Bitcoin (BTC) has fallen under an important market sentiment gauge and has did not reclaim it, additional piling strain on its worth.

The crypto market chief has corrected over 4% up to now this week, relinquishing all of the positive factors from the earlier week. This correctional transfer has ensured it stays under the 0.75 provide cost-basis quantile, a key market sentiment indicator.

Key Factors

- Bitcoin has fallen under the 0.75 provide cost-basis quantile at round $95,000 and has did not reclaim this degree.

- The 0.75 quantile line exhibits the associated fee foundation of 75% of Bitcoin’s provide.

- A drop under highlights that over 25% of the asset’s provide is underwater, as buyers procured it at increased costs.

- The 0.75 price distribution quantile is an important indicator of a bear market and indicators a deep correction when Bitcoin falls under it.

- Apparently, analysts additionally affiliate Bitcoin’s worth development under the important thing quantile as a possible backside.

Bitcoin Developments Beneath Key Degree

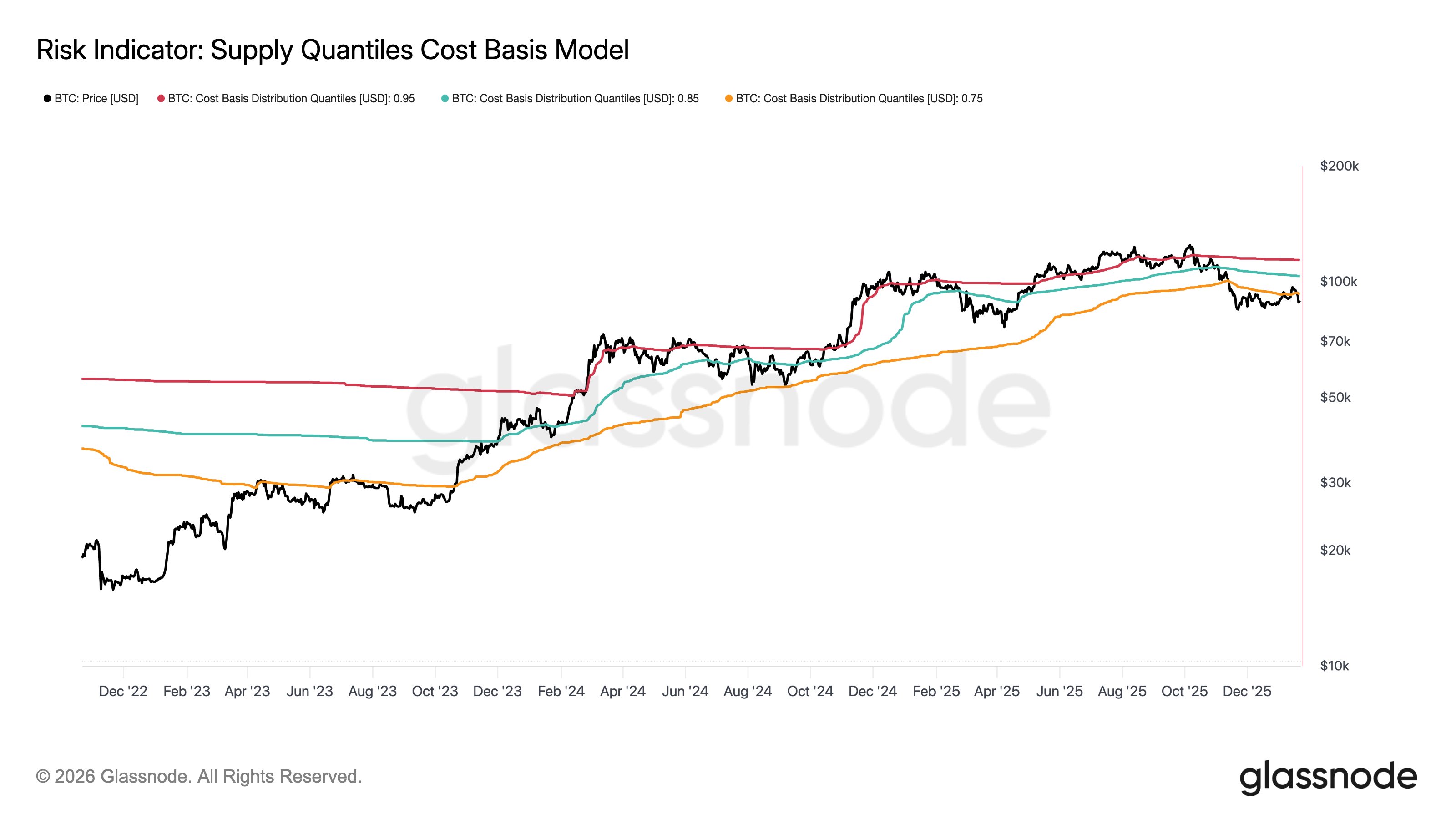

Glasnode knowledge exhibits that Bitcoin has fallen under the 0.75 provide cost-basis quantile at round $95,000 and has did not reclaim that worth degree. The market intelligence platform highlighted this in a Thursday tweet utilizing the provision quantiles price foundation mannequin.

Bitcoin Provide Quantile Price Foundation Mannequin | Glassnode

The mannequin confirmed the costs the place completely different percentages of Bitcoin have been acquired, serving to establish areas of accumulation and distribution. Notably, the metric has 4 main trendlines: the Bitcoin worth and the 0.95, 0.85, and 0.75 quantiles.

The 0.75 quantile line exhibits the associated fee foundation of 75% of Bitcoin’s provide. Sometimes, this can be a key sentiment gauge, and a drop under highlights that over 25% of the asset’s provide was purchased at the next worth.

In the meantime, the 0.85 and 0.95 quantiles present the associated fee foundation for a extra average variety of holders. If BTC trades above the 0.95% quantile, it means that fewer than 5% of holders are unprofitable, indicating a late-stage bullish market part.

What Does the Development Beneath the 0.75 Quantile Imply?

The 0.75 price distribution quantile is an important indicator of a bear market. When Bitcoin drops under this degree, it signifies the market is in a deep correction.

The longer Bitcoin stays under, the extra bearish market sentiment turns into. Moreover, as extra holders panic and promote their stash, the additional the possibilities of steeper worth declines.

Glassnode confirmed that this brings extra distribution strain and creates market situations the place bears are on high. Nevertheless, this adjustments as soon as Bitcoin reclaims the 0.75 provide cost-basis quantile.

Apparently, analysts additionally affiliate Bitcoin’s worth development under the important thing quantile as a possible backside. The market normally kinds a backside under this degree, as seen in 2023 when Bitcoin began an uptrend that endured till the October 2025 all-time excessive of $126,200.

To reclaim the 0.75 cost-basis quantile, Bitcoin must rise by 6.2% from the present market standing. Notably, there isn’t a assure this can occur, because the market stays weak and is stricken by macroeconomic uncertainties.