Bitcoin (BTC) value confirmed sturdy indicators of momentum after per week of constant features. The main cryptocurrency was buying and selling close to $94,846, marking a gradual restoration after earlier consolidations.

Market knowledge suggests Bitcoin is ready for considered one of its strongest weekly performances in 2025.

Analysts imagine that if present circumstances maintain, a possible 15% breakout transfer may quickly push Bitcoin above $109,000.

Massive Transaction Volumes and Whale Accumulation Drive Confidence

Over the previous 24 hours, Bitcoin value has recorded 23,550 giant transactions. This quantity may be very near the 7-day excessive of 23,740, achieved earlier this week.

Excessive transaction exercise, particularly from whales and establishments, usually indicators rising market confidence and accumulation phases.

Market individuals are carefully watching this surge in transaction volumes. Many analysts recommend that enormous gamers shifting Bitcoin are getting ready for a continuation of the uptrend.

This regular rise in exercise has sometimes led to stronger value strikes up to now, as seen in earlier Bitcoin cycles.

Supply: IntoTheBlock

As well as, the present giant transaction exercise means that main traders are nonetheless partaking with Bitcoin at greater value ranges.

This habits displays a perception that the asset has additional room to develop, regardless of the challenges seen across the $95,000 resistance zone.

Open Curiosity in Bitcoin Futures Indicators Rising Leverage

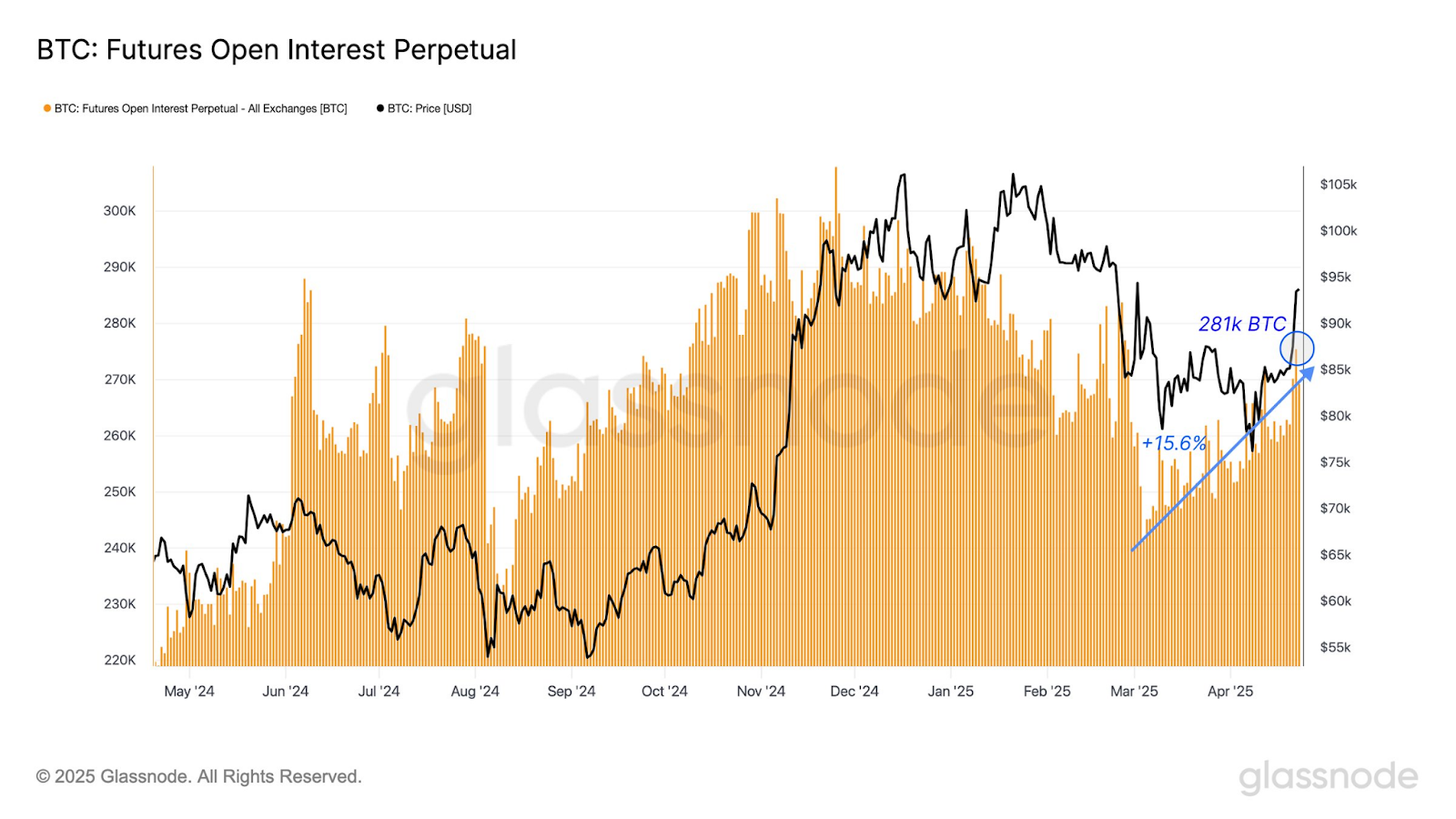

In line with knowledge from Glassnode, Open Curiosity in Bitcoin perpetual swaps has climbed to 281,000 BTC.

This determine represents a 15.6% enhance since early March 2025. Rising Open Curiosity means that merchants are rising their leverage publicity as Bitcoin costs rebound.

Greater leverage can amplify value actions in both course. This build-up has raised issues about potential volatility from liquidations and stop-outs.

Nevertheless, in a bullish atmosphere, leverage may additionally speed up upward strikes when value breaks key resistance ranges.

Supply: X

Analysts have warned that weekends usually see decrease liquidity, which generally results in value gaps when markets reopen.

Bitcoin ended the week at its 2-month excessive, setting the stage for doable market gaps within the coming days if the development continues.

Macro Setting Helps Bullish Momentum

The broader market atmosphere stays favorable for Bitcoin’s bullish momentum. Elements such because the upcoming Bitcoin halving occasion and robust inflows into spot Bitcoin ETFs have supported shopping for strain. Many imagine these occasions may proceed to drive costs greater within the coming months.

Michael Saylor, founding father of MicroStrategy, lately identified that Bitcoin had as soon as once more outperformed main inventory indexes just like the Nasdaq and S&P 500.

Saylor posted, “Bitcoin is Quicker,” on his social media account, accompanied by a graphic displaying Bitcoin’s value energy.

Moreover, Bitcoin reserves on centralized exchanges proceed to say no. A discount in exchange-held Bitcoin provide usually signifies that holders are shifting cash into long-term storage, decreasing out there provide for buying and selling.

This development usually precedes stronger value strikes as demand rises in opposition to shrinking provide.

In the meantime, prime executives like John D’Agostino from Coinbase have acknowledged that Bitcoin’s correlation with inventory markets will be each optimistic and adverse.

Present optimistic correlation with rising equities provides one other supportive issue for Bitcoin’s bullish value habits.

Value Consolidation Units Stage for Breakout Above $95,000

Bitcoin has been buying and selling backwards and forwards between $84,000 to $88,000 earlier than this spike to $95,000. This clear breakout from consolidation signifies that there’s renewed shopping for curiosity evident available in the market.

The realm of $95,000 has acted as a significant impediment up to now; nevertheless, the value motion nonetheless depicts a bullish outlook for Bitcoin.

It is because of this that greater lows and sustainable development present affirmation that consumers are firmly in cost.

Accordingly, if Bitcoin value reclaims $95K, technical indications imply the near-term goal is $98K value degree.

Supply: X

Above $98,000, a number of analysts have supplied particular under $106,000 briefly time period and between $109,300 in the long run thus a 15% appreciation from the present price.

These components have been backed up by tendencies of whale accumulation, greater transactions volumes, in addition to optimistic macros.

At press time, Bitcoin traded at $94,089.9, reflecting a 0.02% surge from the intraday low. It attained a $1.86 Trillion market capitalization, highlighting rising funding.

It has been up by a 0.18% enhance whereas 24-hour quantity decreased by 22% and is at present at $25.13 billion.