Bitcoin has achieved a 1.3 trillion greenback market cap and boasts tons of of tens of millions of customers, however it’s nonetheless met by some with skepticism, worry, and even disdain. Detractors label it a device for criminals or speculative gamble with no actual future within the international monetary system.

Even in the present day, remnants of that narrative persist amongst those that function a mouthpiece for large banks and deny its transformative potential. Nevertheless, over the previous 15 years, bitcoin has transitioned from being primarily a grassroots motion amongst people to gaining speedy adoption inside institutional finance.

Bitcoin’s early detractors weren’t unjustified. In its preliminary levels, the venture may effectively have failed. Nevertheless, now that it has demonstrated its endurance, main monetary establishments, hedge funds, and even sovereign entities have begun to discover bitcoin as a retailer of worth.

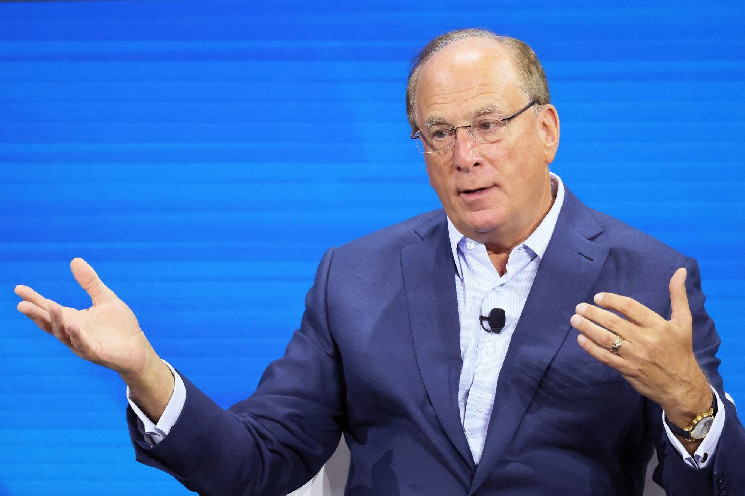

Larry Fink, CEO of BlackRock, has just lately positioned himself as a distinguished advocate. As soon as a skeptic, Fink now believes bitcoin is on the trail to turning into a standalone asset class, corresponding to different monetary improvements that started slowly and later scaled, such because the mortgage and high-yield bond markets. He dismisses the notion that Bbitcoin’s trajectory depends upon political outcomes, stating that neither U.S. presidential candidate will considerably alter its development.

This bullish stance is underscored by the success of BlackRock’s spot bitcoin ETF, which launched in January 2024 and has already amassed over $23 billion in property. The record-breaking inflows into bitcoin ETFs sign a rising institutional urge for food, outpacing even gold-based merchandise by way of capital inflows. In simply ten months, bitcoin ETFs have attracted almost $20 billion, in comparison with gold ETFs, which have solely drawn $1.4 billion regardless of reaching document highs 30 occasions this yr.

This divergence highlights bitcoin’s rising recognition as a retailer of worth and hedge towards financial instability. As Commonplace Chartered predicts bitcoin may attain $200,000 by 2025, no matter U.S. election outcomes, it’s clear that institutional cash is more and more flowing into Bitcoin, solidifying its function as a monetary powerhouse within the international funding panorama.

MicroStrategy’s Infinite Cash Glitch

A pivotal second on this shift occurred when publicly traded corporations started accumulating bitcoin on their steadiness sheets not merely as an funding however as a part of a broader treasury technique. MicroStrategy particularly has change into a key participant on this development, demonstrating how bitcoin can function a strategic asset within the uncommon time interval by which we reside – when a completely new type of base cash is coming into existence.

In 2020, MicroStrategy’s CEO, Michael Saylor, made headlines when the corporate introduced it had transformed its money reserves into bitcoin, citing the long-term devaluation of fiat currencies and the necessity for a more durable asset to protect wealth. This determination was not simply an remoted wager on bitcoin’s future worth however half of a bigger technique to capitalize on the distinctive properties of bitcoin as each a retailer of worth and a strategic monetary asset.

Unpacking MicroStrategy’s bitcoin initiative, which is now colloquially known as the “MicroStrategy playbook” and is being copied by different corporations comparable to Metaplanet, will assist illustrate why bitcoin is ready to disrupt company finance.

On the core of MicroStrategy’s method is the usage of convertible debt to fund the acquisition of bitcoin on an ongoing foundation. By issuing convertible notes at low rates of interest and utilizing the proceeds to purchase bitcoin, MicroStrategy has successfully change into lengthy on “international carry” – borrowing at low rates of interest whereas investing in an asset that has the potential to understand considerably over time. On the identical time, holding bitcoin itself positions the corporate quick on international carry as a result of bitcoin is inherently deflationary – its provide stays predictable as international liquidity will increase, leaving solely its value to reply to rising demand.

This twin place – being lengthy and quick on international carry concurrently – is exclusive. It turns MicroStrategy into what could possibly be described as a contemporary model of a 60/40 portfolio, with the important thing distinction being that each positions (lengthy and quick) are embedded inside the identical asset. Saylor has created a state of affairs the place MicroStrategy is capitalizing on each international liquidity and bitcoin’s shortage to create what some have dubbed an infinite cash glitch. It is a exceptional demonstration of monetary engineering that might solely occur in these early days of bitcoin’s monetization.

The Fading Knowledge Of 60/40

For many years, the 60/40 portfolio – a mixture of 60% equities and 40% bonds – was the gold customary for conservative traders. The idea behind it was easy: equities would supply development, whereas bonds would supply stability and revenue, balancing danger and reward.

Nevertheless, in an financial atmosphere marked by low rates of interest and rampant cash printing, this conventional mannequin doesn’t work in addition to it used to. Bonds are actually dangerous, and the efficiency of the inventory market is tied to a tiny handful of corporations which are monopolistic and extremely regulated.

The outsized efficiency of a choose few corporations – the so-called “Magnificent Seven” – has skewed total market returns, masking weaker performances elsewhere. By mid-2024, this group, together with giants like Apple, Microsoft, and Tesla, delivered a median return of 57% over the earlier yr, greater than double the 25% return of the broader S&P 500. With out these seven mega-cap shares, which now make up 31% of the S&P 500 by weight, the index’s returns would have been considerably weaker. In truth, in the event that they had been excluded, the S&P 500’s year-to-date acquire of 18.1% as of July 2024 could be decreased to only 9%. This disparity illustrates how concentrated market efficiency has change into.

The choice by corporations like MicroStrategy to undertake bitcoin is just not merely a wager on value appreciation; it represents a basic shift in how companies view treasury administration in an more and more unstable financial panorama. For many years, companies have relied on money reserves, bonds, and different fiat-based property to handle their steadiness sheets. Nevertheless, as central banks and regulators around the globe now consistently intervene within the financial system to attain political ends, these conventional property are dropping their means to protect worth.

Bitcoin, in contrast, provides a versatile, low-maintenance retailer of worth that has just about no upkeep prices, and is proof against inflationary devaluation. Furthermore, as bitcoin turns into extra broadly adopted, its liquidity and market infrastructure proceed to enhance, making it simpler for establishments to purchase, promote, and maintain massive portions with out disrupting the market.

MicroStrategy’s transfer to undertake bitcoin as a core treasury asset highlights the rising realization that bitcoin’s potential is way better than many initially believed. The corporate’s progressive method to leveraging each international liquidity and Bitcoin’s shortage has not solely outperformed conventional monetary methods but in addition demonstrated how Bitcoin can present a strategic benefit in an inflationary fiat atmosphere.

Bitcoin’s $100 Trillion Potential

On the time of writing, bitcoin’s market capitalization hovers round $1.3 trillion, roughly a tenth of gold’s $13 trillion. Whereas bitcoin has already confirmed itself as one of many best-performing property of the previous decade, the potential for future development is gigantic. If bitcoin continues to be adopted by establishments, governments, and companies, it may simply rival or surpass gold’s market cap, and even someday change into a $100 trillion asset class.

MicroStrategy’s daring strikes are just the start of what could possibly be an enormous shift in company finance. If extra corporations acknowledge this distinctive second for what it’s, they too may benefit from MicroStrategy’s infinite cash glitch. It now seems that the following wave of bitcoin adoption will come by the use of company steadiness sheets, marking the start of a brand new chapter on this fascinating story.