Though Bitcoin (BTC) fell brief by $200 of building a brand new ATH towards the US greenback, it achieved this milestone towards a number of different fiat currencies. Most significantly, towards the euro, the place the crypto asset surpassed €68,000 for the primary time in historical past.

The main cryptocurrency reached €68,000 on main exchanges, together with Binance, marking its first all-time excessive towards the European forex since March. This breakthrough comes as Bitcoin demonstrates exceptional power towards a number of main fiat currencies, reflecting rising institutional adoption and market confidence.

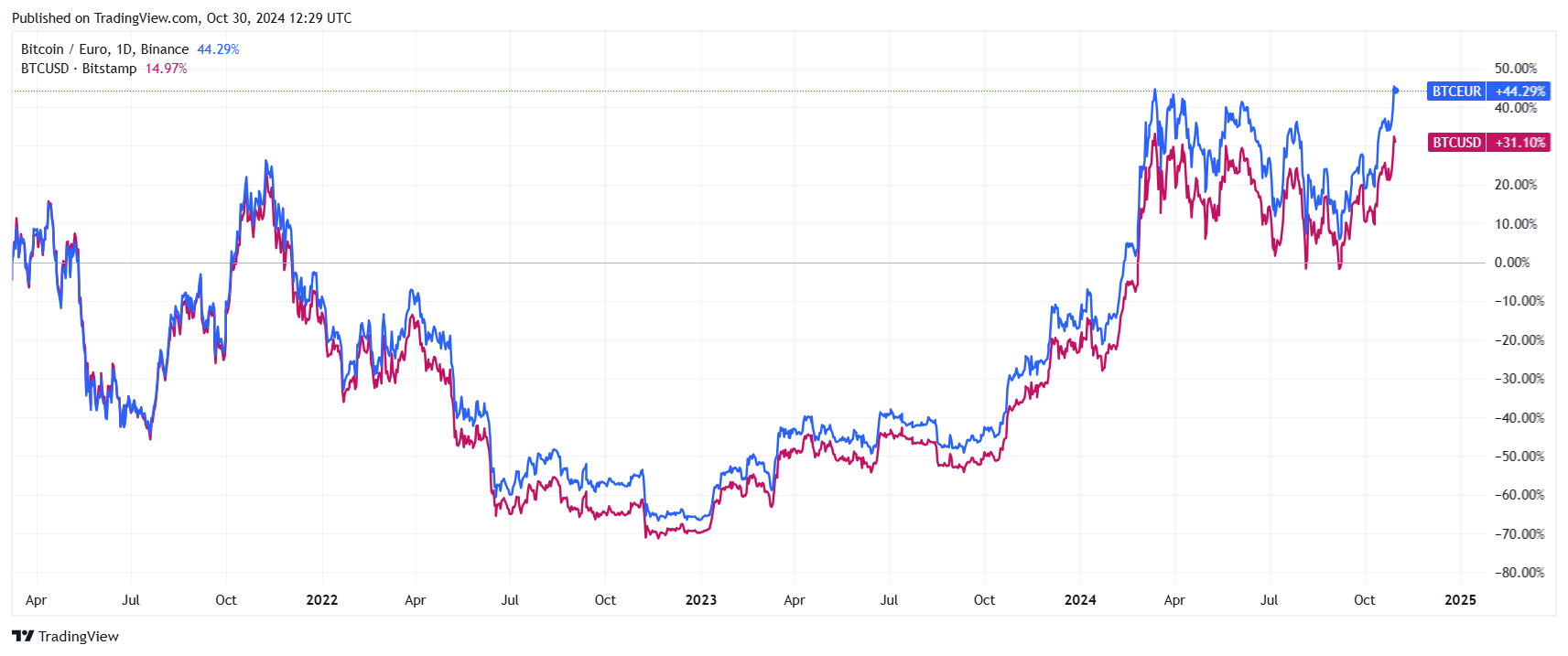

BTC/EUR (blue line) reached new ATH. BTC/USD (purple line). Supply: Tradingview.com

In opposition to the US greenback, Bitcoin examined the $73,600 degree on Binance this week. This implies it got here inside lower than $200 of the earlier ATH established on March 14 at $73,794.

Though the euro is the second most vital forex within the international buying and selling system, it would not carry the identical weight within the cryptocurrency market. Therefore, setting an ATH on the BTC/EUR chart is not as vital for buyers because the BTC/USD pair.

The 350 million residents of the Eurozone simply skilled a brand new all-time excessive for #bitcoin: €67,443. pic.twitter.com/F4yn3feISZ

— Tuur Demeester (@TuurDemeester) October 29, 2024

Historic information exhibits that the overwhelming majority of buying and selling quantity happens on greenback pairs or with dollar-based stablecoins reminiscent of FDUSD, USDT, and USDC. The best buying and selling quantity on the BTC/EUR pair is generated by Bitstamp and Binance exchanges, the place it quantities to barely $40 million day by day for every. As compared, buying and selling quantity in Korean gained on the BTC/KRW pair on Upbit and Bithumb exchanges reaches practically $400 million day by day, ten instances extra.

Buying and selling volumes on the BTC/EUR pair are relatively modest in comparison with BTC/USD. Supply: Coinranking.com

Antonio Di Giacomo, Senior Market Analyst at XS.com

“Within the context of accelerating volatility within the cryptocurrency market, Bitcoin has stunned buyers by reaching an intraday excessive of practically 5 months, climbing to a powerful determine of round $73,600,” stated Antonio Di Giacomo, Senior Market Analyst at XS.com.

“This surge has introduced probably the most well-known cryptocurrency near its all-time excessive of roughly $73,800.00 {dollars}. Analysts level out that hypothesis surrounding the potential victory of Donald Trump within the upcoming U.S. elections has been an important issue behind this improve.”

The digital asset’s efficiency extends past the eurozone, with new information being established towards a number of different main currencies. The Australian and Canadian {dollars} have additionally witnessed unprecedented Bitcoin valuations, highlighting the cryptocurrency’s rising affect in conventional monetary markets.

Bitcoin to $200K

Main monetary establishments are intently monitoring Bitcoin’s efficiency, with a number of predicting additional upside potential. Bernstein Analysis maintains an optimistic outlook, projecting potential valuations reaching $200,000 by late 2025.

“By 2024 finish, we count on Wall Avenue to switch Satoshi as the highest Bitcoin pockets,” commented Bernstein. “Ten international asset managers now personal ~$60Bn wrapped as regulated [exchange-traded funds] in contrast with $12Bn in September 2022.”

Legendary Analysis Dealer Bernstein Has Simply Revealed One among its Famed “Black Books” on #Bitcoin!

160 Pages Explaining Why BTC Will Hit $200k by the tip of 2025 and How Listed #Bitcoin Miners Will Proceed to Consolidate the Business. @gautamchhugani 👏 pic.twitter.com/lDnAvWeYIe

— matthew sigel, recovering CFA (@matthew_sigel) October 23, 2024

Buying and selling volumes have additionally remained strong, with day by day exercise exceeding $47 billion. The cryptocurrency’s technical indicators counsel sustained momentum, with help ranges consolidating round key psychological obstacles.

“The latest improve in Bitcoin’s worth to ranges near its all-time excessive has been influenced by political hypothesis in america and the actions of enormous buyers,” added Di Giacomo. “As elections method, uncertainty and expectations relating to the longer term regulatory framework for cryptocurrencies are components that can proceed to influence the market.”

Immediately (Wednesday), 10X Analysis additionally offered a constructive forecast for Bitcoin, suggesting that the cryptocurrency will attain $100,000 by January 2025.

🔥 #Bitcoin to 100,000 by January 2025 ??? pic.twitter.com/KRJHi4Tbic

— 10x Analysis (@10x_Research) October 30, 2024

Though these projections appear very optimistic, BTC nonetheless has an extended solution to go to achieve them. In the meanwhile, one BTC trades at $72,041 or €66,586 on Binance.