Bitcoin might outperform each main asset over the following decade, in line with a brand new Bitwise report projecting a 28% annual development price. The agency cites rising institutional demand, scarce provide, and rising issues over fiat forex debasement as key drivers for the rally.

Abstract

- Bitwise initiatives Bitcoin may develop 28.3% yearly over the following decade, probably reaching $1.3 million per BTC by 2035.

- Progress drivers embrace $1-5 trillion in potential institutional demand, 94.8% of the 21 million BTC already in circulation, and rising U.S. debt, up $13 trillion in 5 years.

- Mixed with a low 0.21 correlation to equities, these elements make Bitcoin a powerful long-term store-of-value.

Bitcoin (BTC) may very well be on a monitor of one other huge leap, in line with a brand new report by Bitwise Asset Administration, which says that over the following decade, BTC might outperform each main asset on the planet, with an estimated compound annual development price of 28.3%.

In a 24-page report, Bitwise says its thesis is pushed by “three major elements,” outlining what Bitwise sees as the important thing elements for a long-term bitcoin rally: institutional demand, restricted provide, and rising concern about fiat cash debasement.

The primary issue, institutional demand, stems from the distinctive nature of Bitcoin’s adoption. Not like different rising property comparable to personal fairness or credit score, which first attracted institutional buyers, Bitcoin’s rise was led by retail buyers, the report reads. Almost 95% of all Bitcoin that can ever exist is already owned “primarily by retail buyers,” leaving establishments with nearly no publicity, the agency says.

Now that establishments are beginning to allocate to the biggest cryptocurrency by market cap, the market may see a tidal wave of demand.

“The World Financial institution believes that institutional buyers management roughly $100 trillion in complete property. Within the coming decade, we imagine these buyers will allocate between 1% to five% of their portfolios to bitcoin, which means they might want to purchase $1 trillion to $5 trillion of bitcoin.”

Bitwise

By comparability, Bitcoin ETPs presently maintain $170 billion, a fraction of the $1 trillion to $5 trillion that Bitwise expects establishments may purchase within the coming decade.

Scarce provide

Including gas to the fireplace is Bitcoin’s strict shortage. It’s well-known within the crypto circles that the full provide is capped at 21 million BTC, and 94.8% of that provide is already in circulation. New BTC is produced at a slowing price, with annual issuance anticipated to drop from 0.8% at the moment to simply 0.2% by 2032. Not like gold or oil, Bitcoin’s provide can’t be elevated to satisfy rising demand, making it extremely inelastic.

As Bitwise notes, the collision of huge institutional demand with restricted, inelastic provide gives a “easy economics-driven rationale for our thesis.”

You may also like: Bitcoin bottleneck: Demand outmints provide, who’s responsible?

Lastly, Bitwise factors to rising issues about fiat forex debasement. U.S. federal debt has ballooned by $13 trillion previously 5 years to $36.2 trillion, whereas annual curiosity funds have grown to $952 billion, making them the fourth-largest merchandise within the federal price range. As rates of interest rise above anticipated GDP development, the strain on conventional currencies is intensifying.

“The mix of those three elements—institutional demand, restricted provide, and rising issues about fiat debasement—permits bitcoin buyers to profit as bitcoin earns an growing share of the store-of-value market, and because the dimension of that market grows.”

Bitwise

Valuation mannequin

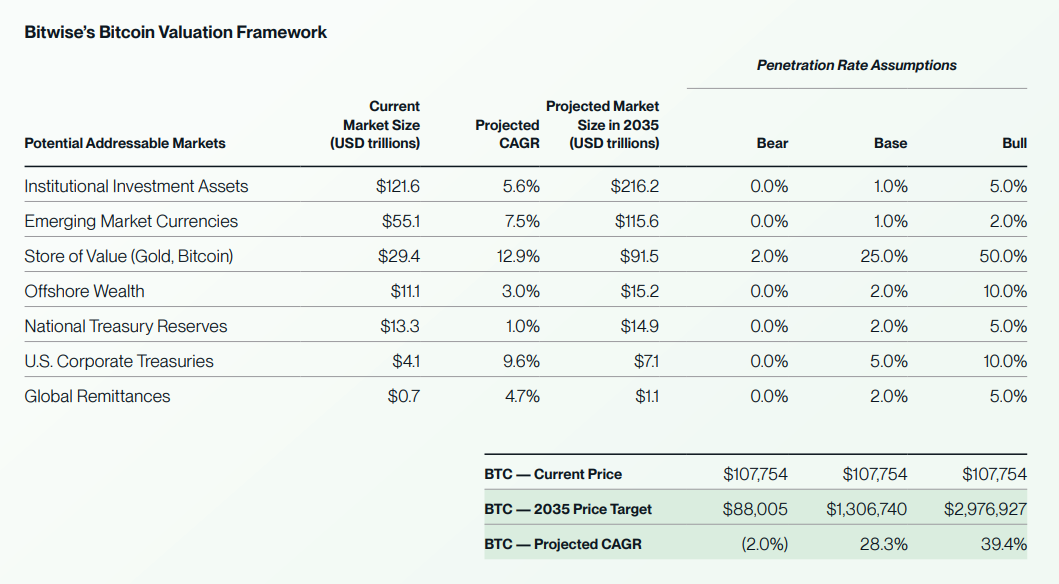

To estimate Bitcoin’s future value, Bitwise makes use of a Complete Addressable Market strategy, which seems on the potential dimension of markets Bitcoin can serve and its probably penetration. This contains non-sovereign shops of worth like gold, company and nationwide treasuries, offshore wealth, and international remittances.

Bitwise’s Bitcoin valuation framework | Supply: Bitwise

Based mostly on conservative assumptions, Bitwise forecasts a 2035 bitcoin value of $1,306,740, reflecting a 28.3% CAGR from present ranges. Bear and bull circumstances vary from $88,005 to just about $3 million per BTC. The agency notes that these projections aren’t a assure, however a framework for understanding the market alternative.

Bitwise additionally makes the case for Bitcoin’s worth in easy phrases: it gives a service, the power to retailer wealth digitally with out counting on a financial institution or authorities. Because the agency explains, the extra individuals who need this service, the “extra precious bitcoin turns into.” On the similar time, the less individuals who need this service, the much less precious Bitcoin turns into. If nobody needs this service, the worth of bitcoin is zero, the report states.

4-year cycle is useless now

Bitcoin’s low correlation with different property provides one other layer of enchantment for buyers. Over the previous decade, its common correlation to U.S. equities has been simply 0.21, and it has not often exceeded 0.50 in short-term measures, opposite to frequent media portrayals. Even when equities drop sharply, bitcoin has traditionally rebounded sooner, highlighting its potential as a diversifying asset.

The mix of shortage, institutional curiosity, hedging potential, and low correlation makes Bitcoin a pretty long-term portfolio asset. Nevertheless, Bitwise analysts warning that the normal four-year cycle might not apply, because the affect of previous market drivers has waned.

Learn extra: Is Ethereum fated for extra upside? Right here’s what analysts assume