Bitcoin can backside quickly as a result of a 2026 recession, or a inventory market crash, retains trying just like the outlier situation

My core concept across the Bitcoin market has remained the identical since final September, earlier than we hit the all-time excessive in October.

I laid it out clearly in my medium-term $49,000 Bitcoin bear thesis revealed on Nov. 24, 2025, and revisited it once more on Jan. 30, 2026.

Throughout each items, the argument didn’t change:

Bitcoin nonetheless trades in cycles, the true “that is the low” second tends to reach when miner economics and institutional flows align, and the eventual backside print normally feels mechanical fairly than emotional.

Since then, the talk round 2026 has drifted into a well-known place, folks (particularly on social media) maintain making an attempt to tie Bitcoin’s subsequent transfer to a looming international recession, or a inventory market crash that forces all the pieces to liquidate collectively.

I get why that story is engaging. It’s clear, it’s cinematic, it provides everybody a single factor guilty.

It additionally feels much less and fewer like the bottom case.

If you happen to have a look at the massive macro forecasts, they invoke slowdown language, not breakage language.

The IMF has international progress projected at 3.3% for 2026. The World Financial institution sees international progress easing to 2.6% in 2026, and it frames the world as resilient even with commerce stress noise. The OECD initiatives international GDP progress easing to 2.9% in 2026.

Then you may have the crowd-sourced model of the identical concept.

On Polymarket, the chances of a US recession by the tip of 2026 have been sitting across the low 20s, a market that’s principally telling you recession threat is actual, but it isn’t the central expectation.

Jobs are the primary place that story actually will get examined, as a result of jobs are how common folks expertise the financial system. Right here, the info became a real warning gentle, and likewise a reminder that slowdown and crash stay in several lanes.

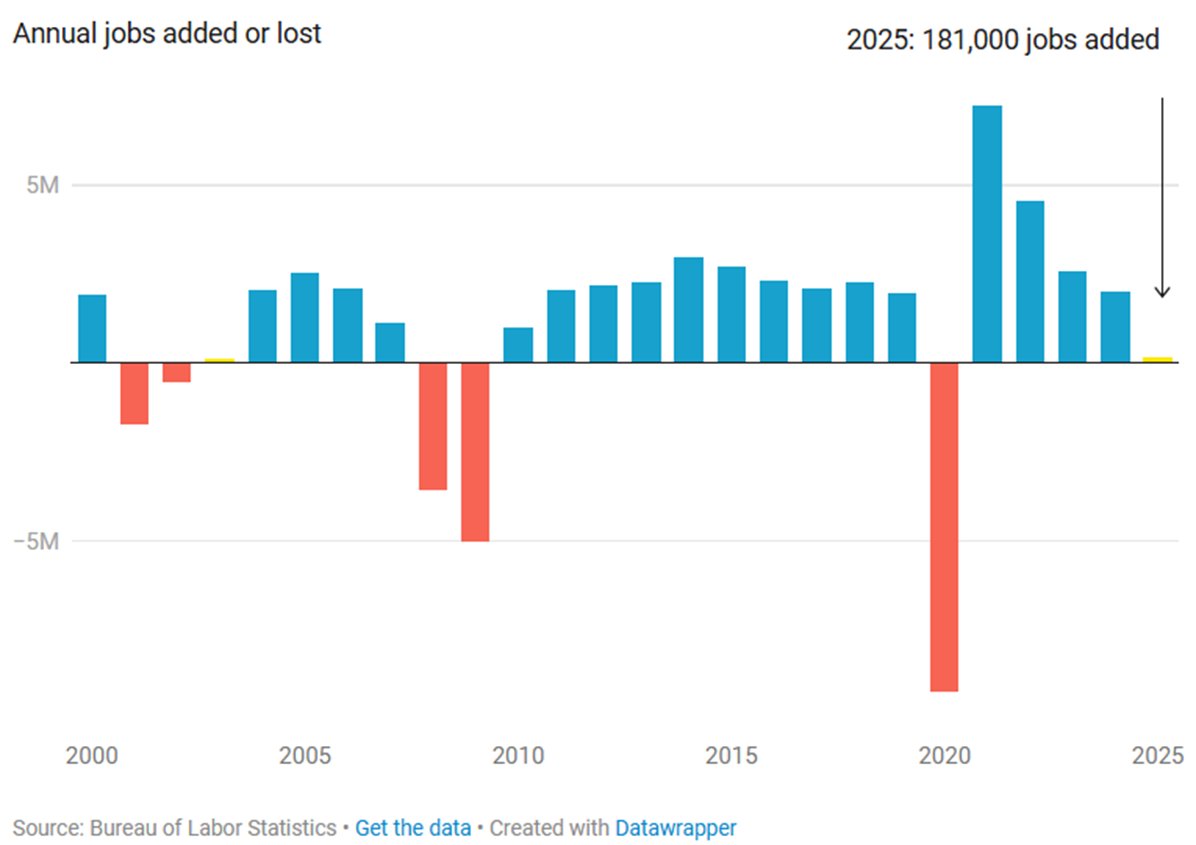

The BLS benchmark revision reveals complete nonfarm job progress in 2025 was minimize to 181,000, down from 584,000. That form of revision adjustments the feel of the entire macro debate, and it matches what many individuals felt via 2025, hiring slowed, job switches grew to become tougher, and loads of white-collar momentum cooled.

The identical BLS launch reveals unemployment at 4.3% in January 2026, and payrolls up 130,000 that month, with positive aspects led by well being care and social help. That may be a cooling labor market, and likewise a labor market that retains transferring, which helps clarify why shares can keep levitated whereas folks argue about recession across the dinner desk.

That hole between how the system feels and the way the indices commerce is precisely why I maintain separating Bitcoin’s cycle mechanics from the worldwide doom narrative. A recession can nonetheless land in 2026, but markets maintain treating it as a minority consequence.

That macro framing issues for Bitcoin, as a result of it means the subsequent large drawdown doesn’t want a world hearth to begin. It may be a neighborhood hearth, leverage will get flushed, miners get compelled into mechanical promoting, ETF flows maintain leaking, and the market prints the extent the place the client base adjustments character.

Bitcoin is already down into the excessive $60,000s, equities have saved making recent highs, and the disconnect is the entire story. The chart seems like a typical cooling part, the internals have felt like winter for weeks.

So, once I say a 2026 recession, or inventory crash, feels just like the outlier situation, I imply the bottom case has shifted. The world seems like it will possibly take up friction, even when it stays politically messy.

That leaves Bitcoin with a easy setup, it will possibly nonetheless print a cycle ground due to Bitcoin-specific mechanics.

Jobs are the macro stress check, and the check factors to a grind

If you need one chart that explains why recession discuss received louder, it’s the annual jobs added or misplaced collection since 2000.

The pandemic contraction sits like a crater, the rebound years tower above all the pieces, and 2025 seems tiny by comparability. The revised BLS determine of simply 181,000 jobs added in 2025 is a quantity that makes folks concentrate.

The sensible level is the form of the slowdown. January 2026 job progress was concentrated in important companies, well being care and social help specifically, per the identical BLS report.

Federal authorities payrolls additionally saved shrinking, with the report noting a large decline from its October 2024 peak. That is the form of labor market that may really feel tough on the bottom whereas the headline unemployment price stays comparatively calm.

Weak hiring will increase recession threat, it additionally will increase the chances of coverage easing and decrease actual yields because the yr goes on. Polymarket’s end-2026 price market has merchants clustering within the low-to-mid threes on Polymarket, which matches the concept of a slower financial system that ultimately pulls charges down.

That is the crux for Bitcoin. Jobs can push policymakers towards simpler circumstances, and simpler circumstances can arrive and not using a international crash. A gradual grind nonetheless creates stress inside crypto, as a result of crypto runs on reflex, leverage, and plumbing.

The macro read-through for 2026 seems like friction, not collapse

The rationale I maintain pushing again on the “all the pieces should crash collectively” framing is that the world’s forward-looking plumbing retains pointing to a muddle-through surroundings.

The IMF describes the worldwide financial system as regular, with know-how funding and flexibility offsetting commerce coverage headwinds. The World Financial institution makes use of the phrase resilient, and it explicitly talks about easing monetary circumstances cushioning the slowdown. The OECD highlights fragilities, nevertheless it nonetheless sits in a forecast world the place progress continues.

On the higher-frequency aspect, the J.P.Morgan International Composite PMI for January printed 52.5, and S&P International’s personal read-through says that stage has traditionally lined up with international GDP working round a 2.6% annualised tempo. That’s boring progress, additionally it is progress.

Commerce is the opposite place folks count on to see the world cracking first, and it’s difficult there too. The UNCTAD commerce replace going into 2026 talks about strain from fragmentation and regulation, however strain is totally different to break down. The Kiel Commerce Indicator is helpful right here as a result of it sits nearer to real-time than most macro knowledge, and it helps you separate delivery drama from precise demand circumstances.

The Bitcoin safety funds seems like winter already arrived

My authentic bear thesis leaned on miner economics for a cause. Miner economics is the place Bitcoin’s real-world prices meet its market construction.

On Jan. 29, miners earned about $37.22 million in every day income. On the identical date, complete transaction charges paid per day have been about $260,550.

That charge share works out to roughly 0.7%.

That quantity issues as a result of it tells you ways the chain is being secured in follow. Charges have been a rounding error, the system has been leaning on issuance, and issuance steps down on schedule. That forces the burden again onto value, and hash economics, when circumstances get tighter.

You possibly can really feel it within the stay charge market too. The mempool feed has had next-block median charge projections that look sleepy for lengthy stretches, precisely the form of surroundings the place a pointy value leg can arrive with none “macro” headline connected.

This is the reason the $49,000 to $52,000 zone nonetheless is smart to me as a cycle ground. It’s the stage the place the market tends to cease debating narratives and begins transferring stock, from compelled sellers and impatient holders to allocators who’ve been ready for a quantity they will dimension into.

The ETF period gave us a clear stress gauge, and the gauge has been flashing

The second pillar of my framework is stream elasticity, and the ETF pipe is the cleanest model of that concept.

In late January, flows seemed like threat urge for food was leaking out even whereas the value was making an attempt to carry collectively.

On Farside, there have been a number of heavy outflow prints, together with roughly -$708.7 million on Jan. 21 and -$817.8 milion on Jan. 29, and the year-to-date complete was detrimental by round -$1.095 billion on the time of my Jan. 30 check-in. Since then, complete yearly flows have reached -$1.8 billion, with $1 billion leaving Constancy’s FBTC alone.

These are the sorts of numbers that change the psychology of dips. Within the pleasant model of the ETF period, down days deliver regular internet shopping for, as a result of allocators deal with weak spot like stock. Within the confused model, the pipe turns into a drain, and the market has to discover a clearing value that turns the drain again right into a bid.

The vital half is that this dynamic can play out whereas the remainder of the world seems positive. Shares can grind greater, progress forecasts can keep intact, and Bitcoin can nonetheless have a violent inside reset as a result of its dominant marginal purchaser and vendor are actually seen via a every day stream desk.

Miners are working two companies now, and that adjustments how drawdowns really feel

The general public-interest angle on this cycle is that miners have stopped being easy Bitcoin margin machines.

Loads of them now appear like energy and infrastructure operators, with a Bitcoin division connected.

That shift issues for 2 causes.

First, it adjustments survival math. When you’ve got a second income stream, you possibly can maintain the lights on via a low-fee surroundings, and you may maintain financing capex even when hash economics really feel tight.

Second, it adjustments behaviour underneath stress. A miner with a compute roadmap would possibly promote Bitcoin extra mechanically to fund buildouts, or defend liquidity for energy contracts, or curtail in ways in which make community circumstances extra elastic on the precise second the market desires stability.

You possibly can see the form of this shift in public bulletins. TeraWulf signed long-duration AI internet hosting agreements tied to large-scale capability, with Google concerned within the construction per the corporate’s launch. DataCenterDynamics reported that Riot has been evaluating choices to pivot capability towards AI and HPC as nicely.

Zoom out and film what which means on the bottom. Groups negotiating energy, managing shareholders, planning knowledge halls, shopping for machines, and nonetheless competing within the harshest hash race on earth. That’s loads of transferring components, and transferring components create reflexive market behaviour when the value begins sliding.

This is the reason I consider the market seems like winter underneath the hood even when the chart has not delivered the total cathartic flush but.

Why a $49k-style backside nonetheless matches, even when 2026 stays economically boring

Put the items collectively and the trail is fairly easy.

Macro seems resilient sufficient {that a} synchronized international threat occasion has slipped out of the centre lane. The Polymarket recession odds replicate that. The expansion forecasters, the IMF, the World Financial institution, the OECD, sit in the identical neighbourhood.

Bitcoin’s internals nonetheless look strained, charges as a share of miner income have been tiny, ETF flows have proven actual risk-off home windows, and the charge market has seemed torpid on mempool.

That mixture builds stress.

Stress normally resolves with a quick transfer, two or three sharp legs decrease, a second the place leverage will get rinsed, and a brand new purchaser base steps in with conviction.

My $49,000 to $52,000 zone continues to be my base case for that form of switch. It’s shut sufficient to really feel believable from right here, and it’s psychologically clear sufficient to draw dimension, particularly from allocators who’ve been ready for sub-$50,000 to deal with Bitcoin as stock.

The macro wildcards nonetheless exist, they usually at all times will. Geopolitics can at all times break the neat forecast world. The marketplace for a China-Taiwan escalation has been actively traded on Polymarket, and people odds transfer quick when headlines hit.

My focus stays boring on goal. Charges, ETF flows, miner behaviour.

If these keep weak whereas value retains bleeding, the chances of a pointy print into the $40,000s keep alive, even when the world financial system retains trudging ahead and shares maintain appearing like nothing is fallacious.