Bitcoin’s worth motion has merchants eyeing two opposing eventualities—both a breakout towards $140,000 or a deeper correction to $60,000.

Analysts spotlight important ranges that would decide the subsequent main transfer.

Bitcoin Value Should Break $95K to Keep Bullish

Crypto analyst Massive Mike sees a transparent roadmap for Bitcoin’s worth trajectory.

In a newly revealed Elliott Wave chart, he outlines two potential outcomes. One is a surge previous $95,000 that would push BTC to $140,000

One other route is a dip to $72,895 earlier than resuming an uptrend.

His evaluation builds on a number of Fibonacci extension targets, shifting averages, and a five-wave impulse construction.

In response to his chart, Bitcoin’s corrective part close to $85,000–$95,000 has created a consolidation zone.

A confirmed breakout above this vary would mark the beginning of a bullish wave concentrating on $114,693, with a remaining leg probably reaching $150,000.

Massive Mike emphasizes key ranges:

“BTC above $95K will set off the transfer shortly in the direction of my goal of $130K—$140K. Beneath $78K, we take a look at $72K, then run to $140K.”

Analyst Warns of $60K Breakdown If Resistance Holds

Not all analysts share the bullish sentiment. TradingView analyst Alixjey predicts that Bitcoin might crash as little as $63,000 if it fails to interrupt previous $99,500.

BTC units for sharp decline towards $60,000 | Supply: Alixjey on Tradingview

He notes that Bitcoin’s newest drop under $90,000 stunned many merchants anticipating a continued rally.

If resistance between $94,000 and $98,000 holds, he expects BTC to say no sharply.

The final time Bitcoin traded within the $60,000 vary was after the launch of spot Bitcoin ETFs in early 2024.

Alixjey labels this potential downturn as a “final probability” for buyers to build up BTC at decrease ranges. He acknowledged,

“If Bitcoin fails to interrupt resistance, we might see a steep pullback.”

Trump’s Bitcoin Reserve Plan Sparks Market Uncertainty

Including to the volatility, President Donald Trump’s government order establishing a U.S. strategic Bitcoin reserve has triggered combined reactions.

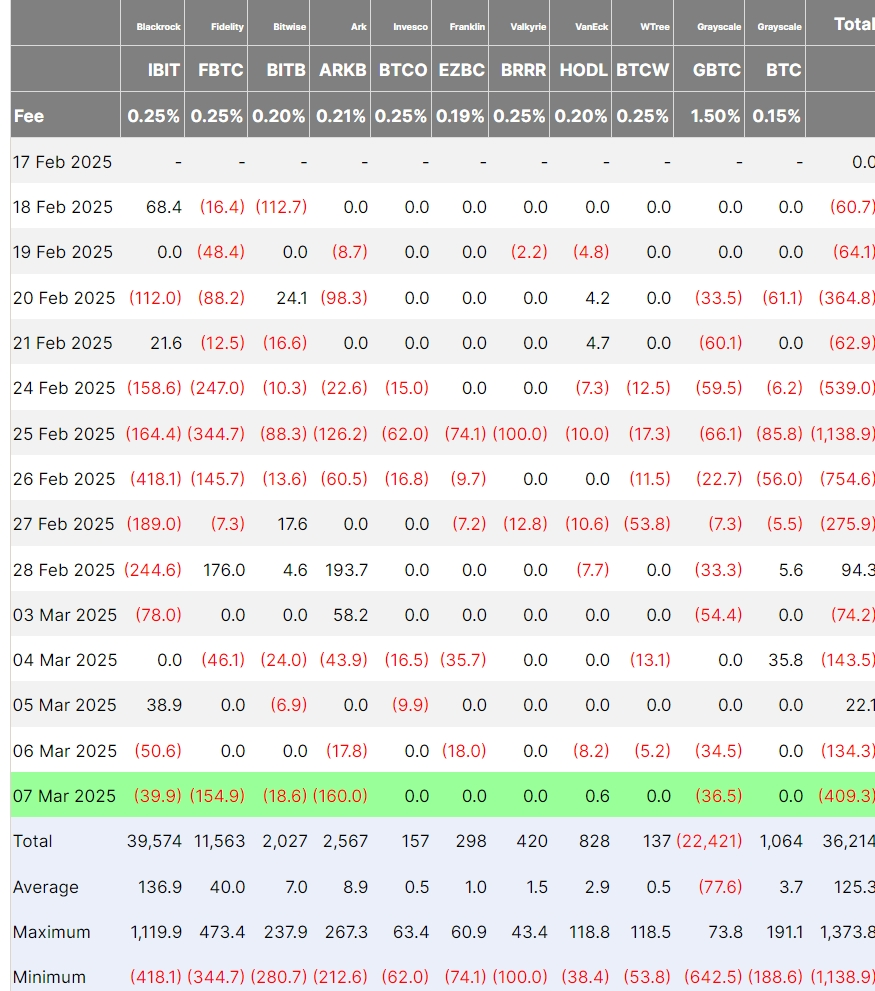

In response to Farside Buyers, Bitcoin ETFs noticed $370 million in internet outflows on March 7 as institutional merchants reacted to the information.

Bitcoin ETF flows present volatility amid market fluctuations. Supply: Farside

The order doesn’t require new Bitcoin purchases however permits budget-neutral acquisitions utilizing seized belongings.

This upset the market, with Wanchain CEO Temujin Louie saying it fell wanting expectations.

Regardless of the sell-off, some see the order as a long-term bullish sign. Bitwise analysis head Ryan Rasmussen famous,

“The U.S. reserve means different international locations will purchase Bitcoin… monetary establishments haven’t any excuse.”

Bitcoin’s present vary between $72,000 and $95,000 stays important.

Analysts stay divided on whether or not BTC is on the verge of a rally or a serious correction.

With key liquidity ranges but to be examined, all eyes are on whether or not Bitcoin can reclaim $95,000 or danger a plunge towards $60,000.