Mid-tier Bitcoin miners are closing the hole on trade leaders in realized hashrate following the 2024 halving.

Abstract

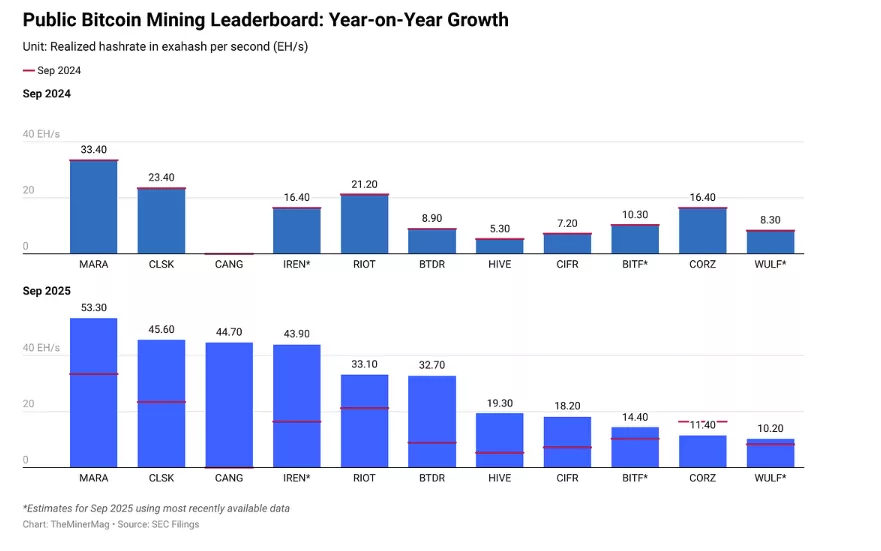

- Mid-tier miners quickly expanded after the 2024 halving, closing in on high gamers.

- Public miners doubled their realized hashrate to 326 EH/s, a one-year report enhance.

- Mining sector debt surged to $12.7B amid heavy funding in rigs and AI ventures.

Cipher Mining, Bitdeer and HIVE Digital have rapidly expanded their operations after years of infrastructure development and narrowed the space to high gamers like MARA Holdings, CleanSpark and Cango.

The change is a extra degree taking part in area within the mining sector. “Their ascent highlights how the center tier of public miners — as soon as trailing far behind — has quickly scaled manufacturing for the reason that 2024 halving,” The Miner Magazine wrote in its newest Miner Weekly e-newsletter.

You may also like: Crypto VC funding: Coinbase acquires Echo for $375m, Pave Financial institution raises $39m

High Bitcoin miners doubled realized hashrate

MARA, CleanSpark and Cango maintained their positions because the three largest public miners. Rivals together with IREN, Cipher, Bitdeer and HIVE Digital posted sturdy year-over-year will increase in realized hashrate.

The highest public miners reached 326 exahashes per second (EH/s) of realized hashrate in September, greater than double the extent recorded a 12 months earlier. Collectively, they now account for almost one-third of Bitcoin’s (BTC) complete community hashrate.

Public Bitcoin mining leaderboard: Supply: The Miner Magazine

Hashrate measures the computational energy miners contribute to securing the Bitcoin blockchain. Realized hashrate tracks precise onchain efficiency, or the speed at which legitimate blocks are efficiently mined.

For publicly traded miners, realized hashrate is a more in-depth indicator of operational effectivity and income potential. The metric has develop into a key measure forward of third-quarter earnings season.

You may also like: James Wynn dives into XRP with a major funding

Mining debt surges to $12.7 billion

Bitcoin miners are taking up report debt ranges and likewise expands into new mining rigs, synthetic intelligence infrastructure and different capital-intensive ventures. Whole debt throughout the sector has jumped to $12.7 billion, up from $2.1 billion simply 12 months in the past.

VanEck analysis famous that miners should constantly put money into next-generation {hardware} to take care of their share of Bitcoin’s complete hashrate and keep away from falling behind opponents.

Some mining corporations have turned to AI and high-performance computing workloads to diversify income streams. The change comes after dropping margins following the 2024 Bitcoin halving, which diminished block rewards to three.125 BTC.

The debt enhance exhibits aggressive growth plans throughout the trade. Mining corporations face stress to scale operations rapidly or danger dropping market share to better-capitalized rivals.

Learn extra: Crypto’s $1 trillion blind spot wants a brand new framework | Opinion