Bitcoin issue hits an all-time excessive of 95.67T, which coincides with a report hashrate that went above 700 EH/s for the primary time.

The three.9% bounce in issue turns into the thirteenth optimistic adjustment for 2024.

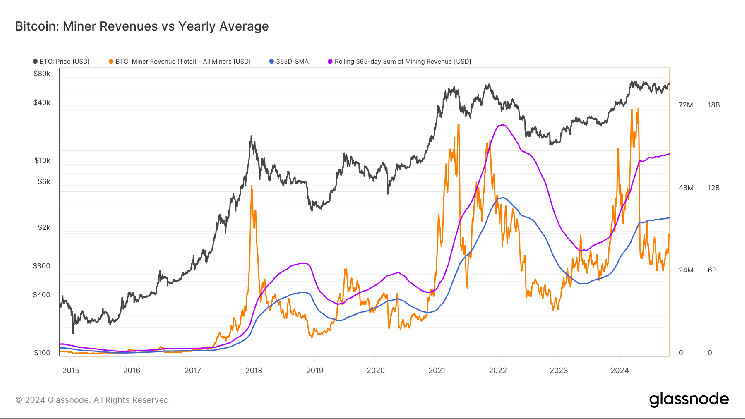

As soon as the 365-SMA complete miner income is claimed, this usually coincides with bull runs in bitcoin.

Bitcoin’s (BTC) mining issue hit an all-time excessive of 95.67 terahashes (T), rising by 3.9%, on Tuesday, Glassnode information exhibits.

Mining issue measures how arduous it’s to mine a brand new block on Bitcoin. Up to now, in 2024, there have been 22 issue changes, with 13 being optimistic. In consequence, the problem has jumped from 72T to 92T, a 27% enhance, year-to-date.

The community robotically adjusts each 2,016 blocks, which is roughly each two weeks, to make sure that blocks on common are mined each 10 minutes.

Learn extra: Mining New Bitcoin Is Extra Troublesome Than Ever. Here is The way it Might Affect BTC Costs

The surge in mining issue has coincided with report hashrate, which additionally made all-time highs of over 700 exahashes per second (EH/s). Hashrate is the mixed computational energy to mine and course of transactions on a proof-of-work blockchain.

As issue will increase, the mining trade faces additional stress because it turns into tougher to generate income. Subsequently, operational prices enhance as extra computational energy is required to put money into extra environment friendly mining gear.

Weak miners being purged

A part of the downward stress on bitcoin, for the reason that April halving, has come from unprofitable miners promoting holdings. These miners, primarily small non-public miners, could not maintain themselves as a result of greater prices. After the halving, these miners began to unplug from the community resulting in a 15% lower in hashrate or began promoting bitcoin as a way to fund working prices.

Taking a look at Glassnode information, we see that miner balances dropped this 12 months as weaker miners knew the halving was approaching and had been making an attempt to fund operations to get forward of the sport.

From November 2023 to July 2024, we noticed over 30,000 bitcoin depart miner wallets, one of many longest distribution durations from miners on report. Nonetheless, we are able to now observe that since July, miner balances have been comparatively flat and have proven indicators of accumulation, telling us remaining miners on common can deal with the brand new surroundings.

The mining trade will proceed to consolidate into stronger palms, with public miners controlling a report share of just about 30%.

Bitcoin bull run commencing quickly

Bitcoin bull runs and surging miner income coincide; as value will increase, so does mining income. Glassnode information exhibits that on a 7-day transferring common (7-DMA), the entire greenback mining income is over $35 million, a rise of over $10 million for the reason that September low.

For the reason that halving in April, the mining income has been beneath the 365-simple transferring common (SMA), at the moment priced at $40 million. Traditionally, as soon as the entire miner income climbs above the 365-SMA, this coincides with a bitcoin bull run, which has been seen traditionally.