In right this moment’s session, the Bitcoin value stays above $92,000, with a every day construction nonetheless impartial however intraday decidedly extra constructive on the bullish aspect.

Market Context: Bitcoin Worth, Dominance, and Sentiment

The Bitcoin value is transferring in a macro crypto context of about $3.23 trillion in whole market cap, with every day development round 1.5% and volumes rising by about 21%. The BTC dominance at 57.1% confirms that, at this stage, the market is favoring Bitcoin over altcoins.

Operational Studying: when the Bitcoin worth rises with excessive dominance and sentiment in concern, we are sometimes in a part the place cash seeks refuge in BTC however doesn’t but have the braveness to push your complete sector. This tends to favor directional actions on BTC, however with robust sensitivity to information and macro stream.

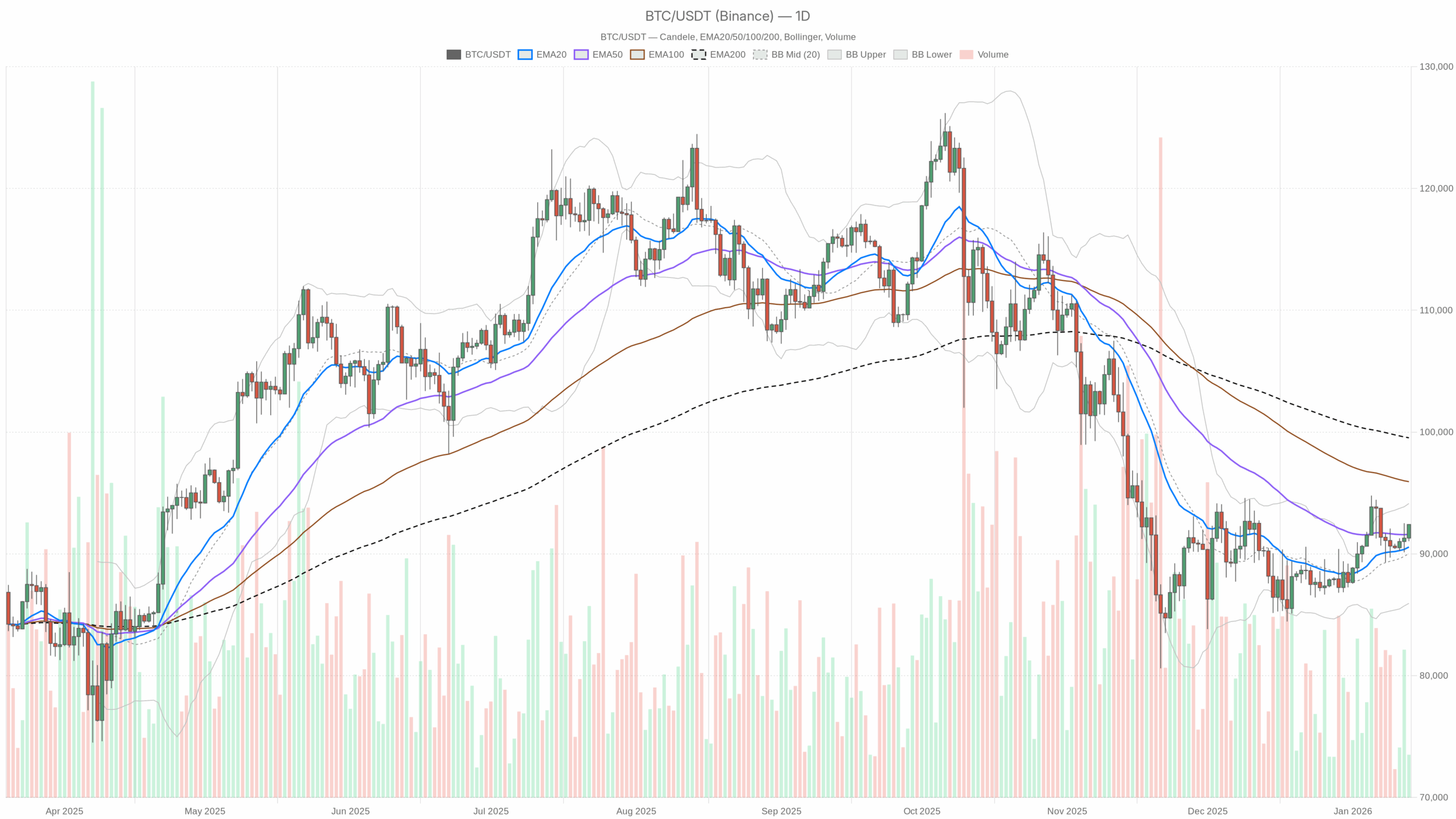

Every day Framework (D1): Foremost Situation on BTC Worth

On the every day timeframe, the BTC value closes at $92,414.91, with a impartial regime. We’re subsequently neither in a transparent bullish pattern nor in a real structural bearish pattern: the market is working an equilibrium zone after the earlier correction.

Transferring Averages (EMA20, EMA50, EMA200) on D1

- 20-day EMA: $90,563.38

- 50-day EMA: $91,610.25

- 200-day EMA: $99,530.49

What They Inform Us: the Bitcoin value right this moment is barely above EMA20 and EMA50, however nonetheless nicely under EMA200. This means a quick/medium-term restoration construction inside a long-term context nonetheless weighed down by the 200-day common. In different phrases: the rebound is there, however the long-term pattern has not but been regained.

Every day RSI

RSI 14D: 58.68.

Studying: the RSI is in a neutral-bullish space, above 50 however removed from overbought. This means a wholesome however not euphoric momentum: there may be demand, however we aren’t in a blind rush part. Typically these readings are appropriate with additional extensions of the motion, however nonetheless depart room for technical pullbacks.

Every day MACD

- MACD Line: 601.58

- Sign: 376.47

- Histogram: +225.11

What It Implies: the MACD line is above the sign, with a constructive and widening histogram. This confirms that the restoration of the Bitcoin value is not only a random bounce however is taking over traits of a short-term structured rise. So long as the histogram stays constructive, the bullish stress maintains management of the tempo.

Every day Bollinger Bands

- Mid Band: $90,036.49

- Higher Band: $94,136.53

- Decrease Band: $85,936.46

The BTC value right this moment is at $92,414.91, thus between the mid and higher band, however with out but a full check of the higher half.

Studying: Bitcoin is working the bullish aspect of the volatility vary, however isn’t but in an explosive breakout part. This normally signifies a pattern in building. If the value begins transferring alongside the higher band, we’d have a extra aggressive energy sign; conversely, returns in direction of the mid band would sign a part of consolidation or profit-taking.

Every day ATR (Volatility)

ATR 14D: $2,004.14.

Implications: a every day common volatility round $2,000 signifies that the chart of the primary asset can simply oscillate by 2–3% in a single session with out this actually altering the technical construction. For threat administration, stops which are too tight threat being hit by easy market noise.

Every day Pivot Level

- Pivot Level (PP): $91,962.52

- Resistance R1: $92,882.39

- Assist S1: $91,495.05

With the real-time reference space at $92,400, BTC is buying and selling barely above the pivot and really near the R1 space.

Studying: the market is respecting the 91,900–92,000$ space as a every day equilibrium stage. Above the pivot, management passes to patrons; a steady return under S1 would once more query the energy of the motion.

1-Hour Timeframe: Affirmation of Bitcoin Worth Restoration

On the 1H, the BTC value right this moment is at $92,429.99, with a bullish regime. Right here the construction is clearer in comparison with the every day: we now have a short-term ascending pattern.

Hourly Transferring Averages

- EMA 20H: $91,645.94

- EMA 50H: $91,349.42

- EMA 200H: $91,021.72

The Bitcoin value in real-time is nicely above all hourly EMAs, with the averages aligned in bullish order (20 > 50 > 200).

Studying: within the quick time period, patrons have management. Furthermore, any retracement in direction of the 91,600–91,000$ space can develop into a dynamic help check fairly than the beginning of a reversal, so long as this construction of averages stays intact.

RSI 1H

RSI 14H: 63.15.

Implications: RSI above 60 signifies a good intraday energy, however not but extra. The market is shopping for pullbacks with conviction. So long as RSI stays steadily above 50–55, the short-term pattern maintains a reputable bullish course.

MACD 1H

- MACD Line: 248.75

- Sign: 153.44

- Histogram: +95.31

Studying: the hourly MACD is aligned with the every day: energetic bullish momentum, though the histogram begins to sign a part of slight slowdown in tempo in comparison with earlier spikes. Typical of a pattern that may enter a lateral consolidation part earlier than a brand new impulse.

Bollinger Bands 1H

- Mid: $91,610.41

- Higher: $92,434.65

- Decrease: $90,786.18

With the BTC value right this moment at $92,429.99, we’re virtually in touch with the higher hourly band.

Implications: the continued motion is stretched within the very quick time period. This could nonetheless lengthen in case of robust demand. Nonetheless, normally when the value sticks to the excessive band on 1H, the likelihood of small pullbacks or lateral phases will increase to alleviate intraday excesses.

ATR 1H and Intraday Pivot

ATR 14H: $407.48.

Actions of $300–400 in a couple of hours fall throughout the regular vary of the present context. This makes it dangerous to hunt excellent tick entries: the intraday oscillation margin is important.

- Pivot Level H1: $92,341.89

- R1 H1: $92,518.10

- S1 H1: $92,253.79

The Bitcoin value in real-time is simply above the hourly pivot and close to the R1 resistance.

Studying: the market is working the higher a part of the intraday vary. Above R1, room for fast extensions; under the pivot, first indicators of purchaser fatigue within the very quick time period.

15-Minute Timeframe: Brief-Time period Operations

On 15m, BTC is quoted at $92,430 with a declared bullish regime. Right here we see essentially the most aggressive push, but additionally the primary indicators of doable extra.

15m Transferring Averages

- EMA 20 (15m): $91,934.40

- EMA 50 (15m): $91,690.39

- EMA 200 (15m): $91,297.86

Worth nicely above all EMAs and averages nicely ordered to the upside.

Studying: the very short-term pattern is robust, however the additional the value strikes away from the averages, the higher the danger of a technical pullback. Late entrants are uncovered to returns in direction of no less than the EMA20 as a traditional market breath.

RSI 15m

RSI 14 (15m): 71.38.

Implications: we’re in intraday overbought zone. This doesn’t essentially imply an imminent collapse, nevertheless it normally signifies that the majority of the fast motion has already been made. From right here, it’s extra more likely to see congestion phases, small retracements, or unstable spikes fairly than a linear rise.

MACD 15m

- MACD Line: 188.36

- Sign: 164.53

- Histogram: +23.83

Studying: the MACD remains to be constructive however the histogram is flattening. Typical sign of a pattern beginning to lose acceleration. Typically, after these phases, both it enters sideways, or a pullback in direction of the quick averages is seen.

Bollinger Bands 15m and Pivot

- Mid: $91,931.05

- Higher: $92,421.48

- Decrease: $91,440.62

The BTC value right this moment on 15m is virtually glued to the higher band, at $92,430.

Implications: we’re at a short-term excessive. It’s the traditional zone the place these already in, fairly than opening new positions, begin desirous about revenue administration and safety. For brand new entries, it usually makes extra sense to attend for a return in direction of the mid band or a decent consolidation under the highs.

- Pivot Level 15m: $92,341.90

- R1: $92,518.10

- S1: $92,253.79

The BTC value is working simply above the 15m pivot.

Studying: the micro-range 92,250–92,520$ is the recent zone within the very quick time period. A clear break above R1 with volumes and strong candle closures can push one other leg; shedding 92,250$ would open house for a return in direction of 91,900–91,700$.

Bullish Situation on Bitcoin Worth

The bullish situation begins from a base: every day impartial however enhancing and intraday clearly constructive. For these trying on the BTC value right this moment with a bullish bias, the important thing factors are:

- Protection above the every day pivot at $91,962. So long as hourly and every day closures stay above this space, patrons keep management of the framework.

- Consolidation above 92,000–92,200$: a decent lateral part right here, with RSI unloading with out breaking helps, could be constructive for a brand new impulse.

- Break and affirmation above the every day higher band at 94,100–94,200$: this is able to be the sign that the primary asset is absolutely exiting the present vary and goals to reattach first the 96,000–98,000$ space, then the psychological zone 100,000$, the place the EMA200 additionally transits.

Operational Bullish Set off: these engaged on the quick time period would possibly take a look at 1H closures above 92,520$ (intraday R1) accompanied by an RSI holding above 55–60 after a small pullback. This might configure a new intraday impulse in step with the enhancing every day framework.

Stage of Invalidation of the Bullish Situation: a every day closure under 90,500–90,000$ (space between EMA20 and mid Bollinger band) would considerably weaken the restoration narrative, remodeling the present motion right into a easy corrective bounce.

Bearish Situation on BTC Worth

The bearish situation leverages the concept the Bitcoin value is just staging a technical rebound inside a nonetheless fragile long-term context (every day EMA200 above the value and sentiment in concern).

For a brief studying, the delicate factors are:

- Lack of the every day pivot at $91,962 with 4H/1D closures under this space. This might sign a return of management to sellers.

- Decisive break of every day S1 at $91,495, opening house in direction of the mid Bollinger band ($90,000) and, in extension, in direction of the decrease band within the $86,000 space.

- Reversal of intraday indicators: RSI 1H steadily falling under 45–40 and MACD 1H turning unfavorable, whereas the value re-enters under the hourly EMA50 (space $91,300). This might paint an image of rebound exhaustion.

Attainable Bearish Targets, in case of a unfavorable situation gaining energy:

- First step: 90,000–89,500$, psychological zone and central space of the volatility vary.

- Second step: 86,000–85,500$, close to the every day decrease band.

Stage of Invalidation of the Bearish Situation: a every day closure above 94,000–94,500$, with the value beginning to work steadily above the every day higher band, would considerably weaken the straightforward rebound speculation, shifting the studying in direction of a new extra structured bullish swing.

What This Context Means for These Bitcoin Worth

The general image is that of a market in restoration part, however not but locked in an uptrend. Every day impartial enhancing, intraday bullish, sentiment in concern, and volatility beneath management: a mix that may be fascinating for these searching for gradual entries, however that doesn’t forgive these coming into leveraged on intraday highs with no plan.

Two key factors:

- The Bitcoin value in euros or {dollars} can nonetheless see sharp actions inside a comparatively clear vary (about 90,000–94,000$). These working within the quick time period should settle for the concept false breakouts and fast returns would be the norm.

- So long as the every day EMA200 stays above the value, the market has not but declared a absolutely bullish long-term pattern. For now, work is being carried out on swings and medium buildings, not on a bull market with out questions.

In this kind of context, these buying and selling the BTC value right this moment ought to focus extra on the high quality of ranges (pivot, bands, key EMAs) and the consistency between timeframes than on searching for most potential revenue. The primary threat isn’t lacking the motion, however getting caught on one aspect of the market whereas BTC remains to be painstakingly constructing the subsequent course.

If you wish to monitor the markets in real-time with superior charts {and professional} instruments, you may open an account on Investing.com:

Open your Investing.com account

This part accommodates a sponsored affiliate hyperlink. We could earn a fee however at no further value to you.

Disclaimer: The data on this article is for informational functions solely and doesn’t represent monetary recommendation, a solicitation for public financial savings, or an funding advice. Cryptocurrency buying and selling is extremely dangerous and may end up in the full lack of invested capital. At all times conduct your analysis and thoroughly assess your threat tolerance earlier than making any operational selections.