The market is digesting a powerful rebound as Bitcoin value at present trades again above $90k, but positioning and sentiment nonetheless look oddly cautious in contrast with the latest transfer.

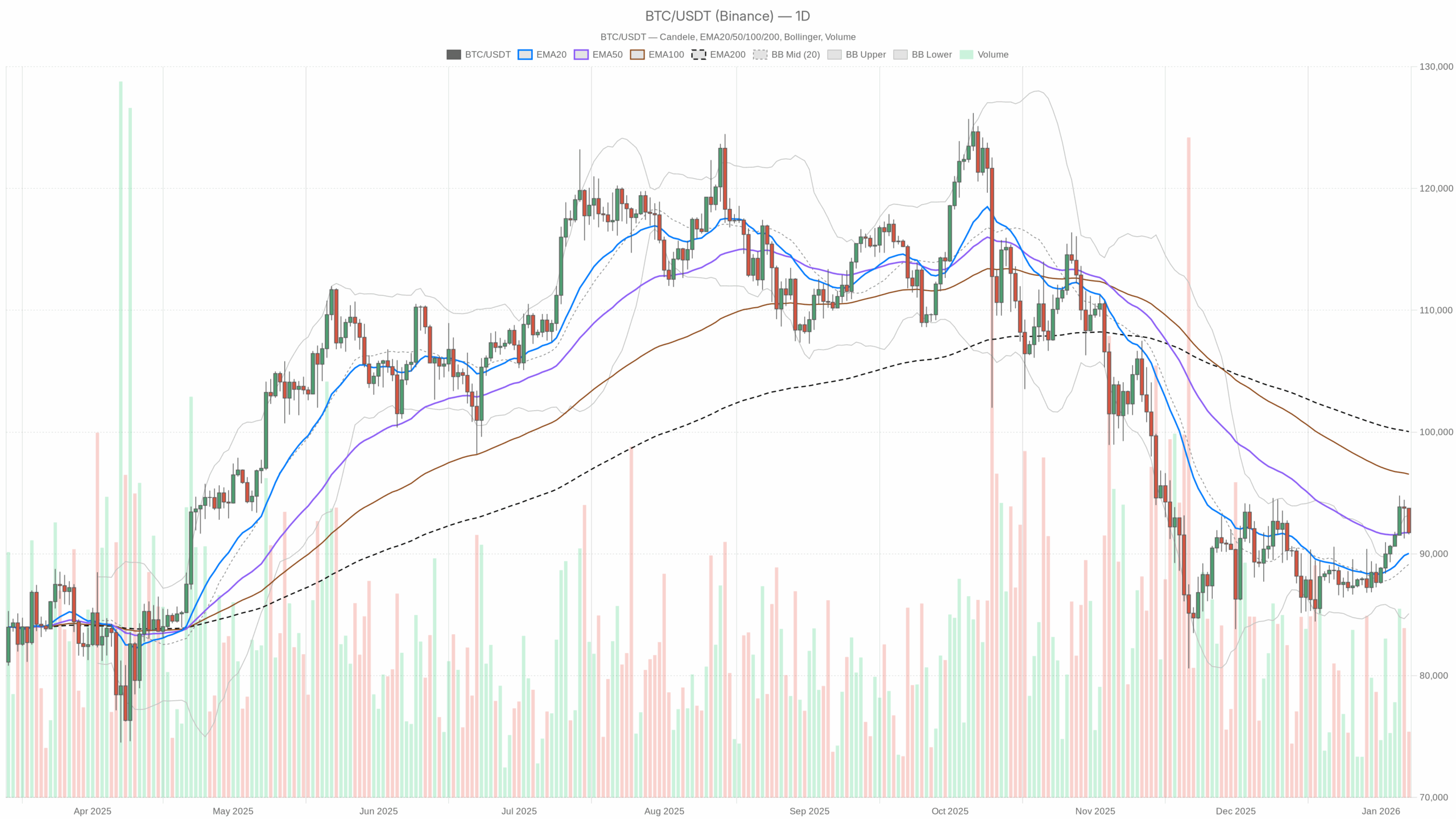

BTC/USDT every day chart with EMA20, EMA50 and quantity”

BTC/USDT every day chart with EMA20, EMA50 and quantity”loading=”lazy” />

Bitcoin value at present: bullish construction, drained short-term tape

Bitcoin value (BTCUSDT) is buying and selling round $91,700, in a market that’s structurally bullish on the every day chart however clearly winded on intraday timeframes. The large image is that Bitcoin reclaimed $90k after the year-end flush, but sentiment is caught in Worry (42) and total crypto market cap is down about 2.3% in 24h. In different phrases, value is recovering quicker than conviction.

This second issues as a result of the market is sitting in a basic post-liquidation equilibrium: choices desks are already reaching for $100k calls, whereas spot flows and surveys present most of the true believers haven’t come again but. Dominance at ~56.6% exhibits BTC remains to be the benchmark danger barometer; when it hesitates right here, the entire crypto advanced takes discover.

On the upper timeframe, the every day pattern leans bullish however under full pattern mode. On the hourly and 15-minute, you possibly can see a short-term distribution or pullback section, not a full-blown reversal but. That rigidity between a constructive every day chart and a tiring intraday tape is the important thing battle to look at.

Each day chart (D1): most important bias – cautiously bullish

On the every day timeframe, BTC holds a gentle bullish bias. Development indicators are supportive however not euphoric, and value is consolidating under key pivot resistance.

Development construction: EMAs

- Worth (shut): $91,739.9

- EMA 20: $90,040.6

- EMA 50: $91,738.2

- EMA 200: $100,038.9

Each day value is buying and selling above the 20-day EMA and primarily locked onto the 50-day EMA, whereas nonetheless effectively under the 200-day.

Studying: short-term momentum is optimistic (above EMA 20), medium-term pattern is neutral-to-bullish (value hugging EMA 50), however the failure to reclaim the 200-day close to $100k retains this transfer in restoration rally territory, not a mature bull leg.

RSI (momentum)

Momentum has pushed again into the higher half of the vary with out being overbought.

Studying: patrons are in management, however this can be a measured advance, not a melt-up. There may be room for BTC to push greater earlier than hitting exhaustion ranges, however it’s not a one-way commerce.

MACD (pattern momentum)

- MACD line: 645.58

- Sign: -98.44

- Histogram: 744.02

Each day MACD is strongly optimistic with a large hole over its sign and a big optimistic histogram.

Studying: underlying pattern momentum is firmly on the bullish aspect. This type of separation usually comes after a powerful impulse leg. It helps the thought of dips being purchased slightly than aggressively bought, a minimum of till the histogram begins contracting.

Bollinger Bands (volatility and site)

- Center band (20SMA proxy): $89,153.4

- Higher band: $93,205.7

- Decrease band: $85,101.1

Worth is sitting between the mid and higher band, however not driving the higher rail.

Studying: BTC is within the higher half of its latest volatility envelope, which aligns with a bullish bias, however the lack of a clear band stroll hints at consolidation slightly than a runaway squeeze. It’s an up however managed regime.

ATR (volatility)

Each day ATR a bit above $2k factors to a median every day swing of about 2.3% round present costs.

Studying: volatility is elevated however not at panic ranges. It is sufficient to wipe out free leverage, however nonetheless tradable for swing setups that plan for a few thousand {dollars} of noise every day.

Each day pivot ranges

- Pivot level (PP): $92,362.62

- Resistance R1: $93,125.25

- Assist S1: $90,977.28

Worth is presently slightly below the every day pivot at about $91.7k.

Studying: holding under PP retains intraday flows barely defensive on the day, however the important thing battleground is $92–93k. A clear shut again above PP and R1 would reassert short-term management for the bulls. Shedding S1 would tilt the every day session towards a corrective tone.

Hourly chart (H1): short-term pullback towards a bullish every day

The hourly tape is extra cautious than the every day pattern, displaying a pullback-to-consolidation section slightly than sustained shopping for.

Development construction: EMAs (H1)

- Worth (shut): $91,772.5

- EMA 20: $92,460.7

- EMA 50: $92,657.0

- EMA 200: $91,070.7

On H1, value trades under the 20 and 50 EMAs however nonetheless above the 200 EMA.

Studying: intraday, this can be a pullback inside a bigger uptrend. Shorter-term momentum has rolled over, but the larger intraday construction, anchored by the 200 EMA, stays intact. That could be a basic buy-the-dip versus short-the-rip battleground.

RSI (H1)

RSI has slipped beneath 40 on the hourly.

Studying: intraday flows are mildly oversold, however not capitulating. It displays a market leaning to the promote aspect on brief timeframes, whereas nonetheless removed from excessive stress.

MACD (H1)

- MACD line: -319.16

- Sign: -248.89

- Histogram: -70.27

Hourly MACD is adverse with a modestly adverse histogram.

Studying: momentum on the one hour is in a corrective section. The promoting strain is actual however orderly. There isn’t any proof but of a full pattern reversal, simply digestion after the bounce from sub-$90k ranges.

Bollinger Bands (H1)

- Center band: $92,544.8

- Higher band: $93,605.6

- Decrease band: $91,484.0

Worth sits near the decrease band on the hourly.

Studying: BTC is urgent the decrease aspect of its intraday volatility vary, which is according to a short-term draw back bias. So long as candles open and shut close to that decrease band, the market is testing help, not breaking out.

ATR and pivot (H1)

- ATR 14 (H1): $440.98

- Pivot level: $91,842.24

- R1: $91,982.63

- S1: $91,632.09

With an ATR round $440, hourly swings of roughly 0.5% are regular intraday noise.

Studying: value is hovering barely under its intraday pivot, suggesting a modest bearish lean on the session. A reclaim of $91.8–92.0k on the hourly could be the earliest signal that the pullback is dropping management.

15-minute chart (M15): bearish execution context

The 15-minute regime is flagged bearish, which inserts with the intraday consolidation and minor drift decrease.

Development construction: EMAs (M15)

- Worth (shut): $91,701.9

- EMA 20: $92,101.7

- EMA 50: $92,375.5

- EMA 200: $92,777.5

Worth is under all of the brief and medium EMAs on M15.

Studying: microstructure is firmly tilted to the draw back. Any bounce into the $92.1–92.4k pocket is prone to meet provide until the hourly pattern flips again in sync with the bullish every day.

RSI (M15)

RSI is hovering within the mid 30s on the 15-minute.

Studying: intraday momentum is weak however not washed out. Sellers are in cost brief time period, but the readings depart room for yet another push decrease or a fast mean-reversion bounce.

MACD (M15)

- MACD line: -138.41

- Sign: -149.20

- Histogram: 10.78

MACD line and sign are each adverse, however the histogram has simply flipped barely optimistic.

Studying: micro draw back momentum is slowing. That always precedes both a consolidation vary or a short-covering bounce, particularly when aligned with mildly oversold RSI.

Bollinger Bands, ATR and pivot (M15)

- Center band: $91,981.0

- Higher band: $92,297.6

- Decrease band: $91,664.4

- ATR 14: $192.83

- Pivot level: $91,818.69

- R1: $91,935.54

- S1: $91,585.00

Worth is barely above the decrease band and beneath each the center band and the pivot.

Studying: the very short-term tape is leaning decrease inside a comparatively tight intraday vary (about $190 of typical swing). That’s extra conducive to scalping ranges than chasing breakouts, until a powerful catalyst pushes value out of this band.

Market context: danger urge for food and positioning

Macro crypto knowledge paints an image of cautious risk-taking:

- BTC dominance: ~56.6% – capital prefers Bitcoin over alts, a typical sample after a pointy drawdown.

- Complete crypto market cap: about $3.23T, down roughly 2.3% in 24h – comfortable, however not a crash.

- Quantity: up about 4.7% in 24h – extra participation on a pink day, which frequently means energetic repositioning or hedging.

- Worry and Greed Index: 42 (Worry) – sentiment nonetheless lagging value restoration.

Choices merchants are reportedly focusing on the $100k strike once more, which normally displays a mixture of speculative upside bets and structured hedges round that psychological stage. On the similar time, mainstream protection notes {that a} chunk of the hardcore retail crowd remains to be disengaged.

Studying: the market is in a professional-led section: derivatives desks and bigger gamers are setting the tone, whereas retail FOMO isn’t but again. That usually favours mean-reversion and vary buying and selling round key ranges till a transparent catalyst breaks the stalemate.

Conflicting indicators throughout timeframes

There’s a real rigidity between timeframes proper now:

- Each day (D1): bullish construction – optimistic MACD, RSI within the 50s, value above EMA 20 and close to EMA 50.

- Hourly (H1): corrective – value under brief EMAs, weak RSI, adverse MACD.

- 15-minute (M15): bearish however stabilising – under all EMAs, weak RSI, MACD dropping draw back momentum.

The sensible takeaway is that the dominant drive remains to be the uptrend on the every day, however intraday gamers are presently promoting into power and probing draw back liquidity. Till these shorter timeframes realign with the every day, breakouts usually tend to fade, and helps usually tend to be examined than cleanly revered.

Bullish situation for Bitcoin value

The bullish path is a trend-continuation after a shallow dip. This retains the broader construction intact whereas digesting latest positive factors.

Key components of a constructive situation:

1. Maintain above every day help and reclaim pivots

Keep value motion above $90,977 (D1 S1), ideally retaining most closes above $91k. On intraday charts, reclaim and maintain above the H1 pivot at about $91,842 and the D1 pivot at about $92,363.

Implication: this might affirm the present pullback as an ordinary pause in an ongoing uptrend, not the beginning of a deeper slide.

2. Brief-term momentum flips again in step with every day

H1 value must push again above the 20 and 50 EMAs, which sit roughly at $92.5–92.7k. H1 RSI ought to reclaim the mid 50s, with MACD crossing again towards optimistic territory.

Implication: as soon as hourly momentum strains up with the every day bullish bias, makes an attempt at $93–95k develop into extra credible and fewer liable to quick rejection.

3. Targets and upside markers

The preliminary upside magnet sits round $93,125 (D1 R1). Above that, the market will begin to concentrate on the $95–97k zone as an interim resistance band. The actual line within the sand for the following leg is the 200-day EMA close to $100k. A sustained break and every day shut above that stage would flip this from a restoration rally right into a extra convincing medium-term bull pattern.

What invalidates the bullish situation?

- A clear every day shut under $90,977 adopted by continuation decrease.

- Each day RSI slipping again towards 45 with MACD histogram rolling over sharply from elevated ranges.

- Worth getting pinned beneath the every day mid Bollinger band, round $89,150, for a number of periods.

If these situations present up, the narrative shifts from pullback inside uptrend to failed breakout and distribution beneath $100k.

Bearish situation for Bitcoin value

The bearish case isn’t dominant on the every day chart, however it’s seen on intraday timeframes and will take management if help provides manner and liquidity thins out.

Key components of a draw back situation:

1. Failure at pivots and decrease highs

Worth repeatedly rejects the $92–93k space, which incorporates the D1 pivot and R1, and fails to reclaim H1 EMAs. M15 and H1 proceed to print decrease highs beneath their 20 and 50 EMAs.

Implication: this might affirm that present motion is distribution beneath resistance, with bigger gamers offloading into each bounce.

2. Break of every day help and mid band

A decisive transfer under $90,977 (D1 S1) opens the best way towards the every day center band close to $89,150. If that mid band fails, the following logical magnet is the decrease Bollinger Band within the $85k area.

Implication: a transfer towards the decrease band would rework the present orderly pullback right into a full mean-reversion again to the decrease half of the latest vary.

3. Momentum rotation

Each day RSI rolls over again to the low 40s. MACD histogram shrinks aggressively from its present elevated optimistic studying and crosses towards zero. H1 and M15 keep pinned close to their decrease Bollinger Bands with increasing ATR.

Implication: that may present bears not solely defending resistance but additionally taking management of volatility, pushing the market right into a extra aggressive de-risking section.

What invalidates the bearish situation?

- A swift restoration above $93k with H1 EMAs reclaimed and M15 flipping again to a impartial or bullish regime.

- Each day closes again above the pivot at $92,363 and a push towards $95k+ with out speedy rejection.

- Intraday RSI readings shifting from 30s–40s into sustained 55–65 zones.

If these situations happen, present draw back makes an attempt will look extra like noise in a broader continuation sample for Bitcoin value, as an alternative of a full pattern reversal.

Positioning, danger and uncertainty

For merchants, the hot button is recognising that timeframe alignment is lacking. The every day chart nonetheless favours the bulls, whereas the hourly and 15-minute charts are in a corrective, barely bearish stance.

That makes this a tough spot to be aggressively directional. Chasing breakouts towards a fading intraday tape is dangerous, however so is shorting right into a broadly constructive every day pattern with Worry nonetheless current and loads of room for a sentiment snap-back.

Volatility, each every day (ATR about $2k) and intraday, is excessive sufficient that place sizing and clear invalidation ranges matter greater than standard. Anybody buying and selling this tape must plan for two–3% swings as regular variance slightly than a shock.

From right here, the market will probably resolve in certainly one of two methods. A realignment greater would see intraday charts restore, value reclaim pivots and the transfer towards $95–100k resume. A deeper shakeout would see help close to $91k fail, with value mean-reverting towards the mid-to-low $80ks earlier than any critical try at new highs.

Neither path is assured. The job now’s to respect each potentialities, use the degrees above as reference factors, and keep away from treating any single situation as a certainty whereas this tape stays cut up throughout timeframes.

If you wish to monitor markets with skilled charting instruments and real-time knowledge, you possibly can open an account on Investing utilizing our associate hyperlink:

Open your Investing.com account

This part incorporates a sponsored affiliate hyperlink. We could earn a fee at no extra value to you.

This text is a market commentary and expresses a technical view on Bitcoin value motion. It isn’t funding, buying and selling, or monetary recommendation, and it shouldn’t be the only foundation for any buying and selling choice. Cryptoassets are extremely unstable and you’ll lose capital. All the time do your personal analysis and think about your danger tolerance earlier than getting into the market.