The Bitcoin value struggled to maintain up its 2024 momentum within the first quarter of 2025, crumbling below the macroeconomic uncertainty in the US. Whereas the crypto market regarded set to proceed its woes in early April, costs wish to reclaim their cycle highs — because of the bettering market local weather.

Based on latest value motion information, the Bitcoin value has elevated by greater than 25% to this point on this quarter, outperforming most large-cap property in the identical interval. Curiously, the premier cryptocurrency seems to have extra room for additional upside progress, with its present all-time excessive value seeming like the subsequent speedy goal.

Three Necessary Ranges To Watch This 2nd Quarter

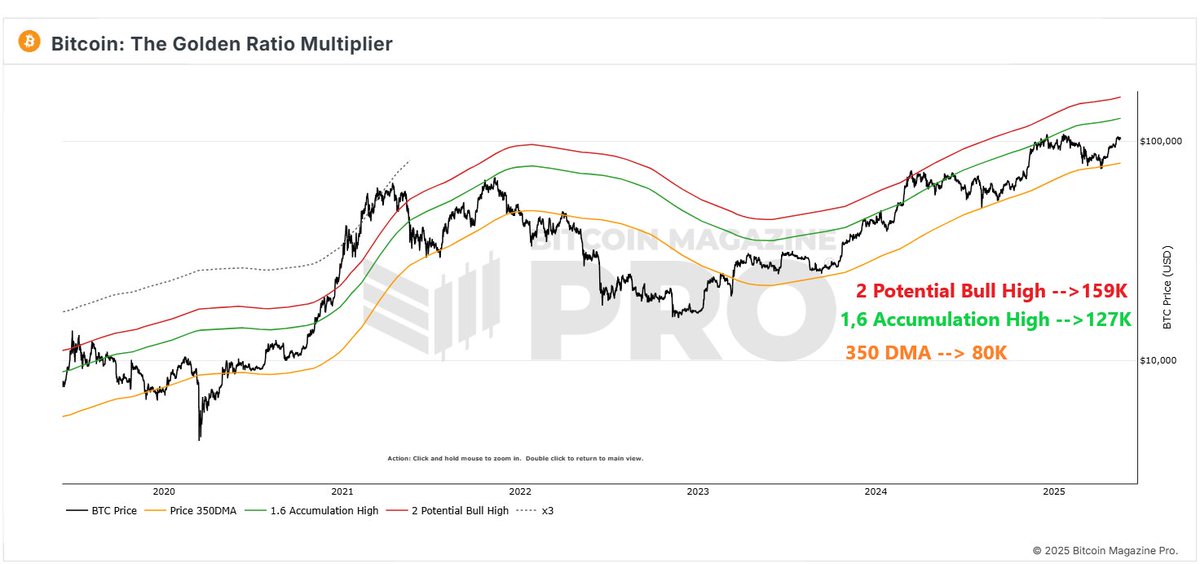

In a Might 17 submit on the X platform, on-chain analyst Burak Kesmeci evaluated the potential of the Bitcoin value within the remaining weeks of this second quarter. In his newest evaluation, the crypto pundit revealed three ranges that could be crucial to BTC’s value trajectory.

The related indicator right here is the Golden Multiplier Ratio, which is beneficial primarily in monitoring cyclical value habits and figuring out essential value ranges. This technical evaluation device applies Fibonacci-based multipliers to the 350-day shifting common (350DMA) to determine potential value tops and bottoms.

Kesmeci recognized the $127,000 and $159,000 ranges because the resistance areas to look at on this bull rally. Particularly, the $127,000 degree aligns with the 1.6x multiplier of the 350-day shifting common, which served as a mid-cycle high in earlier bull runs.

Supply: @burak_kesmeci on X

The $159,000 degree, alternatively, correlates with the 2x multiplier of the 350DMA and has traditionally signaled the cycle tops within the BTC market. Nevertheless, the Bitcoin value would wish to efficiently breach the mid-cycle high if there’s to be an opportunity of a rally in direction of the $159,000 degree.

Moreover, Kesmeci pinpointed crucial help degree to look at for the Bitcoin value within the remaining days of the 12 months’s second quarter. Primarily based on the Golden Multiplier Ratio, this cushion lies at $80,000 across the 350-day shifting common, the place long-term accumulation usually happens. A fall beneath this help might invalidate the bullish principle at present being held for the worth of BTC.

In the long run, Kesmeci famous that the Golden Multiplier Ratio is predicated on shifting averages, and, consequently, the highlighted ranges are topic to adjustments because the Bitcoin value strikes within the coming days.

Bitcoin Value At A Look

As of this writing, the worth of BTC is hovering round $103,275, with no vital value motion previously 24 hours.

The value of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.