Bitcoin (BTC) is displaying indicators of a possible breakout, with current worth motion indicating constructive momentum.

As broader market situations quiet down, BTC has remained regular, with constant investor conduct fueling hopes of additional positive aspects. The altcoin is poised for doable development because it continues to draw buyers’ consideration.

Bitcoin Has The Assist Of Key Holders

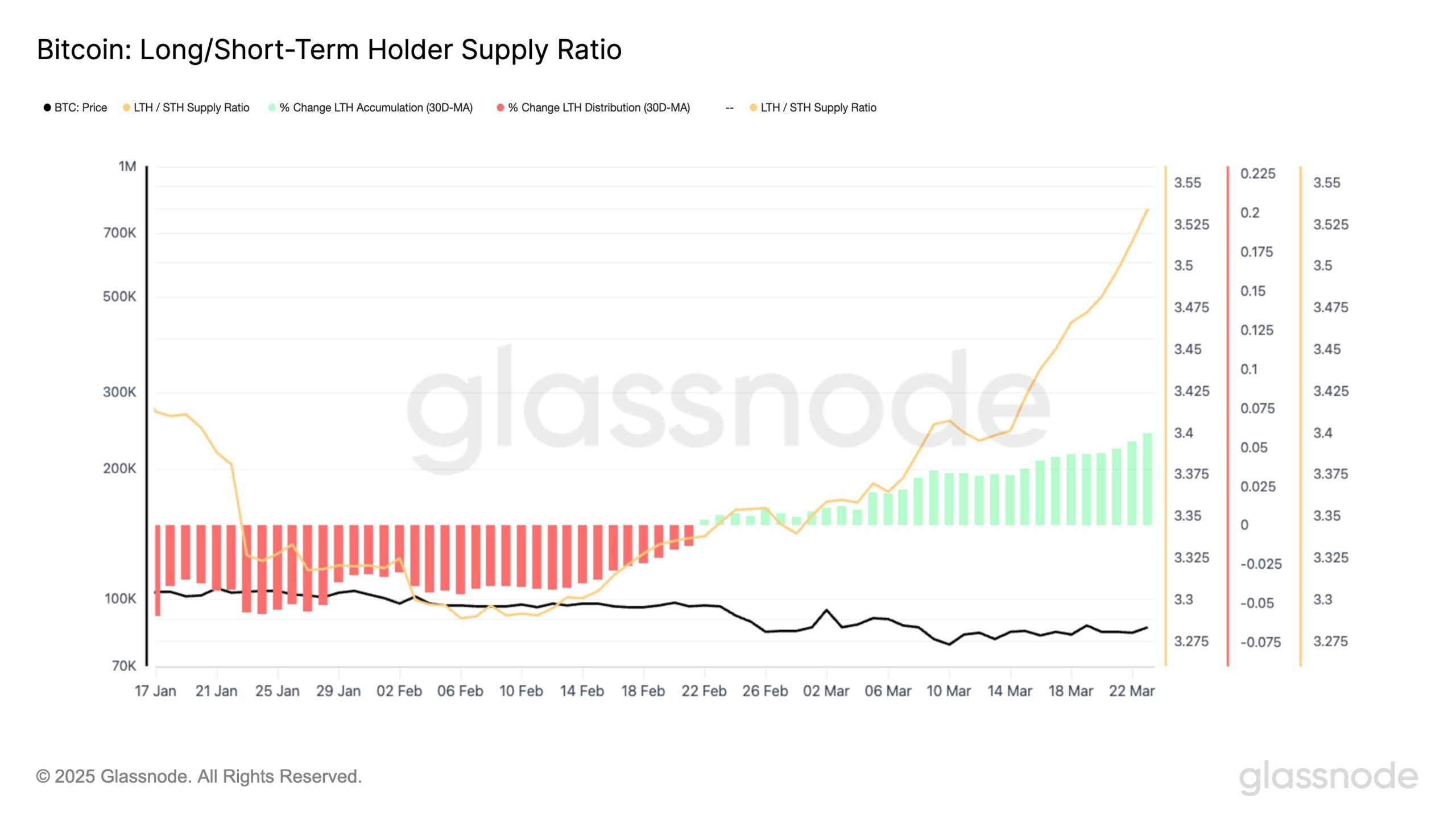

The Lengthy/Quick Time period Holder Provide Ratio has proven notable development because the finish of February, signaling a constructive shift in investor conduct. Lengthy-Time period Holders (LTHs) are in regular accumulation, with the 30-day accumulation charge now nearing 6%. The speed of this alteration has additionally elevated, averaging 7% every day since late February.

This sustained accumulation means that LTHs have a powerful perception in Bitcoin’s future potential, which might assist BTC preserve its current development. LTHs are sometimes seen as a stabilizing drive available in the market, and their constant accumulation might act as a basis for the continuing uptrend in Bitcoin’s worth.

Bitcoin Lengthy/Quick-Time period Holder Provide Ratio. Supply: Glassnode

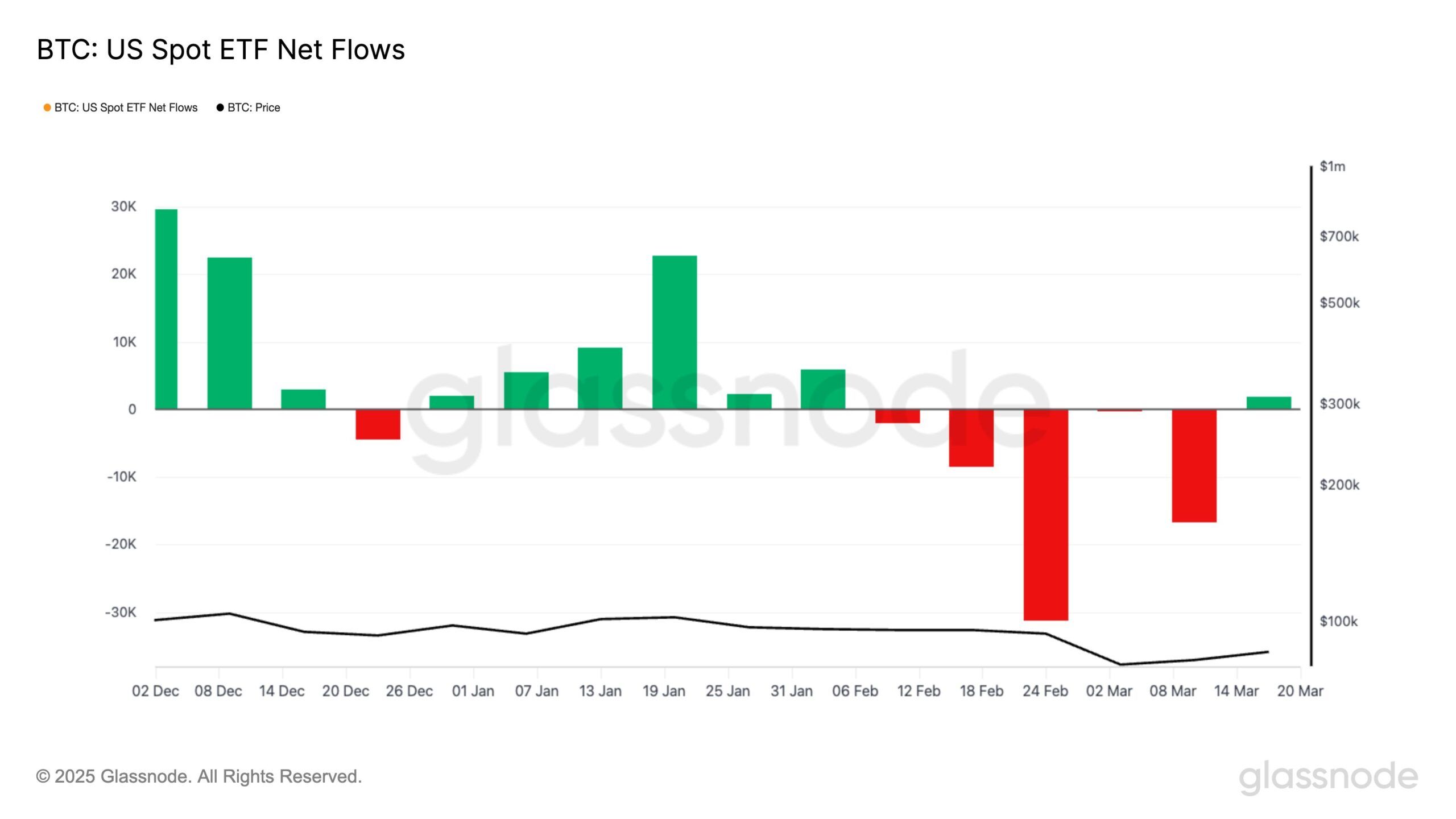

Bitcoin has additionally seen a constructive shift in macro momentum, notably with the current inflows into Bitcoin Spot ETFs. Final week marked the primary ETF inflows in a month, breaking a four-week streak of outflows. This modification alerts returning confidence amongst buyers, notably macrofinancial buyers. The renewed curiosity in BTC ETFs displays the rising demand for Bitcoin publicity in institutional portfolios.

The inflows point out that bigger buyers are as soon as once more viewing Bitcoin as a worthwhile asset. This might be a powerful sign that demand for Bitcoin is recovering, which can assist propel the worth additional. The involvement of institutional buyers might drive vital worth appreciation within the coming weeks.

Bitcoin US Spot ETF Web Flows. Supply: Glassnode

BTC Worth Rise Is Constant

Bitcoin is at present buying and selling at $86,630, breaking out of a descending wedge sample. The worth is making an attempt to safe $86,822 as assist, which can be essential for BTC’s subsequent transfer. If the assist holds, Bitcoin could proceed its upward trajectory in direction of the $89,800 resistance stage.

The affirmation of the breakout will come when Bitcoin efficiently flips the $89,800 resistance into assist. A sustained transfer above this stage might push the worth additional towards $93,625 and probably $95,000.

Bitcoin Worth Evaluation. Supply: TradingView

Nonetheless, if Bitcoin fails to breach $89,800, it might battle to take care of its present momentum. A consolidation beneath this stage or a drop to $85,000 would delay the restoration, shifting the market sentiment towards warning. This could halt the progress and probably result in an extended consolidation part.