The Bitcoin worth has been fairly indecisive in its motion over the previous week, leaping between the $117,000 and $120,000 consolidation zone in that interval. The flagship cryptocurrency, nevertheless, got here tumbling towards the $115,000 mark following large coin actions towards centralized exchanges previously day.

Apparently, a distinguished market skilled has put ahead an much more bearish outlook for the Bitcoin worth over the following few weeks. With this newest projection, the value of BTC appears to solely be firstly of a downward spiral, which may worsen over the approaching days.

How BTC Value Might Be At Threat Of Prolonged Decline

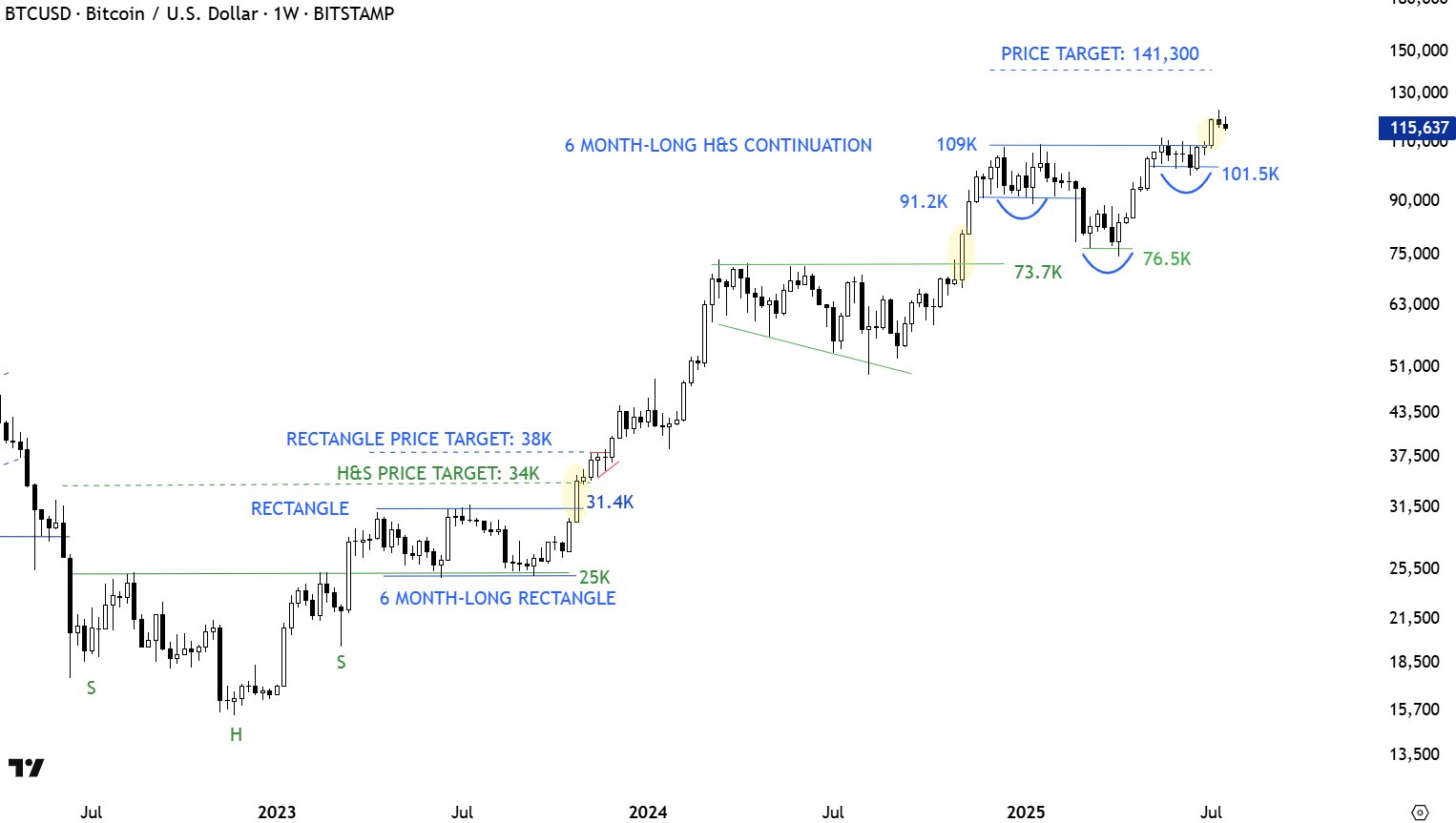

In a July 25 put up on social media platform X, Chartered Market Technician (CMT) Aksel Kibar painted a bearish image for the Bitcoin worth after falling to $115,000 on Friday. In accordance with the analyst, the flagship cryptocurrency may very well be on its approach to round $109,000 within the coming days.

Kibar’s bearish stance revolves across the inverse head-and-shoulder sample on the Bitcoin worth chart on the weekly timeframe. The inverse head-and-shoulders sample is a technical evaluation formation characterised by three distinct worth troughs, together with a decrease “head” set between two larger “shoulders.”

Usually, the inverse sample indicators a potential bullish breakout and is validated when the value breaches the neckline — a trendline connecting the crests (swing highs) between the pinnacle. As proven within the chart under, the Bitcoin worth has already damaged by the neckline to succeed in a brand new all-time excessive.

Nevertheless, Kibar defined that the value breakout witnessed by Bitcoin won’t be the textbook breakout usually anticipated in most inverse head-and-shoulders sample eventualities. In accordance with the market skilled, most head-and-shoulder breakouts are adopted by pullbacks and retests moderately than straight rallies.

Chart information offered by the analyst reveals that, since Could 2017, the Bitcoin worth has witnessed a retest or pullback (sort 2 continuation) extra instances than a straight rally (sort 1 continuation) after a head-and-shoulder sample breakout. This development explains the rationale behind Kibar’s bearish projection for BTC within the subsequent few days.

If the value of Bitcoin does undergo a deeper correction as within the sort 2 continuation, it’s more likely to return to the neckline — and across the $109,000 mark. A transfer like this might symbolize an over 5% decline from the present worth level.

Bitcoin Value At A Look

After a horrendous begin to the day, the market chief appears to be recovering properly from its latest fall to $115,000. As of this writing, the value of BTC stands at round $117,323, reflecting a mere 0.6% decline previously 24 hours.

Featured picture from iStock, chart from TradingView