Ethereum worth immediately: $2,460

- Ethereum registered a 1% decline over the previous 24 hours as bulls ease shopping for strain.

- Bitcoin miner, Bit Digital, introduced plans to change to an ETH treasury technique.

- ETH should get well the $2,500 stage to stop the validation of a bearish flag sample.

Ethereum (ETH) is down 1% over the previous 24 hours following Bitcoin (BTC) miner Bit Digital’s (BTBT) announcement on Wednesday that it is pivoting towards an ETH staking and treasury technique.

ETH loses steam regardless of Bit Digital’s pivot to an Ethereum treasury technique

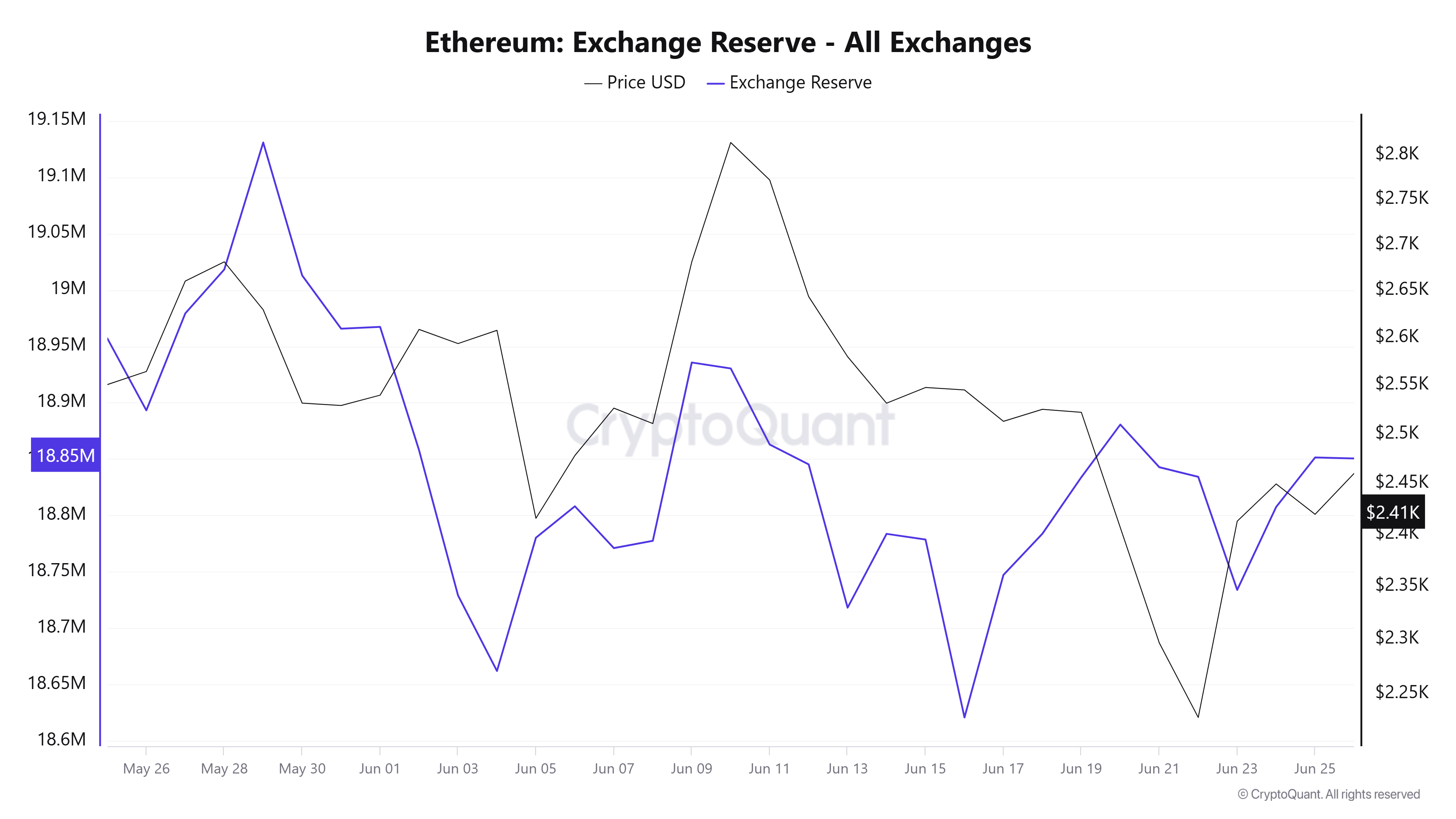

After two consecutive days of recording positive factors following the Israel-Iran ceasefire, bulls have misplaced steam, as Ethereum registered a 1% decline. The decline was spurred by an increase in Ethereum’s change reserve, indicating low demand and a modest improve within the sell-side strain.

ETH Change Reserve. Supply: CryptoQuant

Regardless of the calmness, company entities proceed to allocate funds towards ETH, as Nasdaq-listed Bitcoin miner Bit Digital revealed a decisive shift to change into an ETH staking and treasury-focused firm, in line with apress launch on Wednesday.

The agency introduced plans to wind down its Bitcoin mining operations, redirecting the proceeds to develop its Ethereum staking actions. Bit Digital claimed it started constructing its Ethereum place and staking infrastructure in 2022 and has steadily expanded its ETH holdings.

Bit Digital additionallyintroduced the launch of an underwritten public providing of its bizarre shares, with all shares to be issued and bought immediately by the corporate. The agency mentioned that proceeds from the sale might be used to develop its Ethereum holdings, reinforcing its strategic shift towards changing into an ETH treasury and staking platform. Nevertheless, the dimensions or timing of the providing was not disclosed.

Bit Digital revealed that it held 24,434.2 ETH and 417.6 BTC as of March 31.

The transfer aligns with a rising pattern amongst crypto corporations to undertake treasury fashions that present publicity to Ethereum and different cryptocurrencies. This contains SharpLink Gaming (SBET), which holds the most important Ethereum treasury amongst public corporations. The agency holds a complete of 188,478 ETH, value roughly $457 million primarily based on present costs.

Nasdaq-listed BTCS additionally acquired 1000 ETH final Friday, boosting its treasury holdings to 14,600 ETH.

Ethereum Worth Forecast: ETH should get well $2,500 to stop bearish flag validation

Ethereum skilled $49.49 million in futures liquidations up to now 24 hours, in line with Coinglass knowledge. The full quantity of lengthy and brief liquidations is $30.09 million and $19.40 million, respectively.

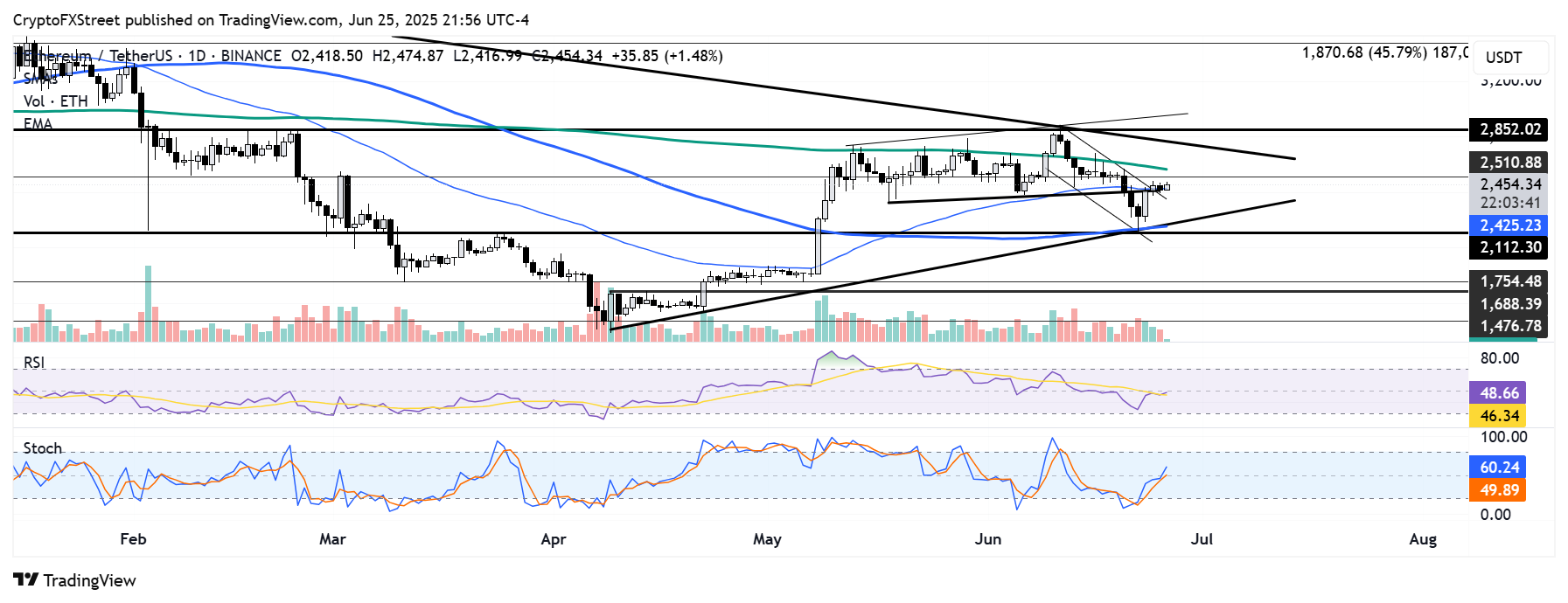

Ethereum briefly broke above the higher boundary of a descending channel and the 50-day Exponential Shifting Common (EMA) over the previous 24 hours earlier than seeing a rejection slightly below the $2,500 key stage.

ETH/USDT each day chart

If ETH fails to get well the $2,500 stage and loses the channel’s higher boundary help, it can validate a bearish flag sample. Such a transfer may ship its worth beneath $2,100 if it fails to carry the decrease boundary help of a symmetrical triangle sample.

On the upside, ETH should clear the $2,500 and 200-day Easy Shifting Common (SMA) resistance to check the symmetrical triangle’s higher boundary and probably the $2,850 key stage.

The Relative Energy Index (RSI) and Stochastic Oscillator (Stoch) are testing their impartial ranges. A rejection may set off the resumption of bearish momentum, however a crossover will speed up bullish strain.

Associated information

- Ethereum Worth Forecast: ETH defies Powell’s hawkish tone as Israel-Iran ceasefire fuels bullish sentiment

- Ethereum Worth Forecast: ETH eyes restoration as Israel-Iran battle spills into US army base

- Coinbase eyes report shut as analysts elevate worth goal to $510, name firm ‘Amazon of crypto’

Share: