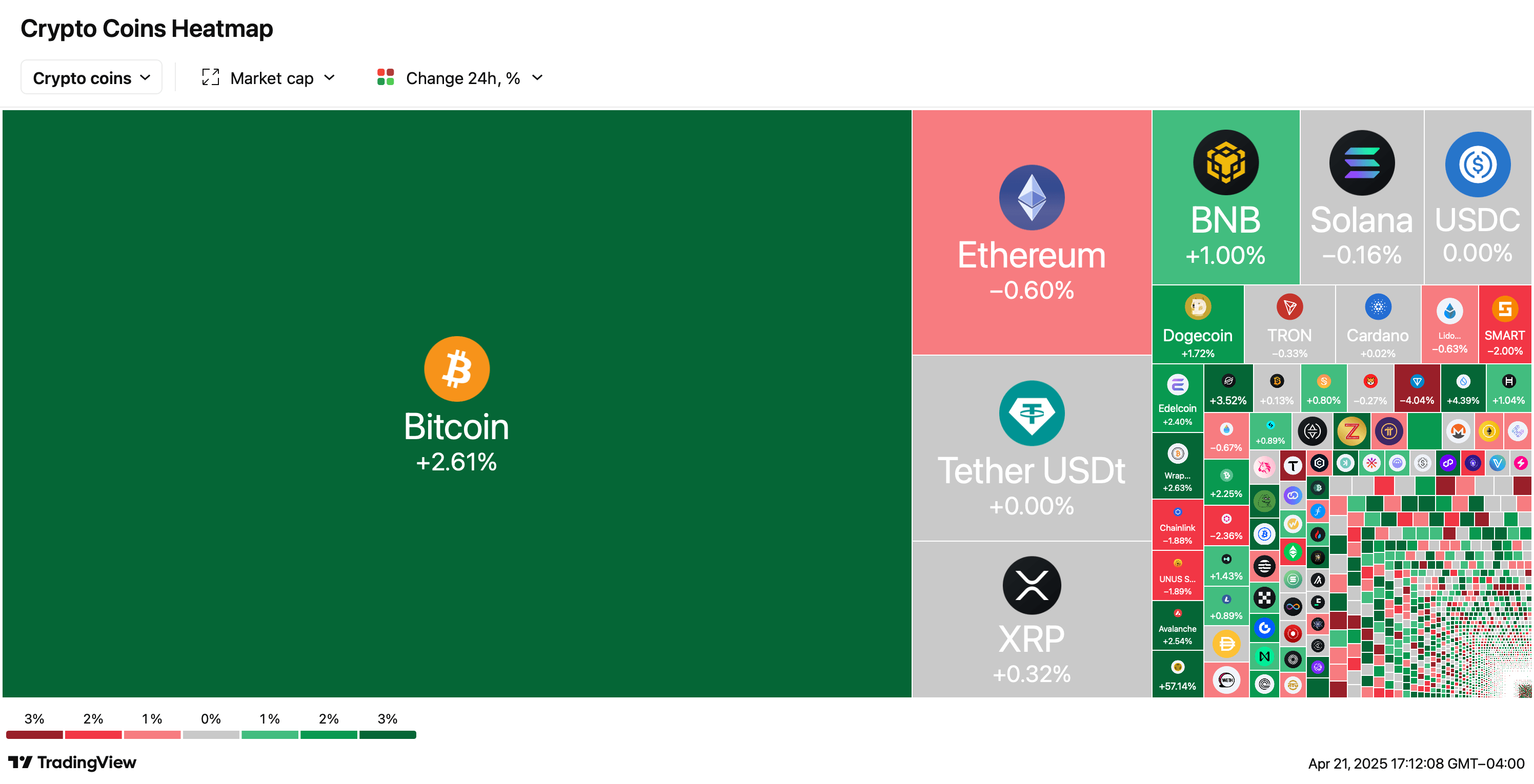

On Monday, the cryptocurrency market skilled a notable uptick as bitcoin reached an intraday excessive of $88,527, reflecting renewed curiosity. Whereas bitcoin recorded a good 2.61% acquire by night, a number of various digital property outperformed, securing extra substantial will increase. Amongst them, convex finance token (CVX) stood out, climbing 21.04% inside a 24-hour interval.

Trump Coverage Triggers $1.5T Inventory Meltdown—Crypto and Gold Emerge as Havens

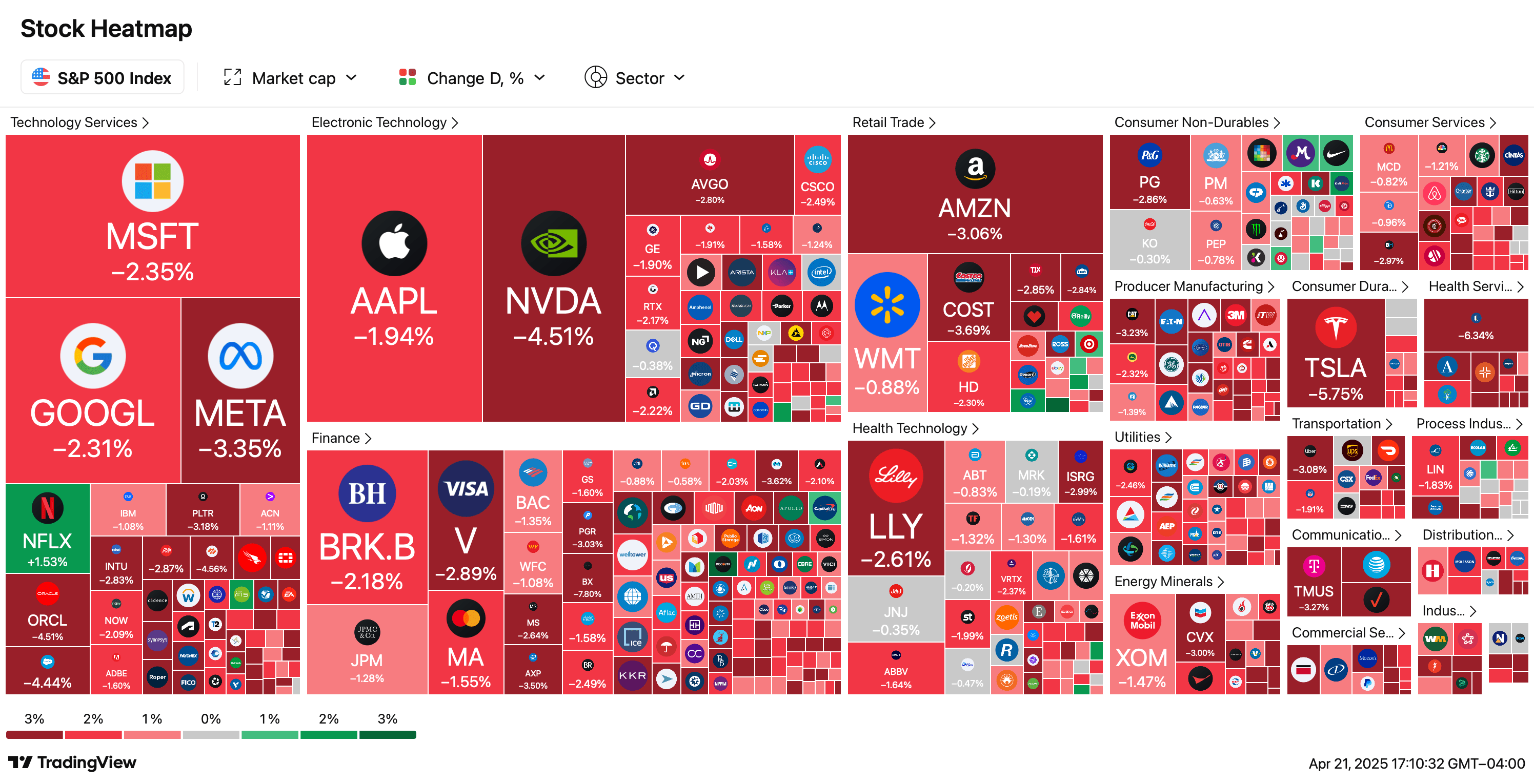

The crypto financial system expanded by 1.77%, reaching $2.73 trillion as of 5 p.m. Japanese on Monday, with round $75 billion added to the sector. Digital property outperformed equities by a large margin as conventional finance (TradFi) markets plunged on April 21. The Dow Jones collapsed by 972 factors, the S&P 500 dropped 125 factors, and tech-heavy Nasdaq Composite nosedived 416 factors amid a pointy erosion in investor confidence.

Bitcoin ( BTC) flirted with $88,527 earlier than settling at $87,262 by 5 p.m., nonetheless boasting a good 2.61% acquire on the day—proving that even crypto’s kingpin isn’t resistant to a little bit afternoon profit-taking. Convex finance coin (CVX) climbed 21.04%, whereas stacks (STX) superior 12.98% over the course of Monday’s buying and selling session. Telcoin (TEL) superior 11.57%, whereas reserve rights (RSR) adopted with a ten.07% acquire.

FARTCOIN, MANA, CKB, KAS, and POL additionally posted will increase, starting from POL’s 4.53% climb to FARTCOIN’s 8.52% uptick. Elsewhere, various tokens chanced on Monday, with MANTRA’s OM persevering with to depreciate regardless of the current burn announcement. OM ended the day because the steepest decliner, falling 6.62%, trailed by DEXE, which dropped 5.44%. CHEEMS slipped 4.12%, whereas PYTH and THETA declined 3.62% and three.54%, respectively.

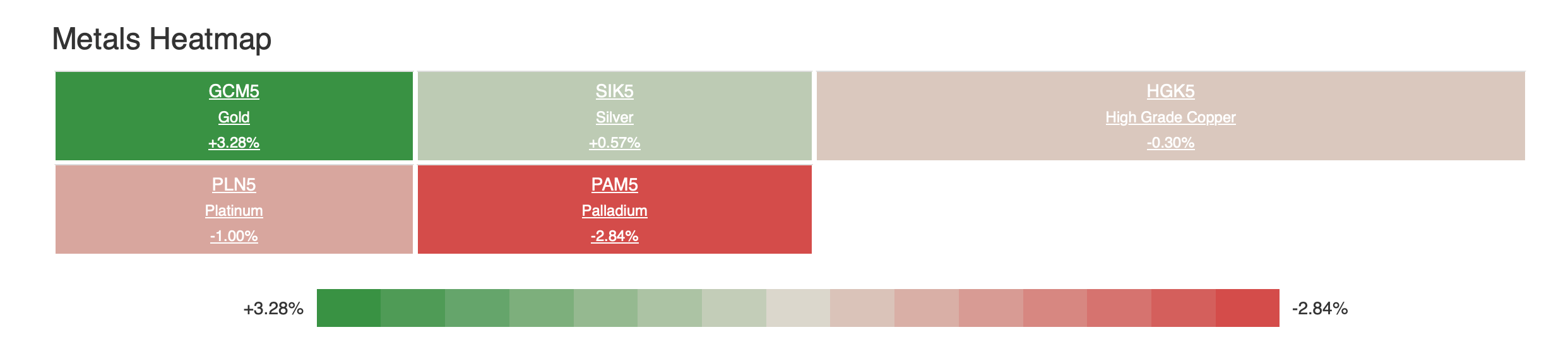

The gold market sparkled with a 3.28% acquire on Monday to the present $3,425/oz, cementing a stellar 12% month-to-month advance, whereas silver—up a modest 0.57% right this moment—nonetheless languished 2.67% under its month-ago degree, a reminder that treasured metals march to completely different drummers.

The monetary world holds its breath as President Trump’s commerce wars dominate the narrative, with a staggering $1.5 trillion evaporating from U.S. equities in right this moment’s session alone.