Bitcoin has slipped beneath the $70,000 degree, a transfer that displays rising promoting strain and rising market anxiousness. The break of this psychological threshold has intensified volatility, with short-term members reacting shortly to draw back momentum. Analysts be aware that the present atmosphere is outlined much less by macro headlines and extra by inner market construction, significantly the habits of long-term holders.

In keeping with insights shared by On-chain Thoughts, Bitcoin value alone hardly ever defines a market backside. As an alternative, the important thing sign tends to come back from holder habits — particularly, whether or not long-term buyers start to point out indicators of stress. Traditionally, these members are the least reactive cohort, typically absorbing volatility reasonably than amplifying it by fast promoting.

When long-term holders transfer into widespread unrealized losses, nevertheless, the dynamic modifications. Such situations have ceaselessly coincided with the late levels of bear markets, when conviction weakens and broader capitulation turns into potential. This section doesn’t assure a direct reversal, however it typically indicators that structural exhaustion is growing.

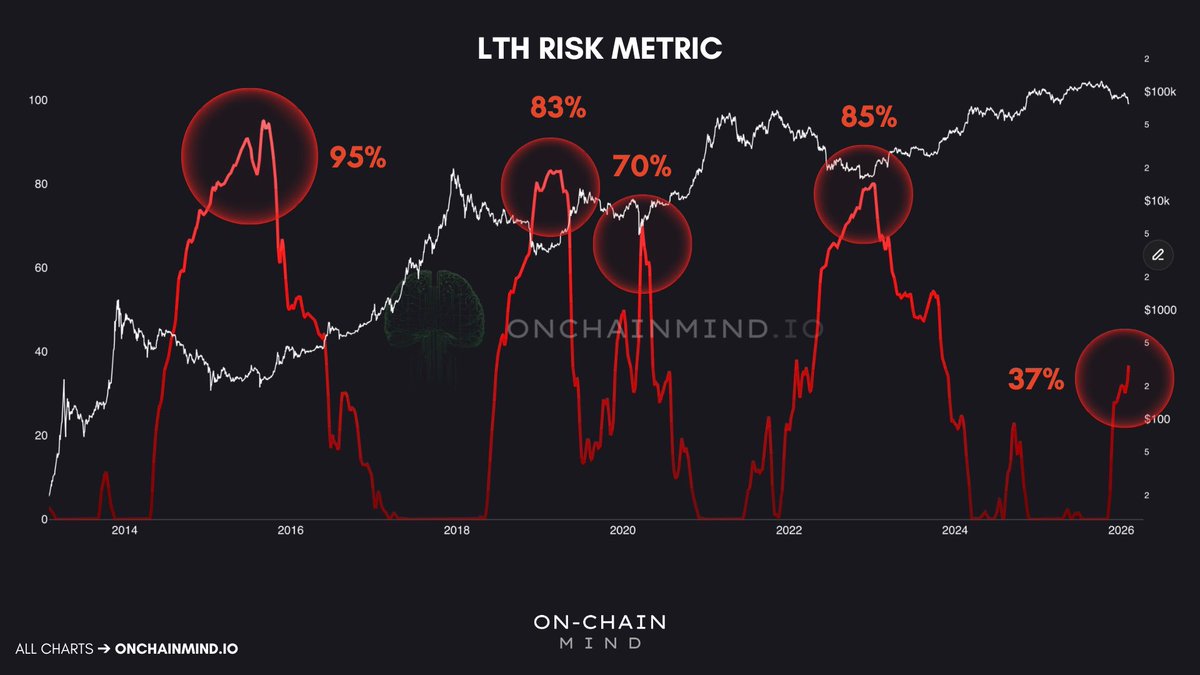

On-chain Thoughts additional highlights that long-term holder threat has traditionally performed a decisive position in figuring out late-stage bear market situations. Earlier cycles present clear peaks on this metric: roughly 95% in 2015, about 83% in 2019, close to 70% throughout the COVID crash, and round 85% within the 2022 downturn. These spikes sometimes mirrored widespread unrealized losses amongst long-term buyers, signaling deep structural stress throughout the community.

Traditionally, as soon as this indicator rises above the 55–60% vary, the bottoming course of tends to speed up. At these ranges, even probably the most affected person holders start to expertise significant strain, typically coinciding with the ultimate phases of capitulation. This doesn’t essentially mark the precise value low, however it has ceaselessly preceded stabilization and eventual restoration.

At present, nevertheless, the metric sits nearer to 37%, properly beneath prior capitulation thresholds. This implies that whereas market stress is clear, situations might not but replicate the full-scale exhaustion sometimes related to sturdy cycle bottoms. If the sample of diminishing peaks continues, a transfer towards the 70% area would point out that even sturdy fingers are underneath substantial strain — traditionally a prerequisite for a extra structural and lasting market low.

Bitcoin’s weekly construction exhibits a transparent deterioration in momentum after the rejection from the $120K–$125K area, with value now buying and selling close to the $69K zone. The newest breakdown pushed Bitcoin decisively beneath the 50-week shifting common (blue) and the 100-week common (inexperienced), ranges that had beforehand acted as dynamic help all through the prior uptrend. Shedding each indicators a shift from a corrective pullback to a extra structural downtrend section.

The 200-week shifting common (pink) stays properly beneath the present value, suggesting the broader macro development will not be but in deep bear-market territory. Nevertheless, the pace of the decline and increasing bearish candles point out aggressive distribution reasonably than orderly consolidation. Quantity spikes accompanying current draw back strikes reinforce the interpretation of compelled promoting and liquidation exercise.

From a technical standpoint, the $70K area has transitioned from help into resistance after the breakdown. Failure to shortly reclaim this degree would enhance the chance of additional draw back exploration, doubtlessly towards historic demand zones within the low-$60K space. Conversely, stabilization above this area with declining promote quantity may sign exhaustion amongst sellers.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.