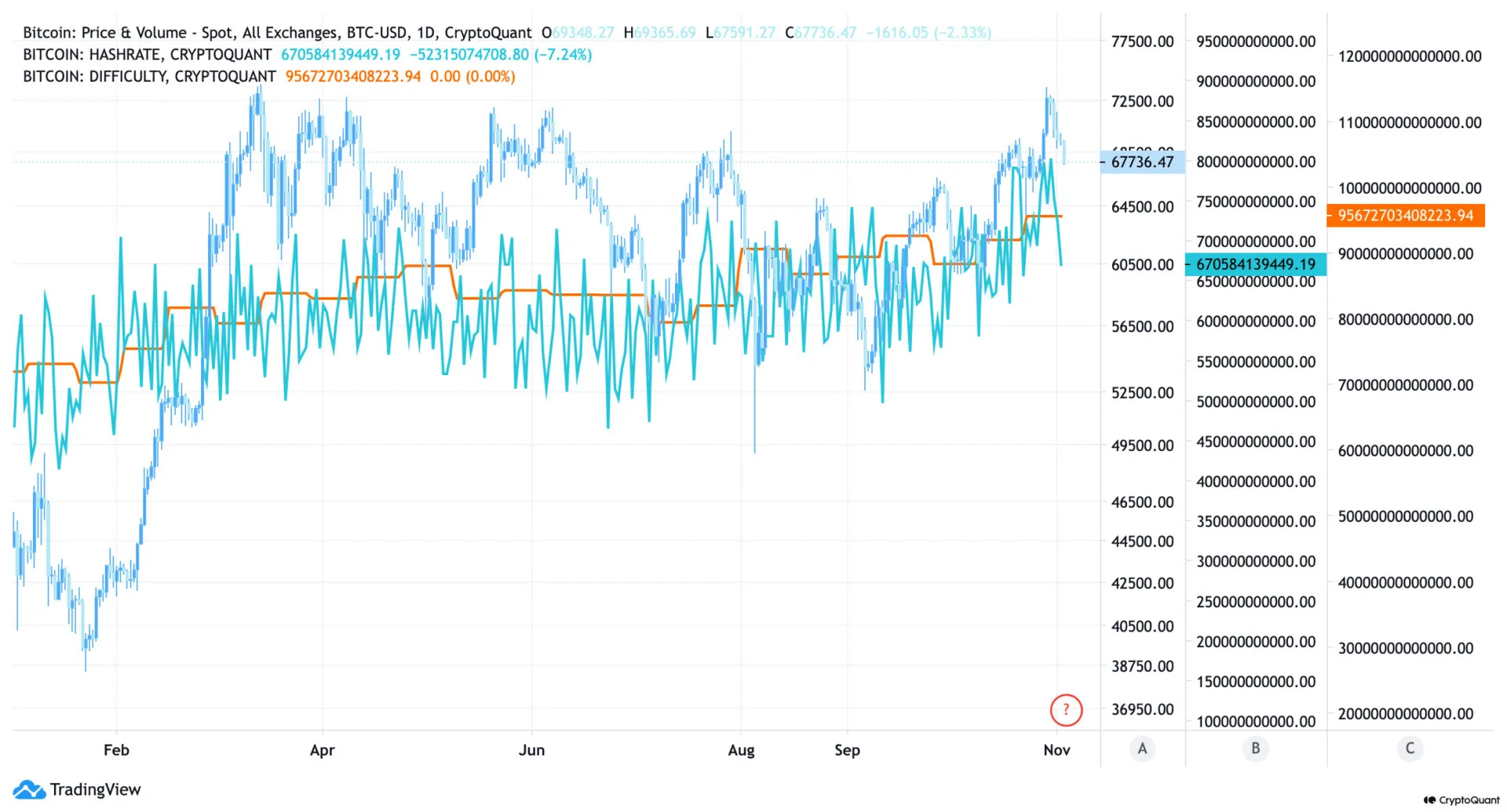

Bitcoin mining issue simply set a brand new file, hitting heights which can be forcing miners to throw much more assets on the community.

With competitors heating up and Bitcoin holding regular close to its all-time highs, the business faces new pressures. Now miners want much more computational energy to maintain tempo, resulting in larger prices and probably straining the system’s sustainability.

Miners aren’t simply coping with new issue ranges. Bitcoin’s current value motion has them scrambling as properly. As demand rises—largely pushed by ETF purchases—mining competitors is climbing, however so are bills.

And transaction charges, which regularly assist cowl mining prices, won’t be sufficient to offset these rising bills. That’s inflicting some to surprise if this spike in issue will begin chopping into income.

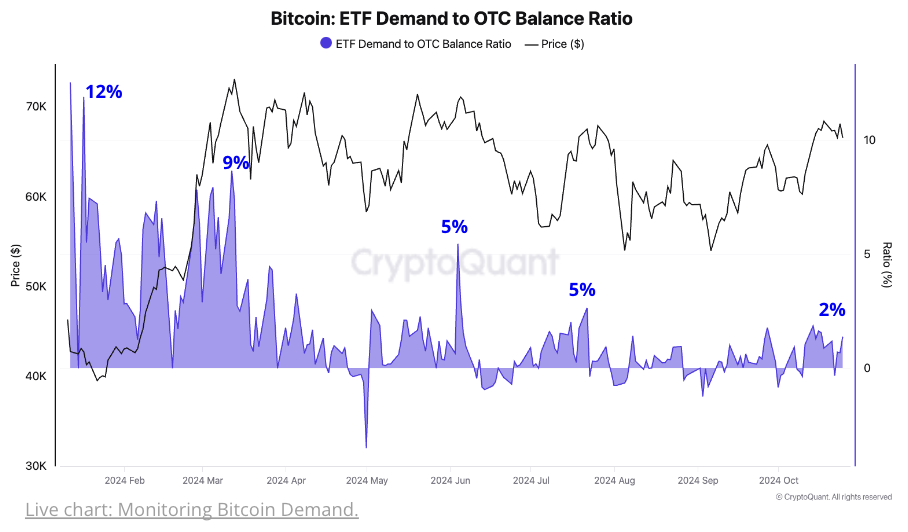

ETF demand and its position in Bitcoin’s value surge

Bitcoin has been buying and selling manner too near its all-time excessive lately, and the push from U.S.-based ETFs is a giant a part of that. Since early October, ETF exercise has spiked considerably. In the beginning of the month, internet every day ETF purchases had been down by 1.3K Bitcoin.

By the top of October, although, that quantity had skyrocketed to five.8K. On October 13 alone, ETFs bought 7.7K Bitcoin—the very best single-day purchase up to now.

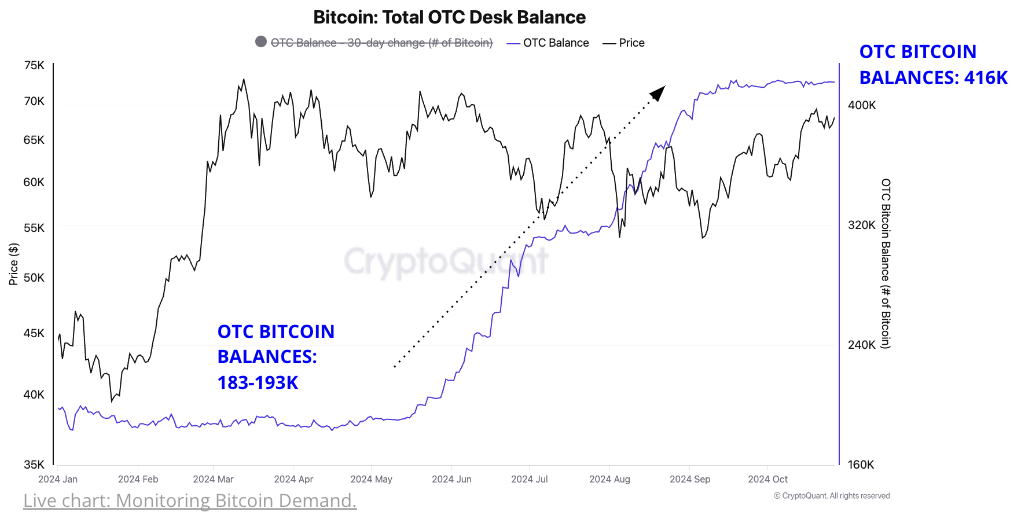

As demand from ETFs grows, it’s value noting the shifting dynamics with Over-The-Counter (OTC) desks. CryptoQuant’s information reveals that OTC desks have stored Bitcoin provides at file ranges, with a complete stock of round 416K Bitcoin, in comparison with 183K–193K at first of the yr.

This surplus means ETFs can get their fill with out touching public exchanges and spiking the worth. As a substitute, they purchase straight from OTC desks, which shields the broader market from sharp value swings.

The every day ETF purchases now symbolize simply 1% to 2% of the overall stock held by OTC desks. Examine that to the primary quarter of 2024, the place every day ETF buys took up a a lot bigger chunk—as much as 12% of OTC’s stock. ETFs would wish to ramp up demand much more in the event that they’re going to make a severe dent in OTC provides.

And there’s a shift taking place in these stock numbers. OTC desks’ total Bitcoin stability isn’t climbing prefer it did earlier this yr. Throughout Q2 and Q3, their stockpiles ballooned by over 77K and 92K Bitcoin in August and June, respectively. Within the final month, nevertheless, that stability rose by solely 3K.

Decrease every day Bitcoin inflows to those desks (right down to 90K from the year-to-date common of 189K) are serving to to gradual the stock development. This drop in provide would possibly add upward stress to Bitcoin’s value if ETF demand holds sturdy.

Market nerves forward of the U.S. election

With the U.S. presidential election approaching, Bitcoin is going through market jitters. Buying and selling exercise has reached new heights, with open curiosity hitting data this week. After pushing towards an all-time excessive of $73,800, Bitcoin stumbled, signaling that market gamers are feeling the pressure. Analysts are actually predicting a doable value retracement earlier than any severe good points resume.

Crypto analyst Titan of Crypto noticed a neighborhood backside at $66,200 and questioned if a bounce would possibly observe. His chart confirmed Ichimoku cloud information for a one-day timeframe, highlighting a value dip under the Tenkan-sen development line, suggesting Bitcoin might nonetheless slide additional.

He stated, “BTC couldn’t shut above Tenkan, signaling a doable extra profound pullback. If the breakout is confirmed, we’d see a retest of Kijun round $66,200, which might mark a neighborhood backside.”

Bitcoin closed October with a ten% achieve, ending the month above $70,000 for the primary time since March. However with the election days away, the market isn’t precisely steady.

Observers observe that election uncertainty might set off volatility within the quick time period, whereas Bitcoin’s total supply-demand dynamics stay bullish. Traders have expressed combined opinions on how every candidate would possibly impression the business.

Nic Puckrin, CEO at Coin Bureau, stated, “What’s driving value motion is undoubtedly the election.” He added, “The markets will take their cue primarily based on who wins the White Home. Trump is extensively seen as pro-crypto, though no matter who wins, Bitcoin remains to be primed for a pump.”

Election-related stress is amplifying Bitcoin’s typical October-November rally. Traditionally, these months have been sturdy for the cryptocurrency, with Bitcoin closing larger in seven of the final eleven Novembers. Whereas traders put together for post-election swings, some are betting {that a} Trump win might add 10%–15% to Bitcoin’s value, whereas a Harris victory would possibly trigger a similar-sized dip.

This election season additionally overlaps with key milestones for Bitcoin. October marked six months because the final halving occasion, which halved the speed of latest Bitcoin issuance. With provide tightening and demand growing, some analysts consider Bitcoin is on the trail to a different file, although election volatility is likely to be a stumbling block within the close to time period.