534

- USD M2: $1,085,641

- International M2: $4,359,238

- International equities $5,641,026

- International bonds: $6,666,667

- International actual property: $32,307,692

Whereas these figures could seem extraordinary, they present the potential for development that bitcoin possesses, real looking potential at that. As adoption will increase and the elements driving its worth proceed to strengthen, bitcoin isn’t just resilient—it’s laying the groundwork for unprecedented development.