Momentum indicators are additionally holding up. The Relative Energy Index (RSI) is sitting at 69, close to overbought ranges however nonetheless pointing to continued curiosity from bulls. A current bullish cross within the shifting averages helps the potential for extra upside within the close to time period. These indicators mirror energy slightly than exhaustion at this stage.

- Miners are slowly shifting cash to exchanges, hinting at nerves over extra draw back strikes.

- The value nonetheless holds inside a bullish chart setup, however a clear break above $105K is required for a carry.

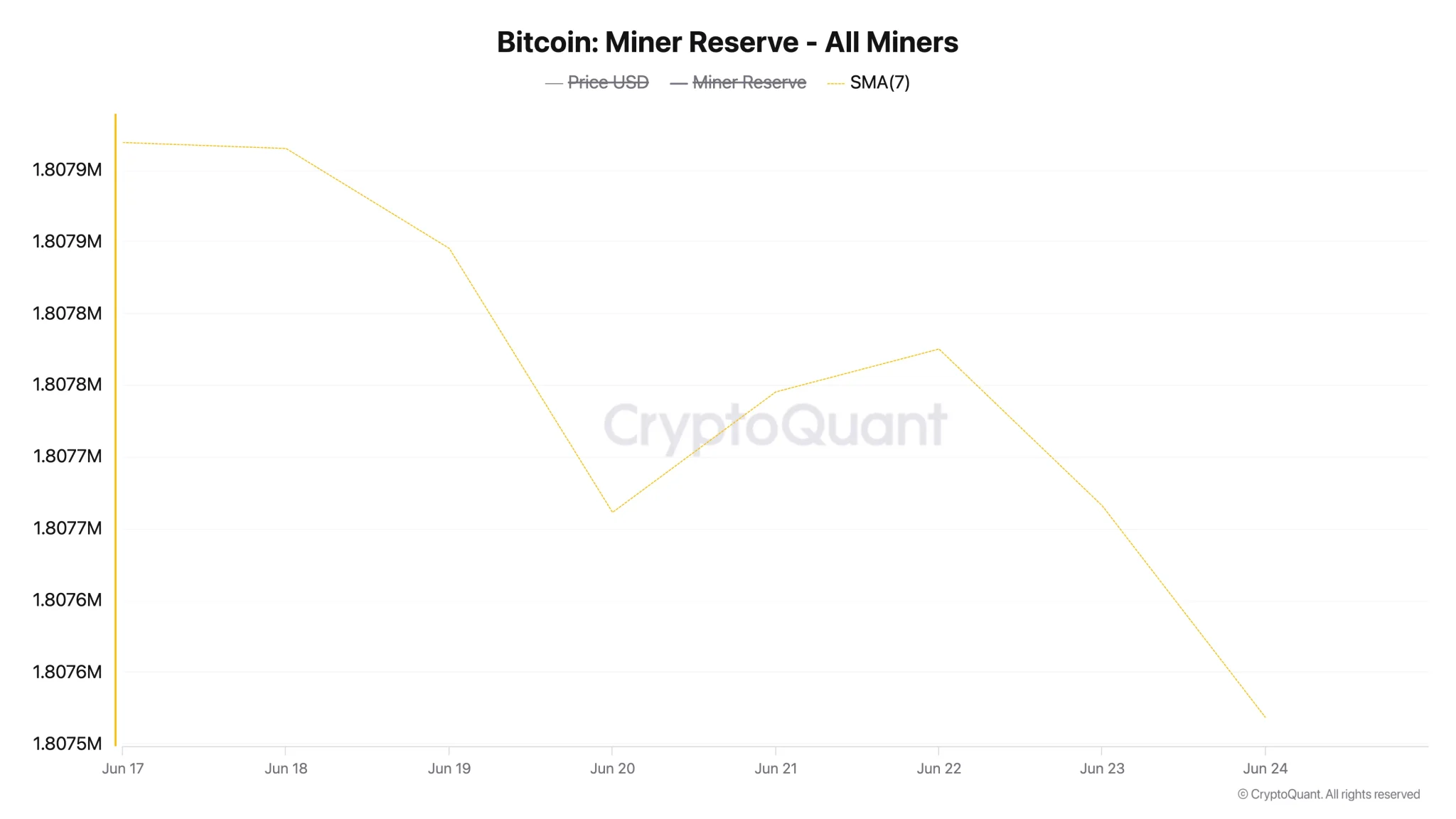

Bitcoin miners seem like exhibiting restraint, trimming their publicity and presumably bracing for broader market weak spot. The miner reserve, which tracks how a lot Bitcoin miners are holding, dropped barely by 0.022% over the previous week on a 7-day common. Although small, this alteration means that some miners are leaning towards promoting.

This shift factors to declining confidence, particularly after Bitcoin dipped under the $100,000 stage over the last two buying and selling periods. That worth has served as a psychological line for a lot of, and falling via it might sign rising uncertainty throughout the market.

Supply: CryptoQuant

Including weight to this sentiment is the sharp 55% spike within the Miners’ Place Index (MPI) inside three days. This metric compares the amount of Bitcoin miners ship to exchanges in opposition to their one-year common. A rising MPI typically implies that miners are shifting extra of their holdings to exchanges, sometimes an indication that they intend to promote.

Market Stress Mounts as Bitcoin Miners Again Away

The current development within the MPI suggests elevated promoting exercise, signaling that miners have gotten much less assured in Bitcoin’s short-term efficiency. The shift of cash from wallets to exchanges signifies a perception that costs could drop additional or fail to achieve upward traction for now.

Nevertheless, some analysts maintain a distinct view. CryptooELITES expressed agency optimism, saying,

When you suppose a rally isn’t coming for Bitcoin, then you definately in all probability don’t know something in any respect.

One other market watcher, Analyst Jelle, believes that Bitcoin stays in a bullish pennant sample. He acknowledged that preliminary breakouts from such a setup are sometimes misleading. Based on him, as soon as the value reclaims energy and breaks above $110,000, “this flies quite a bit larger.”

#Bitcoin is again within the bullish pennant!

Often with these patterns, the primary breakout is a pretend – and when worth reverses, the true breakout is simply across the nook.

Break above $110k and this flies quite a bit larger.

Let’s have a look at 👀 pic.twitter.com/TiSlKCUR8i

— Jelle (@CryptoJelleNL) June 24, 2025

Cup-and-Deal with Targets $144K—Key Breakout Close to

Bitcoin is presently exhibiting a cup-and-handle sample on the day by day chart, a setup that merchants typically affiliate with a doable upward transfer. The value is buying and selling inside the deal with portion, with resistance sitting at $105,000. This stage additionally aligns with the 50-day easy shifting common. An in depth above it could open the best way to $109,000, which represents the neckline of the sample.

Breaking $109,000 with robust quantity may open the trail to retesting the Could 23 excessive of $112,000. If Bitcoin closes above that, merchants would begin awaiting the total goal of the cup sample at $144,000—a stage roughly 37% above present costs.

Supply: TradingView