The world’s largest cryptocurrency, Bitcoin, is experiencing a downward wave right now and is buying and selling at $82,400 on the time of writing, with a lower of roughly 4% within the final 24 hours.

BTC fiyatının gün içerisindeki hareketini gösteren grafik.

The elevated volatility marks essentially the most important turbulence since December, when Bitcoin’s value surged on hypothesis about Trump’s return to the White Home and his pro-crypto stance. Nevertheless, not like the upward momentum final December, Bitcoin’s value has been on a downward development, shedding over 15% previously month.

The newest value swings come as Trump signed an govt order establishing the Strategic Crypto Reserve. The order mandates a full accounting of the U.S. authorities’s digital asset holdings, together with an estimated 200,000 BTC value round $17 billion. The administration has ensured that these belongings is not going to be bought, with Trump’s Crypto Chief David Sacks likening the reserve to a “digital Fort Knox.”

Along with the chief order, Trump held a “crypto summit” with business leaders together with Coinbase CEO Brian Armstrong and Kraken co-CEO Arjun Sethi. Regardless of these strikes indicating elevated institutional recognition of Bitcoin, the market response was bearish, suggesting that buyers had been both ready for the reserve announcement or discovered the small print inadequate. Trump first floated the thought of a Strategic Bitcoin Reserve in July of final yr.

Nick Ruck, director of LVRG Analysis, mentioned buyers are doubtless “disenchanted” that the reserve will likely be funded by Bitcoin seized by legal or civil asset seizures fairly than direct authorities purchases.

Bitcoin’s decline and elevated volatility coincided with a broader market sell-off triggered by new tariffs introduced by the Trump administration.

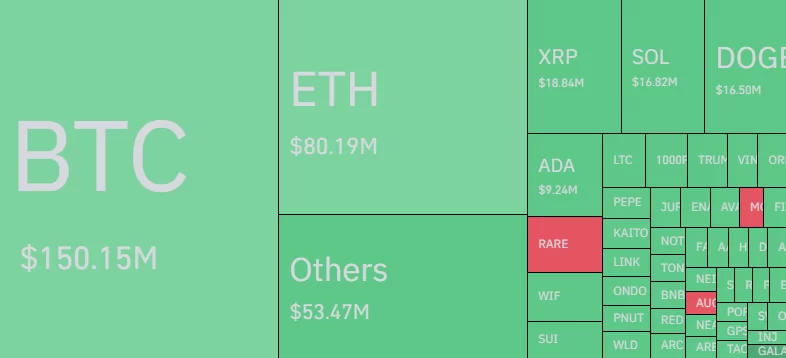

Together with the declines, there have been severe liquidations in the whole cryptocurrency market. In line with the information, the cryptocurrency market skilled a liquidation of $423 million, $387 million of which had been in lengthy positions.

Graph displaying liquidations within the cryptocurrency market within the final 24 hours.

The biggest liquidations had been seen in Bitcoin, Ethereum, XRP, Solana and Dogecoin.

*This isn’t funding recommendation.