At this time’s U.S. jobs report indicated fewer positions added to the economic system than anticipated, however bitcoin remained largely flat on the information.

Regular Bitcoin Value Displays Cautious Market Response to U.S. Jobs Report

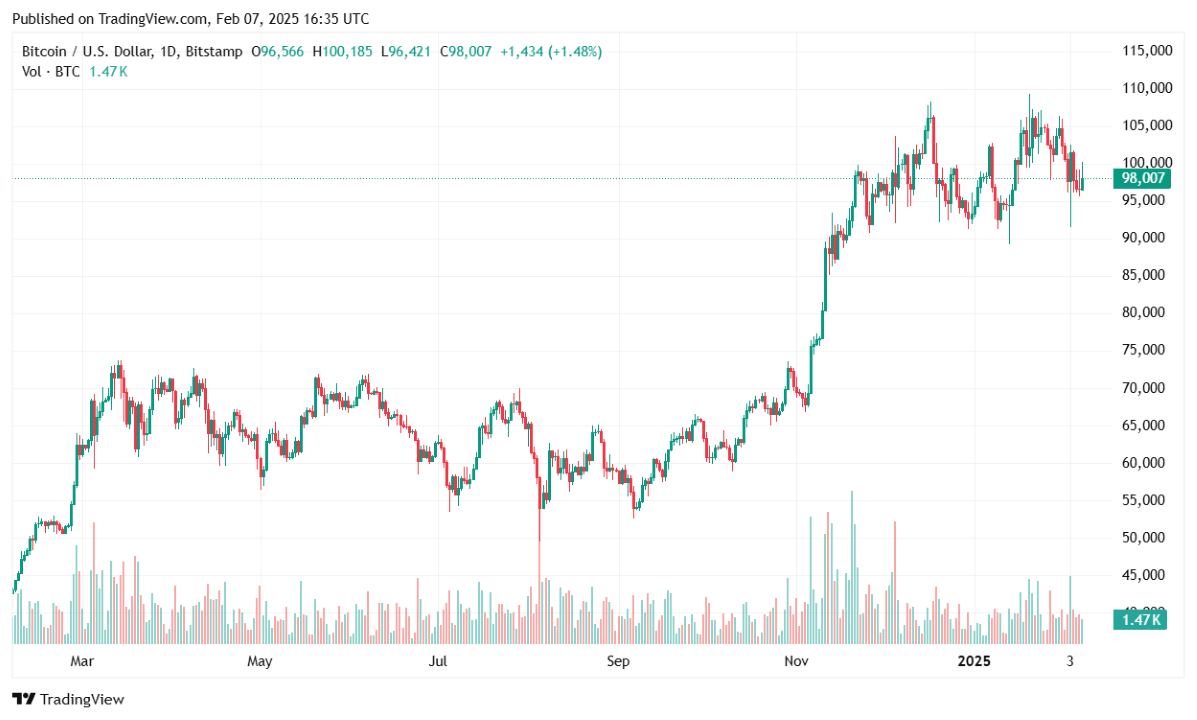

Bitcoin (BTC) is buying and selling at $97,783.95 on the time of reporting, rebounding barely after dipping to $95,707.35 and peaking at $100,154.14 previously 24 hours. The world’s dominant cryptocurrency has gained 0.48% within the final day however stays down 6.50% over the previous week, reflecting ongoing market uncertainty.

(BTC Value 1D chart / Tradingview)

U.S. Jobs Information Provides to Market Uncertainty

The newest U.S. jobs report from the Division of Labor revealed that 143,000 jobs had been added in January, falling in need of economists’ predictions of 170,000. Nevertheless, the unemployment fee dropped from 4.1% to 4.0%, signaling a combined financial image.

Bitcoin and different danger property are inclined to react to labor market knowledge, as employment figures can affect Federal Reserve coverage selections on rates of interest. A slowdown in hiring may enhance hypothesis about future fee cuts, which generally advantages bitcoin by making different property extra engaging in comparison with conventional finance devices like bonds and financial savings accounts.

Buying and selling Quantity Rises as Futures Open Curiosity Climbs

Regardless of bitcoin’s current uneven value motion, buying and selling quantity surged 14.65% to $52.33 billion previously 24 hours, indicating elevated exercise as merchants react to macroeconomic developments. In the meantime, bitcoin’s whole market capitalization stands at $1.93 trillion, sustaining BTC’s dominant place within the crypto area.

Bitcoin dominance edged up barely to 60.8%, a 0.1% enhance, suggesting that capital is continuous to consolidate in BTC whereas altcoins stay beneath stress. Futures markets have additionally seen a slight uptick, with whole BTC futures open curiosity rising 1.18% to $59.44 billion, indicating that merchants are taking recent positions as they anticipate the subsequent main transfer.

Liquidations Present a Balanced Market Shakeout

Bitcoin liquidations totaled $64.64 million over the previous 24 hours, with $34.26 million coming from lengthy positions and $30.39 million from shorts. This comparatively balanced liquidation knowledge means that each bullish and bearish merchants are being caught off guard by the volatility.

Outlook: Key Ranges to Watch

With BTC struggling to reclaim the $100,000 stage, merchants are watching whether or not Bitcoin can break previous resistance or if bearish stress will push it towards $95,000 help. Whereas Bitcoin’s buying and selling quantity and futures open curiosity signifies robust market engagement, broader financial circumstances and regulatory developments will possible play an important function in figuring out the subsequent value pattern.