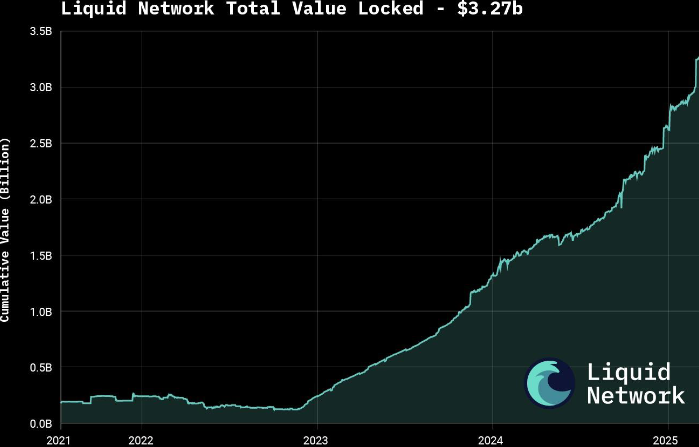

Right now, the Liquid Federation has introduced that the Liquid Community has surpassed $3.27 billion in whole worth locked (TVL), based on a press launch shared with Bitcoin Journal.

“Surpassing the $3 billion threshold marks a pivotal second for each Liquid and Bitcoin, signaling the evolution of Bitcoinʼs ecosystem right into a full-fledged platform for international monetary markets,” mentioned the CEO and Co-Founding father of Blockstream Dr. Adam Again. “As Bitcoin positive factors mainstream acceptance, and demand for regulated asset tokenization accelerates, Liquid is healthier positioned than ever to bridge Bitcoin with conventional finance and drive the subsequent wave of capital markets innovation.”

The announcement follows rising curiosity in tokenizing real-world belongings (RWAs), with main strikes equivalent to BlackRock’s resolution to tokenize a $150 billion Treasury fund. In response to a 2025 report by Safety Token Market, the tokenized asset market is projected to develop to $30 trillion by 2030.

Liquid helps over $1.8 billion in tokenized non-public credit score and provides merchandise like U.S. Treasury notes and digital currencies by means of Blockstream’s AMP platform. The community additionally options quick, low-cost, and confidential transactions, with help for atomic swaps and strong sensible contracts.

Ruled by over 80 international establishments, Liquid was launched in 2018 as Bitcoin’s first sidechain. It’s now making ready for a serious improve with the mainnet launch of Simplicity, geared toward increasing its sensible contract capabilities.

To maintain up with growing demand, the Liquid Federation is boosting developer sources and technical onboardings, together with integrations with exchanges, custodians and repair suppliers. Latest bootcamps and necessary conferences with coverage makers in Asia, Europe and Latin America replicate the community’s rising international presence.

This publish Bitcoin Liquid Community Surpasses $3.27 Billion in Complete Worth Locked first appeared on Bitcoin Journal and is written by Oscar Zarraga Perez.