Over the previous few weeks, the cryptocurrency market has been overwhelmed by a excessive diploma of uncertainty and volatility triggered by the consistently shifting world macroeconomics. This unsettled market situation noticed the Bitcoin worth dance between $74,000 and $83,000 within the house of some days.

The value of BTC sank towards $74,000 in the beginning of the previous week as crypto traders panicked after United States President Donald Trump introduced new commerce tariffs. On Thursday, April 10, the premier cryptocurrency reclaimed the $83,000 degree after President Trump paused commerce tariffs on all nations besides China.

Is Bitcoin Now A ‘Mature Asset’?

The Bitcoin worth has been fairly reactive to just about every bit of stories within the world commerce, demonstrating the extremely unstable state of the cryptocurrency market. Nonetheless, an on-chain analytics professional has defined that the volatility of the present Bitcoin market pales compared to previous episodes.

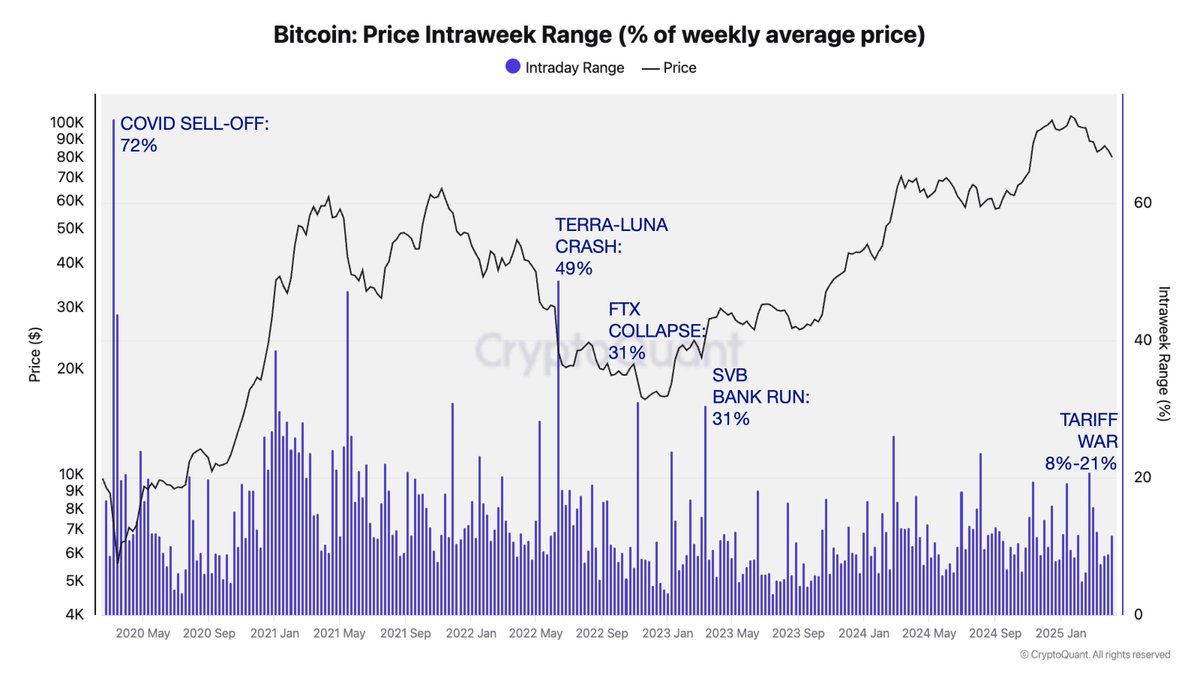

In a brand new submit on the social media platform X, CryptoQuant’s head of analysis, Julio Moreno, revealed that the Bitcoin worth volatility within the ongoing world commerce drama has been “to date decrease” than that from different previous occasions, such because the COVID-19 crash, Terra-Luna collapse, FTX downfall, and the Silicon Valley Financial institution (SVB) financial institution run.

The related indicator right here is the Worth Intraweek Vary metric, which estimates the proportion change within the common weekly worth of Bitcoin. Based on information from CryptoQuant, the Bitcoin Worth Intraweek Vary climbed to an all-time excessive of 72% through the COVID-19 market downturn in April 2020.

Supply: @jjcmoreno on X

The chart above exhibits that the BTC Intraweek Vary metric surged to 49% after the crash of the Terra Luna ecosystem in Might 2022. In the meantime, the indicator reached 31% following the collapse of the Sam-Bankman-Fried-led FTX change in late 2022 and the SVB financial institution run in early 2023.

With the escalating commerce tensions between america and China, the Bitcoin Worth Intraweek Vary metric stands between 8% – 21%. This lowered volatility means that the premier cryptocurrency has matured as an asset, with deeper liquidity and a greater market construction.

The comparatively steady worth motion may be related to the rising base of long-term holders and regular company adoption, as institutional gamers are starting to view the world’s largest cryptocurrency much less as a high-risk asset and extra as a hedge in opposition to macroeconomic uncertainties.

Bitcoin Worth At A Look

As of this writing, the value of BTC stands at round $83,700, reflecting a 5% improve previously 24 hours.

The value of BTC returns to above $83,000 on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.