The euphoria of October’s report highs has evaporated, leaving the economic spine of the Bitcoin community dealing with a brutal actuality test.

In response to CryptoSlate’s information, Bitcoin is at present buying and selling close to $78,000, a stage that represents a punishing decline of greater than 38% from its all-time excessive of over $126,000 simply 4 months in the past.

Whereas informal observers may see a regular market correction, the view from contained in the mines is much extra dire. The steep drop within the flagship digital asset’s value has collided with stubbornly excessive community problem and rising vitality prices to create an ideal storm for operators.

Analytics agency CryptoQuant not too long ago described miners as “extraordinarily underpaid,” given the present mixture of depressed costs and problem, with its profit-and-loss sustainability index slumping to 21. That’s the lowest studying since late 2024.

Notably, the monetary pressure is already inflicting machines to go offline, leading to Bitcoin’s complete hashrate declining by about 12% since final November, the steepest drawdown because the China mining ban in 2021. This has left the community at its weakest stage since September 2025.

For a system that sells itself as essentially the most safe pc community on this planet, that is greater than only a bear-market story. It’s a stress take a look at of Bitcoin’s safety mannequin at a second when miners have better-paying alternate options than ever earlier than.

Bitcoin miners’ capitulation maths

Bitcoin’s safety depends on a easy incentive construction through which the community pays a set block subsidy plus transaction charges to whoever solves the subsequent block.

When costs had been above $126,000 in October, the “safety finances” was ample to cowl inefficiencies. Nonetheless, the margin for error has vanished as costs have crashed below $80,000.

New figures from the mining pool f2pool illustrate how extreme the income compression has turn out to be.

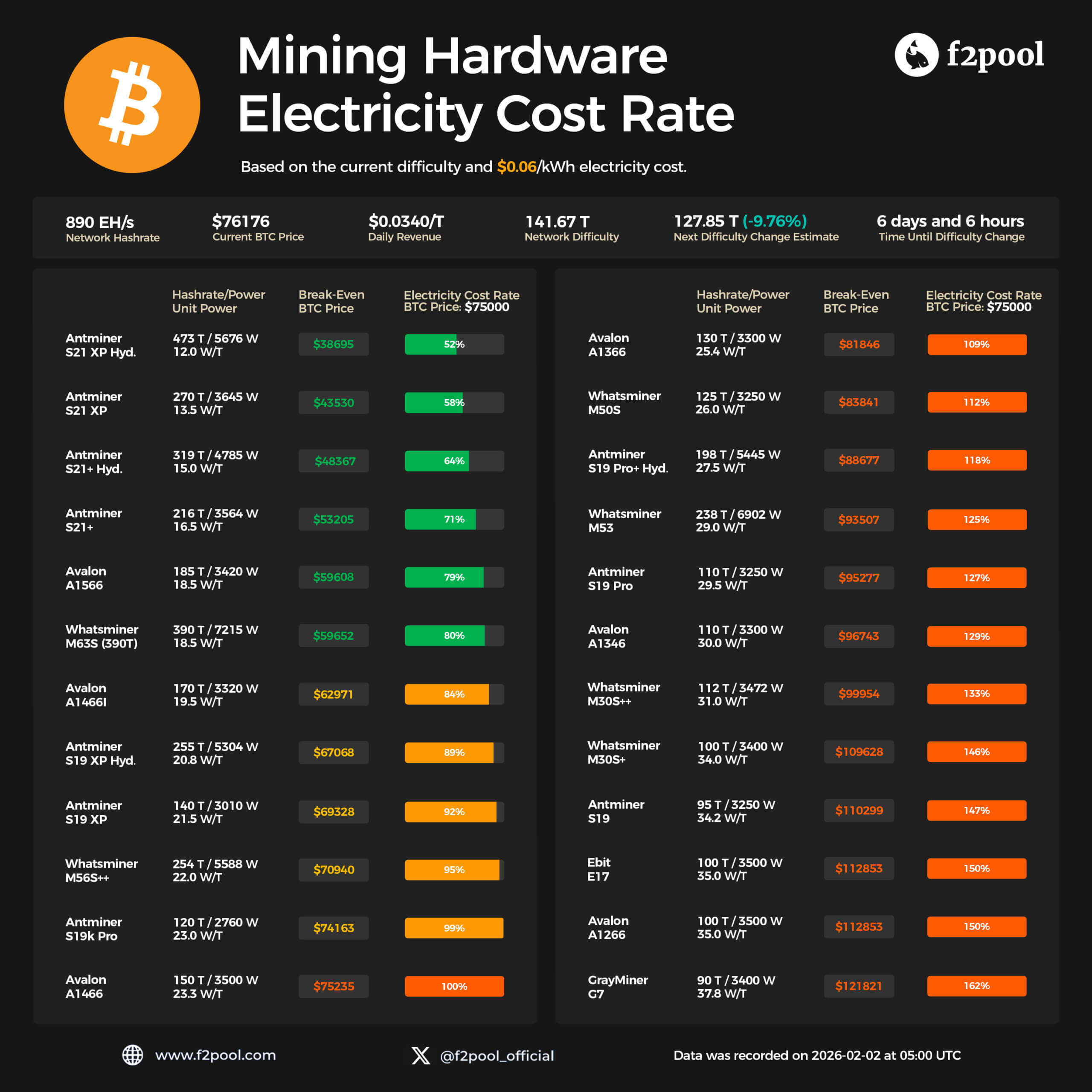

On its Feb. 2 {hardware} electrical energy value dashboard, the pool estimates Bitcoin’s value at round $76,176, community hashrate at close to 890 exahashes per second (EH/s), and day by day income at about $0.034 per terahash for miners paying $0.06 per kilowatt-hour.

To place that in perspective, Luxor Know-how’s Hashrate Index recorded spot hashprice close to $39 per petahash per second (PH/s) per day only some months prior.

That determine was already skinny by historic requirements earlier than falling towards an all-time low of round $35 as of press time.

The present f2pool determine of $0.034 per terahash, equal to $34 per PH/s, confirms that miners are working on the historic ground.

When these economics are mapped onto particular person machines, it turns into clear why hashrate is falling.

At a reference Bitcoin value of $75,000 and the identical six-cent energy value, electrical energy accounts for about 52% of income for Bitmain’s latest Antminer S21 XP Hydro models, which mix roughly 473 TH/s of hashpower with 5,676 watts of draw. These are the very best numbers out there.

Because the effectivity curve worsens, the mathematics turns purple. Mid-generation rigs, reminiscent of an Antminer S19 XP or an Avalon A1466i, exhibit electrical energy value charges of roughly 92%-100% at that value level.

In the meantime, older or much less environment friendly fashions, together with the Avalon A1366, Whatsminer M50S, and S19 Professional strains, present electrical energy value charges starting from roughly 109% to 162%.

In plain English, which means at $75,000 Bitcoin and a mainstream energy tariff, huge fleets of {hardware} are mining at a money loss earlier than even accounting for debt, internet hosting charges, or basic bills.

The AI escape hatch

This present income crash differs from earlier crypto winters as a result of the miners’ distressed belongings, like energy contracts and grid connections, have a brand new, deep-pocketed suitor.

The identical infrastructure that allows Bitcoin mining is exactly what hyperscale AI compute requires. And in contrast to the struggling Bitcoin community, AI infrastructure suppliers are prepared to pay up.

The previous mining operation CoreWeave has turn out to be emblematic of this shift. It pivoted from crypto to turn out to be a specialist “neocloud” for AI workloads and not too long ago secured a $2 billion fairness funding from Nvidia to speed up its information middle buildout.

In 2025, it sought to accumulate miner Core Scientific in a multibillion-dollar deal, explicitly framing miners’ websites and energy contracts as prime actual property for GPUs fairly than ASICs.

Different public Bitcoin miners have taken the trace and are pivoting arduous in direction of AI. For instance, Canadian operator Hut 8 not too long ago signed a 15-year, 245-megawatt AI information middle lease at its River Bend campus, with a said contract worth of roughly $7 billion.

This deal successfully locks in long-term economics that differ markedly from the volatility of mining rewards.

For shareholders, these pivots supply a rational exit from the bleeding attributable to the 30% value drop. They will swap cyclical Bitcoin revenues for contracted AI money flows that traders at present worth at a premium.

For the Bitcoin community, nevertheless, this raises a tougher query: what occurs when a part of its safety infrastructure discovers a enterprise that provides larger compensation?

Bitcoin’s community safety finances below siege

Jeff Feng, co-founder of Sei Labs, known as the present interval “the largest bitcoin miner capitulation since 2021,” arguing that enormous miners pivoting to AI compute are amplifying the drawdown.

The important thing distinction from prior cycles is that a few of this hash isn’t simply powering down till the value recovers. It’s being reallocated completely.

As soon as a 245 MW web site is absolutely re-racked for AI below a long-term lease, that energy is, in observe, unavailable for future hashrate growth.

Make no mistake, Bitcoin stays extraordinarily safe in absolute phrases. Even after current declines, the price of amassing ample hashpower to assault the community stays immense.

Nonetheless, the priority is about path and composition fairly than rapid collapse. A sustained decline in hashrate lowers the marginal value of attacking.

With much less sincere hash on-line, it takes fewer sources to accumulate a disruptive share of the community’s compute, whether or not via renting capability or constructing it outright.

This pattern additionally narrows the bottom of stakeholders paid to defend the chain. If older, higher-cost operators exit and solely a handful of ultra-efficient miners stay worthwhile, management over block manufacturing turns into more and more centralized.

This creates a fragility that’s masked by the headline hashrate numbers.

So, CryptoQuant’s “extraordinarily underpaid” label is successfully a warning that, at immediately’s block rewards and charges, a significant slice of commercial hash is working on skinny or adverse margins.

It serves as a ahead indicator of how strong the community’s safety finances actually is relative to competing makes use of of capital and electrical energy.

How will Bitcoin miners survive?

From right here, the miner squeeze might affect Bitcoin’s evolution in a number of distinct methods.

One path is quiet consolidation. Issue resets, essentially the most environment friendly operators seize a bigger share of block manufacturing, and hashrate grows extra slowly than in earlier cycles however stays giant sufficient that few outdoors specialists discover.

For traders, the first impact is volatility, as every market drawdown compresses a narrower group of miners, thereby rising their promoting and hedging habits.

One other path would speed up Bitcoin’s transition to fee-driven safety sooner than the halving schedule alone implies. If subsidies stay mild relative to AI returns, the ecosystem could should rely extra on transaction charges to maintain miners absolutely engaged.

That would imply larger concentrate on high-value settlement on the base layer, extra exercise on second-layer programs, and a wider acceptance that block house is a scarce useful resource fairly than an affordable commodity.

A 3rd, extra speculative path would see exterior backstops turn out to be express. This might imply that the identical establishments that normalized spot Bitcoin ETFs may finally view the safety finances as they view financial institution capital ratios, as one thing that may require deliberate assist.

That would take the type of larger charges for sure transaction lessons, industry-funded incentives for miners, or scrutiny of AI conversions that materially dent hashrate in key areas.

Notably, none of these outcomes would require a break with Bitcoin’s core design. All contain the {industry} deciding, in a extra crowded vitality market, how a lot it’s ready to pay to maintain hash on the community fairly than in GPU clusters.

At current, the f2pool dashboard gives a snapshot of that negotiation. A system with about 890 exahashes per second of compute and a value of roughly $76,000 is paying roughly 3.5 cents per terahash per day for its safety.

Whether or not future vitality investments settle for that fee or demand one thing nearer to AI economics will decide how the mining market finally pivots.