Bitcoin miners with the correct infrastructure and administration expertise can achieve substantial worth by pivoting into the booming AI and HPC information heart market, analysts say.

As demand for AI infrastructure grows, crypto miners with entry to energy and cooling could possibly be effectively positioned to revenue from supporting high-performance computing workloads, based on a Galaxy Digital analysis report.

The analysts consider miners with skilled administration groups able to executing AI and HPC buildouts have a “super alternative” to convey “vital incremental worth to their corporations.” The attraction lies within the long-term contracts and powerful, regular money circulation fashions of AI and HPC colocation — described by Galaxy Digital as “predictable and excessive margin money circulation streams” — a degree of stability that’s usually missing in crypto markets.

“Not solely is income extra predictable than Bitcoin mining, it’s additionally uncorrelated to crypto markets, which smooths income profiles of corporations with excessive publicity to the risky crypto markets. In Bitcoin bear markets, this could improve monetary stability, permitting miners to proceed to boost money by fairness or debt with out incurring extreme dilution or curiosity burden.”

Galaxy Digital

Financing choices are additionally increasing. Information heart operators which have a lease in hand with a credit score worthy counterparty “can take that lease and lift substantial sums of venture financing to assemble the info heart,” Galaxy wrote, citing $18 billion in improvement financing underwritten in Q1 2024 alone.

You may also like: Bitcoin miners face mounting stress from gear tariffs and ETF demand: Bitwise

The valuation hole is one other key issue, with the report noting that Bitcoin (BTC) miners have usually traded at six to 12 occasions their earnings, whereas a number of the world’s largest information heart operators are valued at 20 to 25 occasions earnings.

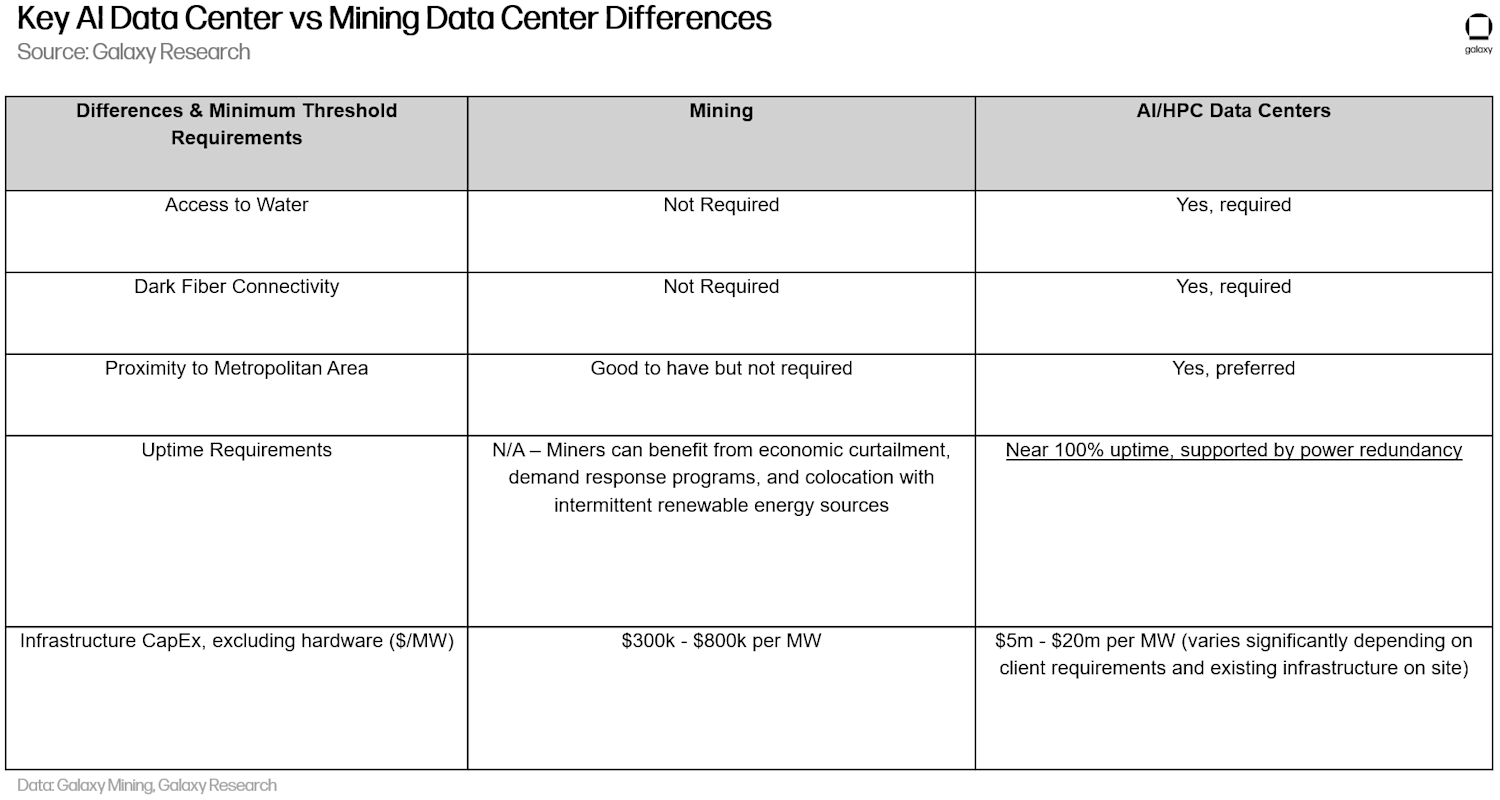

Key AI information heart vs mining information heart variations | Supply: Galaxy Digital

Nevertheless, not all crypto mining websites are match for the shift, Mike Novogratz’s Galaxy Digital wrote, noting that some could not have the correct circumstances for AI and high-performance computing, even when they nonetheless work effectively for Bitcoin mining.

With U.S. information heart capability anticipated to greater than double by 2030, Galaxy says miners who adapt now might grow to be “a number of the largest operators within the business.”

Learn extra: Galaxy Digital proposes new voting framework to scale back Solana inflation