Bitcoin has witnessed a notable worth surge just lately, with rising optimism out there. This bullish sentiment is basically pushed by substantial institutional investments and new developments within the crypto infrastructure. As of mid-February 2025, Bitcoin is buying and selling at roughly $97,601, having reached an intraday excessive of $98,895. The urgent query stays: Can Bitcoin break previous the $100K mark?

Worldwide Adoption: A Robust Market Catalyst

Institutional buyers from throughout the globe have considerably influenced the current Bitcoin worth surge. Two main disclosures have made headlines:

- Wisconsin Funding Board: The state funding board revealed $321 million in holdings of BlackRock’s iShares Bitcoin Belief ETF. This substantial allocation signifies rising institutional confidence in Bitcoin’s long-term worth.

- Abu Dhabi Sovereign Wealth Fund: The fund disclosed $463 million in Bitcoin ETF holdings. Such investments from globally influential establishments bolster market belief and will encourage different sovereign wealth funds to comply with go well with.

These vital strikes are solidifying Bitcoin’s standing as a mainstream asset class and probably fueling its subsequent leg upward.

Influence on Bitcoin and Altcoins: Conventional Finance Embraces Crypto Custody

The entry of main monetary establishments into the crypto area provides one other layer of bullish sentiment. State Road and Citi Financial institution have introduced plans to launch cryptocurrency custody companies. This initiative goals to offer safe storage options for digital belongings, mitigating safety issues which have historically deterred institutional buyers.

The influx of institutional capital does not solely affect Bitcoin. Traditionally, Bitcoin’s bullish momentum tends to elevate your entire crypto market. Altcoins usually expertise vital good points following Bitcoin’s lead, particularly Ethereum and Solana, which have seen elevated adoption in decentralized finance (DeFi) and non-fungible tokens (NFTs).

The broader market can also be benefiting from improved investor sentiment, with Bitcoin’s dominance fluctuating as altcoins seize extra consideration. If Bitcoin’s uptrend continues, different belongings like XRP, Cardano, and newer entrants like MEW might comply with go well with.

Bitcoin Worth Surge: Non permanent or Everlasting?

Bitcoin Worth Prediction: Can BTC Worth Break $100K?

The $100K milestone has lengthy been a psychological barrier for Bitcoin. Analysts have blended opinions about Bitcoin’s potential to surpass this degree in 2024:

Optimistic Forecasts: Some market analysts estimate an 85% likelihood of Bitcoin exceeding $100K this yr, pushed by ETF inflows and institutional participation.

Cautious Outlook: Historic patterns present that Bitcoin usually experiences corrections after substantial good points. Whereas new inflows from ETFs and conventional monetary establishments are bullish alerts, the market could face profit-taking phases that would sluggish its ascent.

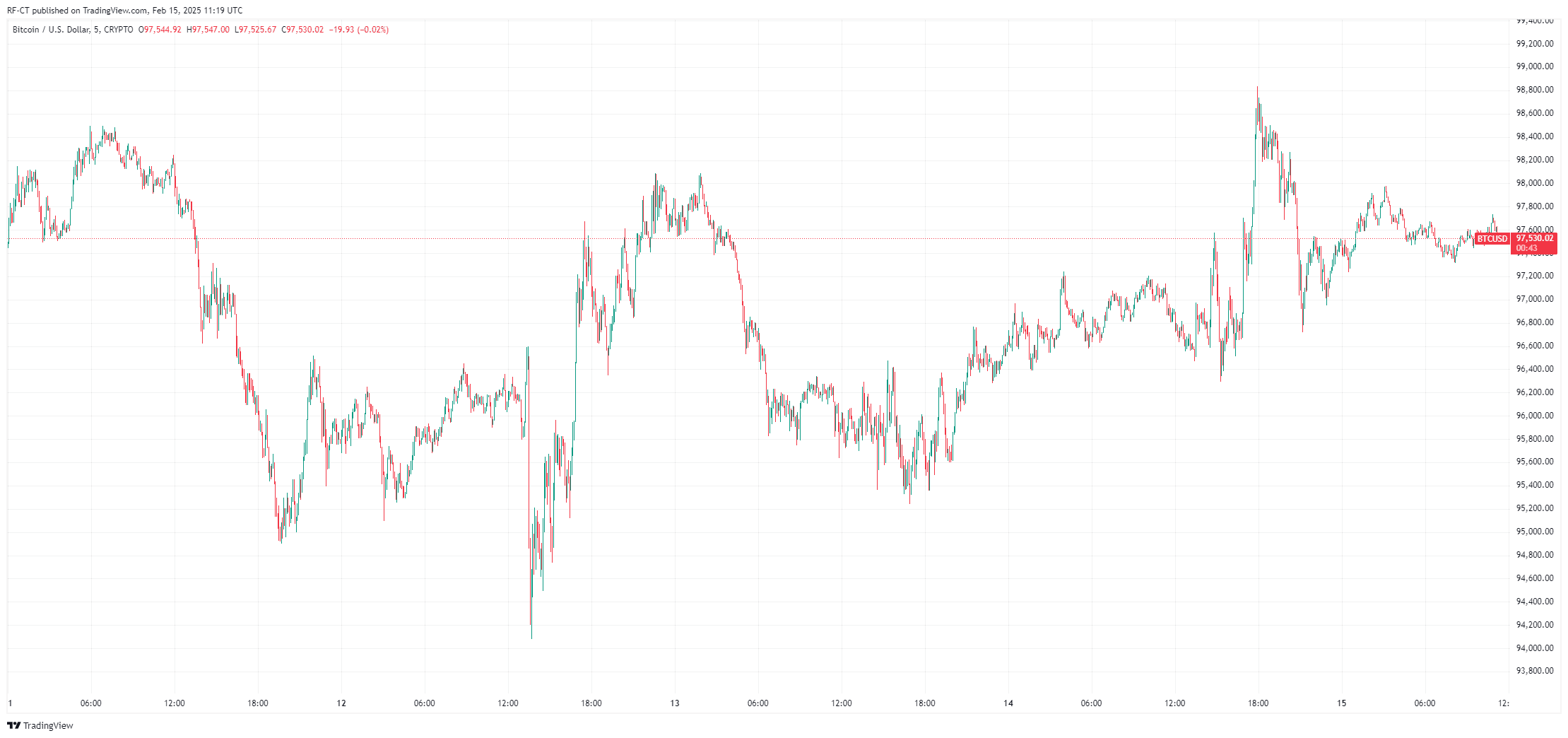

By TradingView – BTCUSD_2025-02-15 (5D)

The current Bitcoin worth surge is undeniably linked to rising institutional curiosity and enhanced crypto infrastructure. With heavyweight buyers just like the Wisconsin Funding Board and Abu Dhabi’s sovereign wealth fund getting into the market, alongside the launch of crypto custody companies from State Road and Citi Financial institution, Bitcoin appears poised for additional development.

Whereas surpassing $100K seems more and more believable, the market stays inclined to volatility. Buyers ought to keep knowledgeable, monitor ETF inflows, and take into account the broader macroeconomic panorama when assessing Bitcoin’s future trajectory.

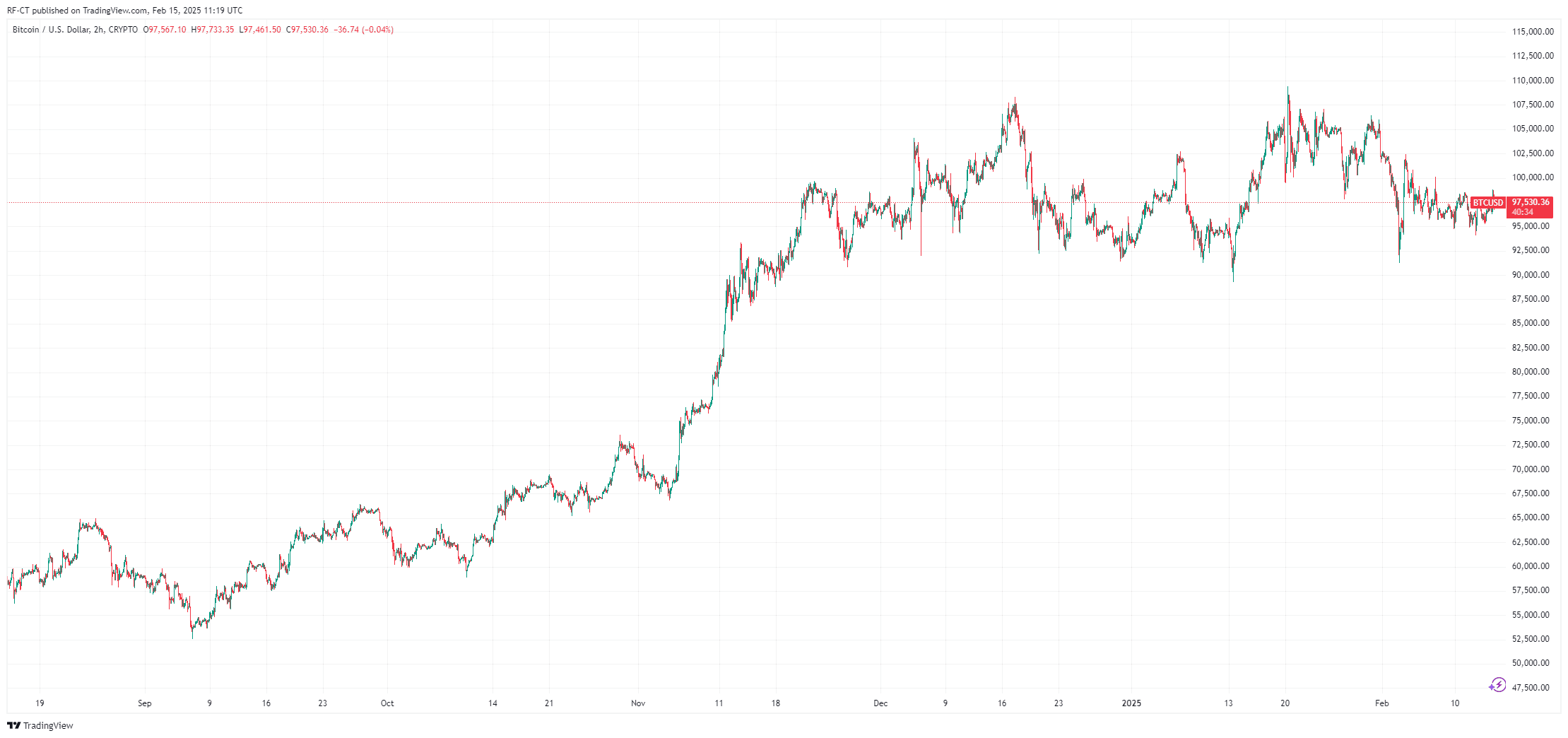

By TradingView – BTCUSD_2025-02-15 (6M)