Ark is a novel off-chain transaction batching mechanism initially proposed by Burak, a younger Turkish developer. There are presently two implementations being constructed, one by Ark Labs, and the opposite by Second, neither of which Burak is concerned with.

The unique proposal for Ark was way more sophisticated, and concerned some design targets extra targeted round privateness than the implementations presently being constructed. It was additionally initially envisioned to require CHECKTEMPLATEVERIFY (CTV) so as to be constructed.

The protocol is determined by a central coordinating server so as to perform correctly, however regardless of that is ready to present the identical performance and safety ensures that the Lightning Community does. So long as a person stays on-line throughout the required time interval, always (except they select to belief the operator for brief intervals of time) each person is succesful at any time of unilaterally exiting the Ark system at any time and taking again full unilateral management of their funds onchain.

Not like Lightning, Ark doesn’t require customers to have pre-allocated liquidity assigned to them so as to obtain funds. An Ark person can merely onboard to a pockets and obtain funds instantly with no liquidity pre-allocation in any respect.

Let’s stroll by way of the completely different constituent items of Ark.

The Ark Tree

Cash held on Ark are known as Digital UTXOs (vUTXOs). These are merely pre-signed transactions that assure the creation of an actual UTXO beneath the unilateral management of a person as soon as submitted onchain, however are in any other case held offchain.

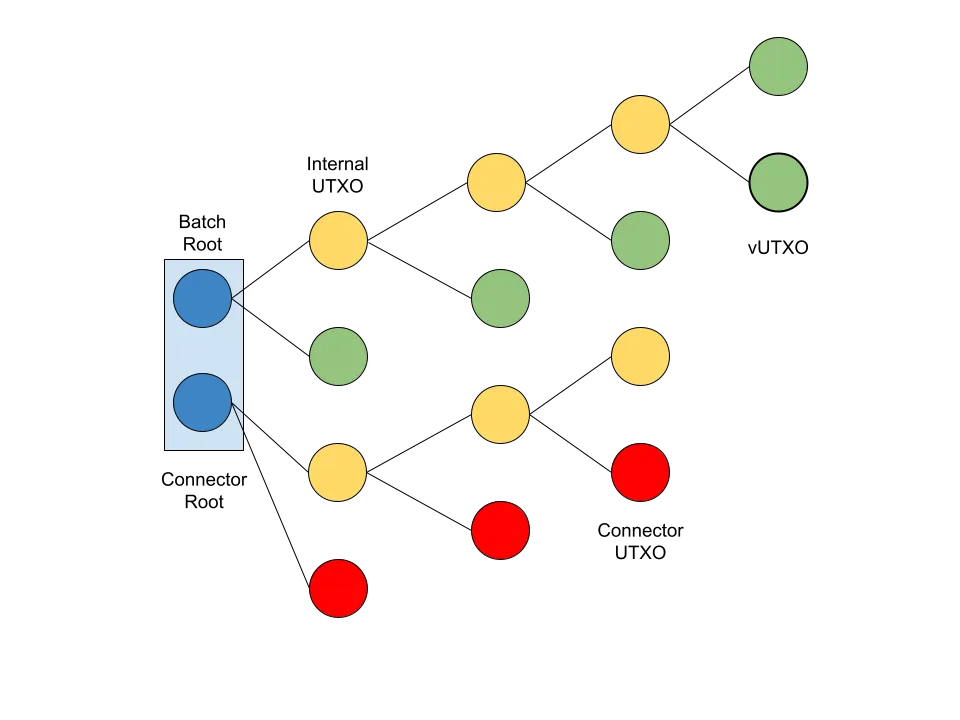

Each person’s vUTXOs are nested inside a tree of pre-signed transactions, or a “batch.” Ark works by having the coordinator server, or Ark Service Supplier (ASP), facilitate the coordination between customers essential to create a batch. Each time customers are receiving funds, onboarding to Ark, or offboarding, it’s essential to assemble a transaction and the related transaction tree to create a brand new batch.

The tree is constructed to take the one root UTXO confirmed onchain, locked with an n-of-n multisig together with all customers holding vUTXOs within the tree in addition to the ASP, and slowly break up into increasingly more UTXOs till finally reaching the leaves, that are every customers vUTXO. Every vUTXO is assured utilizing a script that must be signed by a 2-of-2 multisig, one key held by the person, and the opposite by the ASP, or simply the person after a timelock.

Every time the tree splits, vUTXOs are created onchain, however so are extra inside UTXOs which have but to really break up into vUTXOs. Every of those inside UTXOs is locked with an n-of-n multisig composed of the ASP, and all customers who’ve a vUTXO additional down the tree. Throughout the batch creation course of, customers begin at their respective vUTXOs, and undergo a signing course of all the way in which again down the basis of the tree. This ensures that the basis won’t ever be signed earlier than every person’s declare to a vUTXO is, making certain they all the time have unilateral entry in a worst case state of affairs to their funds.

Every batch additionally has an expiry time (which can make sense within the subsequent part). This expiry spend path, which exists as an alternate spending situation for the basis UTXO onchain in addition to each inside UTXO, permits the ASP to unilaterally spend all funds by itself.

Transactions, Preconfirmation, and Connector Inputs

With regards to transacting on Ark, there are two doable mechanisms which might be doable, each with their very own prices and implications when it comes to safety mannequin. There are out-of-round transfers, or preconfirmed transactions, and there are in-round transfers, or really confirmed transactions.

To conduct an out-of-round switch is a quite simple course of. If one person (Alice) desires to pay one other (Bob), they merely contact the ASP and have them co-sign a transaction spending the vUTXO to Bob. Bob is then on condition that pre-signed transaction, in addition to all the opposite ones previous it again to the batch root onchain. Bob is now able to unilaterally exiting the Ark with this transaction, however, he should belief the ASP to not collude with Alice to doublespend it. These out-of-round transactions may even be chained a number of occasions earlier than lastly confirming them.

To finalize an Ark transaction, customers have to have interaction in a “batch swap.” Customers can not really trustlessly verify a switch inside a single batch, they must atomically swap a vUTXO in an present batch with a recent vUTXO created in a brand new batch. That is executed utilizing the ASP as a facilitator of the swap, and with the help of what known as a “connector enter.”

When a person goes to finalize an Ark transaction with a batch swap, they relinquish management of the vUTXO to the ASP. This could possibly be problematic, what’s to cease the ASP from merely preserving it and never giving them a confirmed vUTXO in a brand new batch? The connector enter.

When a brand new batch is created, a second output is created within the transaction that’s confirmed on chain instantiating a brand new tree composed of connector UTXOs. When Bob goes to signal over a forfeit transaction to the ASP to conduct the batch swap, the transaction consists of as an enter one of many connector UTXOs from the brand new batch.

This creates an atomic assure. Bob’s confirmed vUTXO is included in a batch in the identical transaction the connector enter is created in that’s crucial for his forfeit transaction to be legitimate. If that batch is rarely created onchain, i.e. Bob by no means really receives the brand new confirmed vUTXO, then the forfeit transaction he signed for the ASP won’t ever be legitimate and confirmable onchain.

Liquidity Dynamics and Blockspace

The entire liquidity essential to create new batches so as to facilitate transfers between customers is offered by the ASP. They’re required to have sufficient liquidity to create new batches for customers till outdated ones have expired and the ASP can unilaterally sweep them to reclaim outdated liquidity beforehand locked as much as create vUTXOs for customers.

That is the core of the liquidity dynamic on the heart of the Ark protocol. Whereas in a single sense it is a huge effectivity win, not requiring liquidity suppliers to evaluate customers and primarily guess which of them will really obtain giant volumes of funds earlier than they will obtain any funds, in one other it’s an effectivity loss because the ASP should have sufficient liquidity to proceed creating new batches for customers for nevertheless lengthy they configure the expiry time to be and so they can begin reclaiming allotted liquidity.

This may be mitigated to an honest diploma by how typically an ASP gives to create new batches to finalize pending transactions. Within the occasion of an ASP trying to create new batches in actual time as transactions are coming in, the liquidity necessities could be exorbitantly excessive. Nevertheless, an ASP can decrease the frequency at which they create new batches and drastically decrease their liquidity necessities.

This dynamic additionally has implications for blockspace use. Not like Lightning, which might present sturdy affirmation ensures completely offchain, to ensure that an Ark transaction to have an equal trustless diploma of finality a brand new batch has to be created onchain. Which means that in contrast to Lightning, the place transaction quantity doesn’t replicate itself onchain, the speed of Ark transactions inherently requires a proportional quantity of blockspace use, albeit in a really compressed and environment friendly method. This creates a theoretical higher restrict of what number of Ark batches could be created throughout any given time interval (though Ark timber could be smaller or bigger relying on this dynamic).

Wrapping Up

Ark presents in some ways an nearly reverse set of tradeoffs to the Lightning Community. It’s a huge blockspace effectivity enchancment for offchain transactions, and does away with the issue of liquidity allocation on the Lightning Community, however it does have a a lot nearer tied throughput restrict that’s correlated with the blockchains throughput restrict.

This dynamic of virtually reverse tradeoffs makes it a really complementary system to the Lightning Community. It might additionally interoperate with it, i.e. vUTXOs could be swapped atomically in transactions coming into or exiting the Lightning Community.

Finally the way it matches into the broader Bitcoin ecosystem is but to be seen, however it’s an undoubtedly precious protocol stack that may discover some practical area of interest, even whether it is completely different than initially meant.

This publish Bitcoin Layer 2: Ark first appeared on Bitcoin Journal and is written by Shinobi.