Bitcoin mining is now a extremely aggressive trade that’s not simply costly however technology-intensive as effectively. People involved in becoming a member of the rising mining trade should put money into a specialised pc system, regular web, dependable vitality provide, and a very good quantity of talent to handle the method.

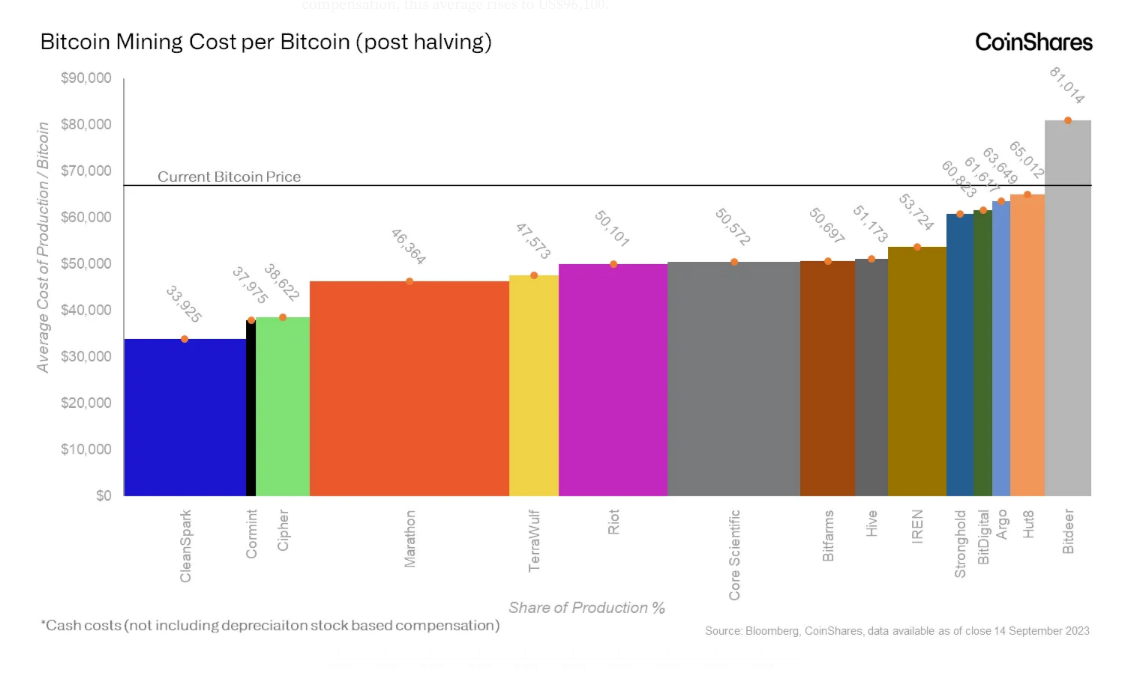

As such, miners typically flip to credit score services to fund their operations. Right this moment, mining prices proceed to develop, with some consultants saying that prices have skyrocketed to $49,500 as of the second quarter.

CoinShares reviews that the second quarter knowledge is $2,300 greater than the primary quarter when mining prices common $47,200. The funding firm additional defined that the miners’ money bills common $85,900, and prediction prices quantity to $96,100.

Failing to safe a credit score line is now a standard criticism amongst BTC miners, whereas others say rising rates of interest worsen their state of affairs.

BTC Miners Fail To Capitalize On Current Worth Rallies

Bitcoin mining is inextricably linked to the digital asset’s excessive volatility. For instance, a lot of our miners did not capitalize on the rumors of Bitcoin ETFs circulating in late 2023.

In January 2024, the Securities Trade Fee (SEC) lastly authorised the purposes of not less than 11 ETFs, pushing Bitcoin to breach the $70k degree. The sudden improve within the asset’s valuation solely confirmed that the mining trade is delicate to those value actions, particularly after the halving of rewards took impact.

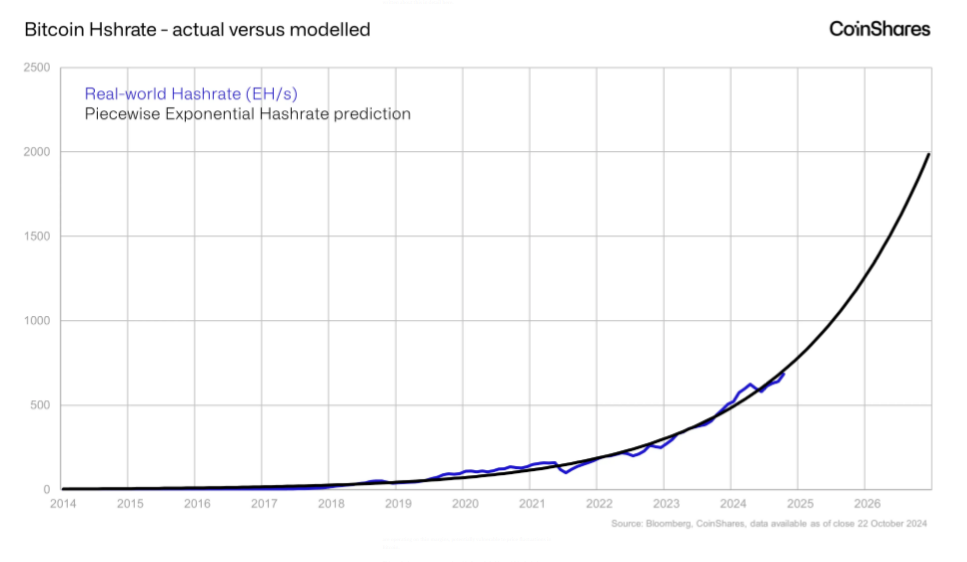

Right this moment, many mining analysts are fashions that may anticipate the asset’s persevering with improve in hash charge. Present fashions utilized by most miners anticipate the speed to hit 765 EH/s.

Time For BTC Mining To Embrace Different Vitality Sources?

One of many complaints in opposition to BTC mining is that it hurts the surroundings because of the huge vitality necessities, to not point out the carbon footprint it emits. Specialists say that if miners use various vitality sources, we will cut back our carbon footprint by 63% by 2050.

Miners ought to be able to embrace these various vitality sources since bills develop because the hash charge will increase.

As Prices Rise, Some Bitcoin Miners Flip To AI

Since mining effectivity is beginning to fall, many miners are searching for methods to reinforce their revenues. For instance, many skilled miners are holding tokens as a substitute of mining them. Others flip to AI-related options as a possible income.

It’s secure to say that the BTC mining trade is coming into a brand new section. When planning and shifting ahead, miners and different stakeholders should think about the challenges, from prices to compliance to competitors. As prices proceed to extend, miners should discover options and choices to stay worthwhile.

Featured picture from Dall-E, chart from TradingView