For a lot of traders, 2025 looks as if a particularly bullish 12 months for the broader crypto market. However on the primary day, Bitcoin (BTC) faces intense promoting strain on day one, which has raised issues in regards to the flagship cryptocurrency’s capability to interrupt above $95,000.

On this evaluation, BeInCrypto examines Bitcoin’s short-term worth outlook utilizing key indicators.

Bitcoin Traders Put Sustained Uptrend in Doubt

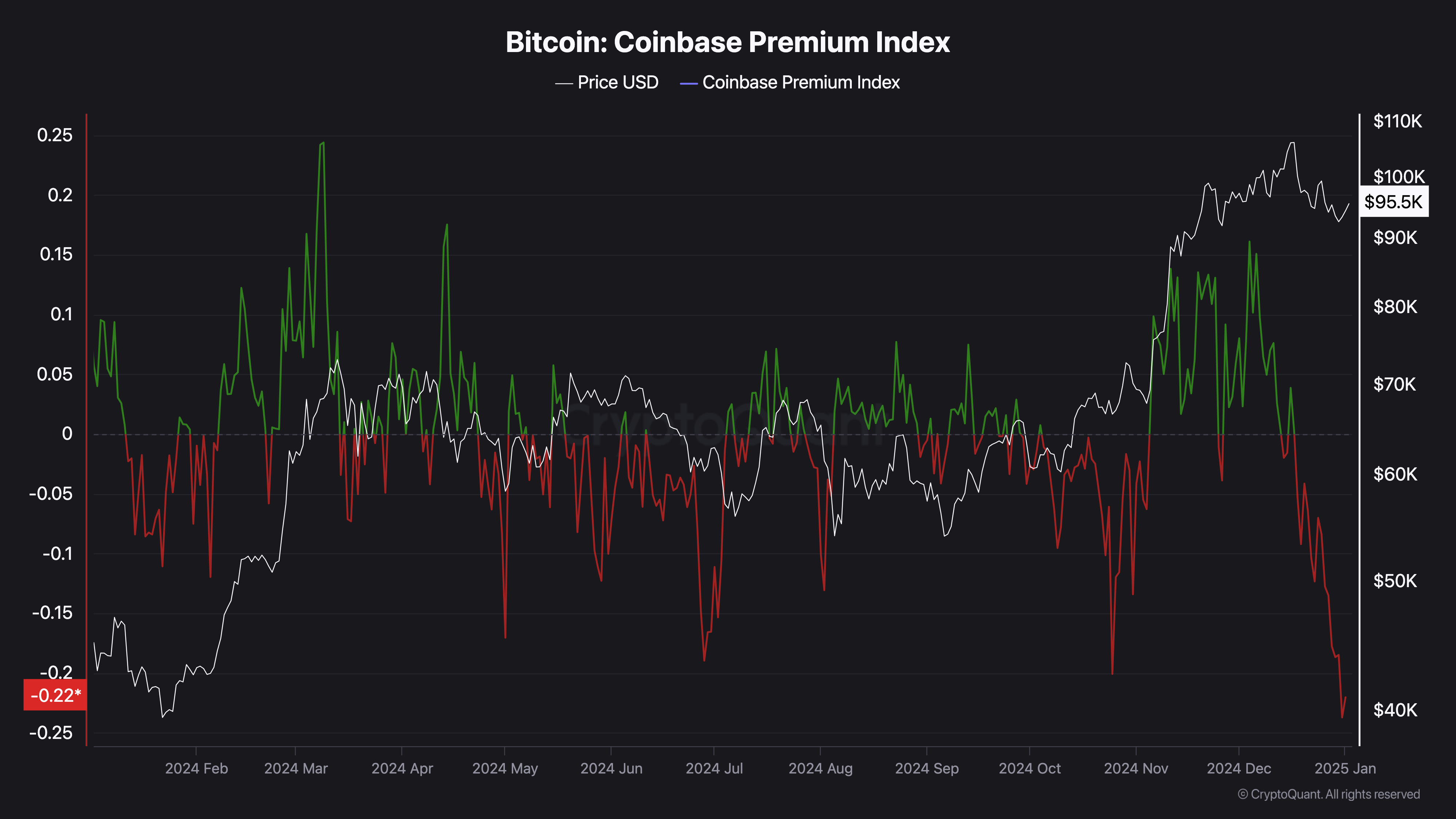

After the US elections in November 2024, the Bitcoin Coinbase Premium Index climbed to 0.14. The Coinbase Premium Index measures whether or not there’s robust shopping for strain amongst US traders or whether or not they’re promoting in giant volumes.

Excessive values, like these in November, point out robust promoting strain. Nevertheless, as of this writing, the index has dropped to -0.22, the bottom degree within the final 12 months. This important decline signifies that Bitcoin traders within the US are promoting their property.

Regardless of that, Bitcoin worth trades at $95,318, representing a light 2.06% enhance within the final 24 hours. Nevertheless, ought to these traders proceed to let go of their BTC, this development may change, and the value of cryptocurrency may slide decrease.

Following this growth, crypto analyst Burak Kesmeci famous that it might turn out to be troublesome for the Bitcoin worth to climb.

“Such tendencies can create a difficult surroundings for Bitcoin’s short-term worth restoration until we see a shift in macroeconomic situations or renewed curiosity from institutional or retail consumers,” Kesmeci opined by way of CryptoQuant.

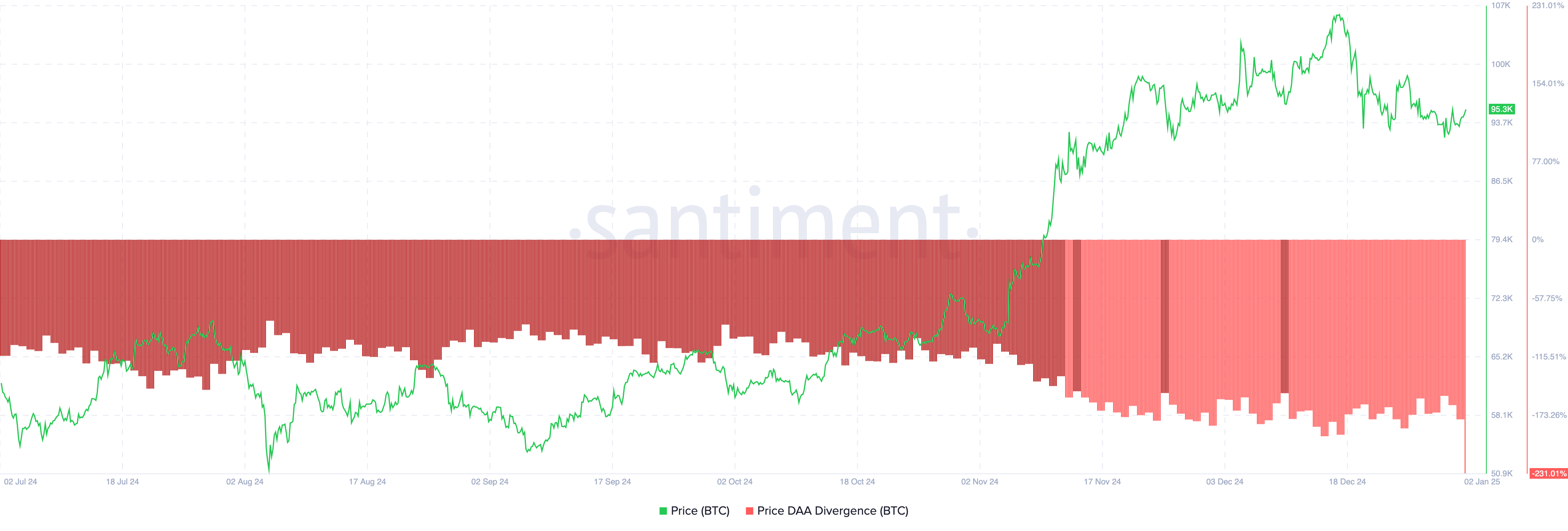

One other indicator that helps this outlook is the value — Day by day Lively Addresses (DAA) divergence. This metric measures the connection between consumer engagement on a blockchain and the value motion.

When it’s optimistic, it implies that consumer participation has improved, which is bullish for the cryptocurrency. Then again, a unfavorable studying signifies lowering consumer engagement, which is, in flip, bearish.

Bitcoin Worth DAA Divergence. Supply: Santiment

As proven above, Bitcoin’s worth DAA divergence is right down to 231%, indicating the latter. If this development persists, the chance of BTC buying and selling beneath the $95,000 mark might develop even stronger.

BTC Worth Prediction: Sub-$90,000 Ranges Nonetheless Attainable

Despite the fact that BTC has not too long ago elevated, the Exponential Shifting Common (EMA) means that the current upswing may not final. The EMA is a technical indicator that gauges development course relative to the value.

When the EMA slopes above the value, the development is bearish. However when the value is above the indicator, the development is bullish. As of this writing, Bitcoin’s worth is beneath 20 EMA (blue), suggesting that the worth of cryptocurrency may proceed to say no.

Bitcoin Day by day Evaluation. Supply: TradingView

Ought to the crypto fail to rise above the 20 EMA and Bitcoin promoting strain will increase, then the value may drop to $85,851. Nevertheless, if US traders contribute to Bitcoin’s shopping for strain, this development may change. In that situation, the coin’s worth may bounce to $108,398.