Bitcoin mempool exercise has hit an all-time low, miners’ payment income has declined, and a few within the crypto group are sounding alarms concerning the world’s most useful blockchain’s long-term sustainability.

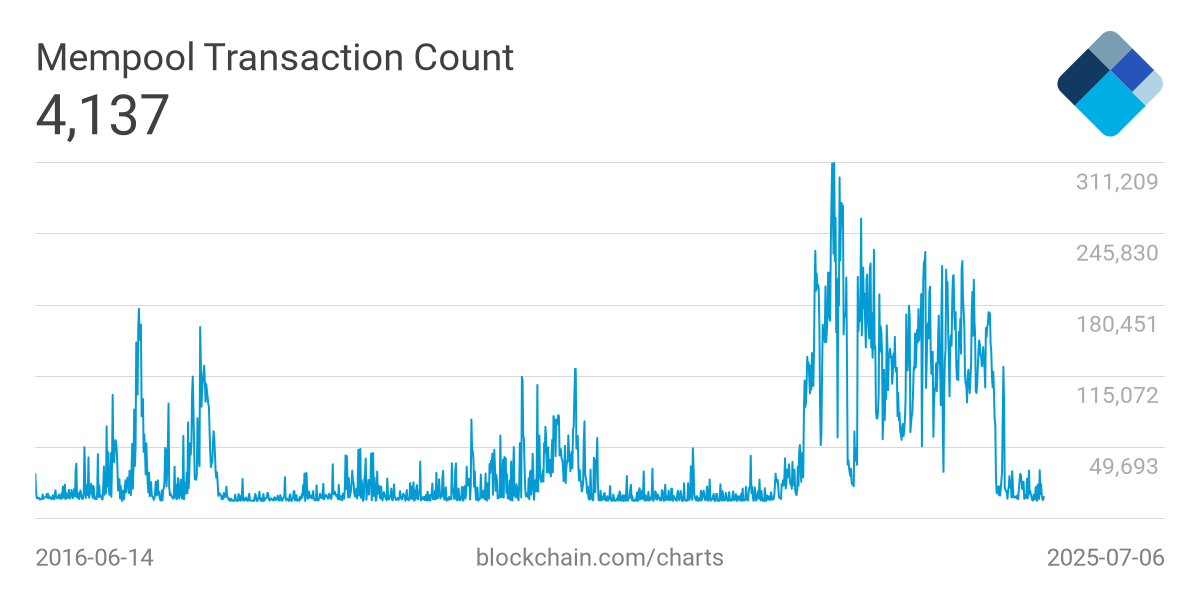

Based on information from Blockchain.com, only a few thousand unconfirmed transactions stay in Bitcoin’s mempool as of press time, down from tons of of hundreds throughout peak durations just like the post-halving Rune mint frenzy. Charge income now accounts for lower than 0.5% of miner earnings, far under ranges seen in earlier bull markets.

“Merely put, virtually all of Bitcoin’s precise customers have gone away. In any respect-time worth highs, too,” wrote Joel Valenzuela, Enterprise Improvement lead at Sprint, in an X submit. “We’re dealing with a significant disaster. Both the Bitcoin community goes bankrupt, undergoes main modifications, or the asset turns into a totally custodial asset run by governments and establishments.”

BTC Pending Transactions

The mempool — the queue of pending Bitcoin transactions — acts as a buffer when transaction demand exceeds block capability. Customers connect charges to incentivize miners to incorporate their transactions within the subsequent block. When exercise surges, so do charges. However when the mempool is obvious, competitors for blockspace disappears, and so does miner income from charges.

Miners Face Declining Income

With the mempool empty, miners are already feeling the squeeze. Ethan Vera, chief working officer at Luxor Applied sciences, a Bitcoin mining infrastructure supplier, instructed The Defiant that Bitcoin’s long-term safety mannequin hinges on both payment progress or sustained worth appreciation.

“We consider that continued funding in infrastructure and hashrate manufacturing is a key aspect of Bitcoin’s safety,” Vera stated, including that “as block rewards lower, it’s crucial that Bitcoin worth will increase and/or transaction charges enhance…”

“So whereas low transaction charges are usually not a reason behind concern within the close to time period, they’re actually necessary within the mid to long-term, and miners must be encouraging extra tasks to eat blockspace and transact on the L1,” Vera defined.

Others level to altering patterns in each consumer conduct and protocol utilization. For example, as doggfather, CEO of Doggfather Analytics, defined in a commentary for The Defiant, retail buyers are simply “not there but or they do not come in any respect throughout this cycle as a result of retail quite invests in ETFs and related oblique automobiles (like exchange-traded notes in different legislations).”

Community Safety at Stake

One other issue behind the mempool vacancy is the shortage of non-financial transaction exercise. With the minting of Ordinals and fungible tokens like BRC-20s and Runes now largely dormant, blockspace demand has plummeted, doggfather famous.

“The mempool was crowded and charges had been excessive when there have been ‘sizzling’ ordinals or rune mints. Essentially the most well-known block was after the fourth halving at block 840,000. The charges had been 37.626 BTC ($2,402,245) only for this one block. Everybody needed to get their Rune ticker first and paid excessive charges,” he stated.

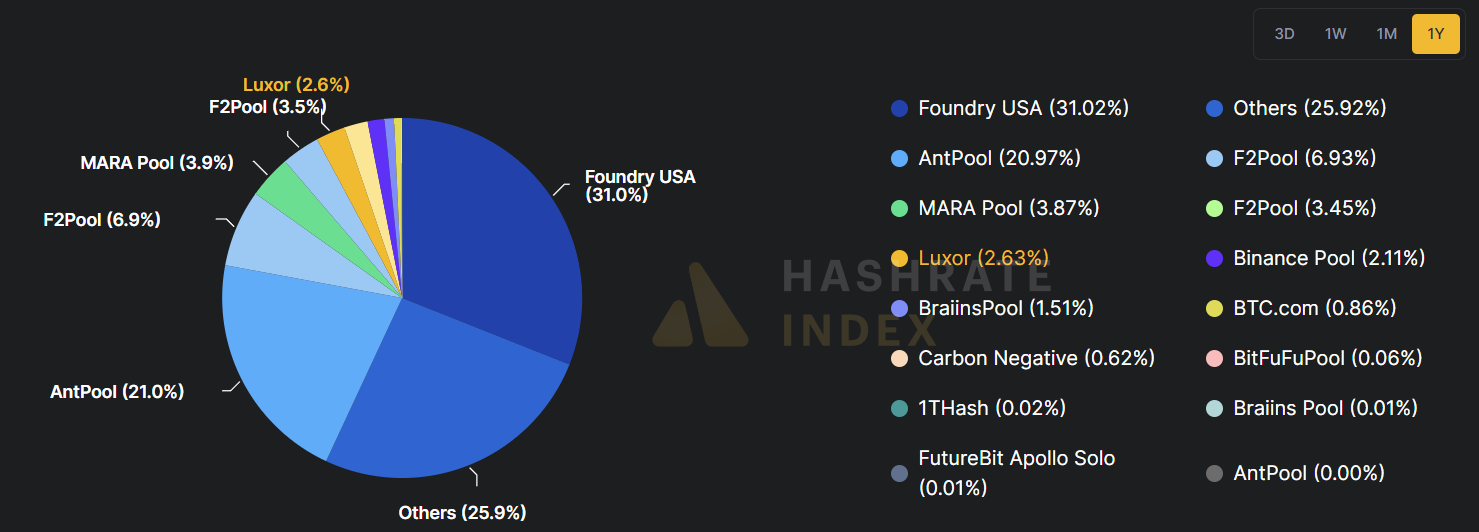

BTC Miners Market Share

However considerations run deeper than utilization. “Charge income for miners is now a pitiful fraction of a %, endangering safety,” stated Nishant Sharma, head of developer ecosystem at Doma Protocol. “Worse, mining’s centralized, with the highest 5 swimming pools, together with Foundry and AntPool, controlling over 60% of blocks.”

Sharma highlighted grassroots mining efforts as a possible approach to problem centralization. He described a brand new mining pool mannequin that expenses no charges to collaborating miners, gives Lightning Community payouts, and is designed to empower smaller, home-based miners to compete with dominant swimming pools.