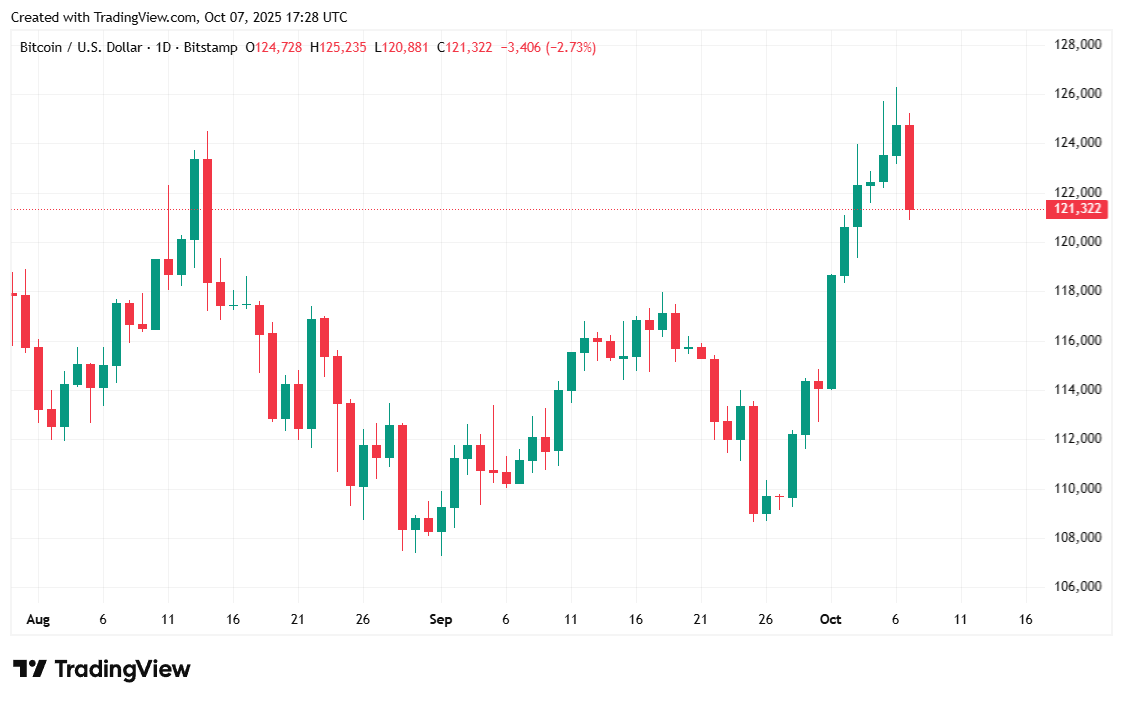

The dominant digital asset rallied to a document peak on Monday however stumbled Tuesday morning within the wake of rising considerations over the federal authorities shutdown.

Bitcoin’s Document Rally Stalls on Rising Shutdown Issues

Only a day after surging to a $126,198.07 document, bitcoin fell again to $121K on Tuesday, shedding roughly 4% of its peak worth as mounting considerations over the U.S. authorities shutdown, now on its seventh day, appeared to spook traders.

Senate Republicans and Democrats as soon as once more did not agree on the very best short-term funding strategy required to maintain the federal equipment operating after the federal government exhausted its fiscal sources final week Wednesday. Democrats rejected the non permanent spending invoice to fund the federal government till November 21, proposed by Republicans yesterday.

Different elements additionally performed a job in bitcoin’s retreat, amongst them revenue taking by traders who could have felt the cryptocurrency was approaching a blow off high. Knowledge from Glassnode reveals roughly 99.79% of bitcoin provide was sitting in worthwhile territory yesterday. At present, that quantity inched all the way down to 99.29%.

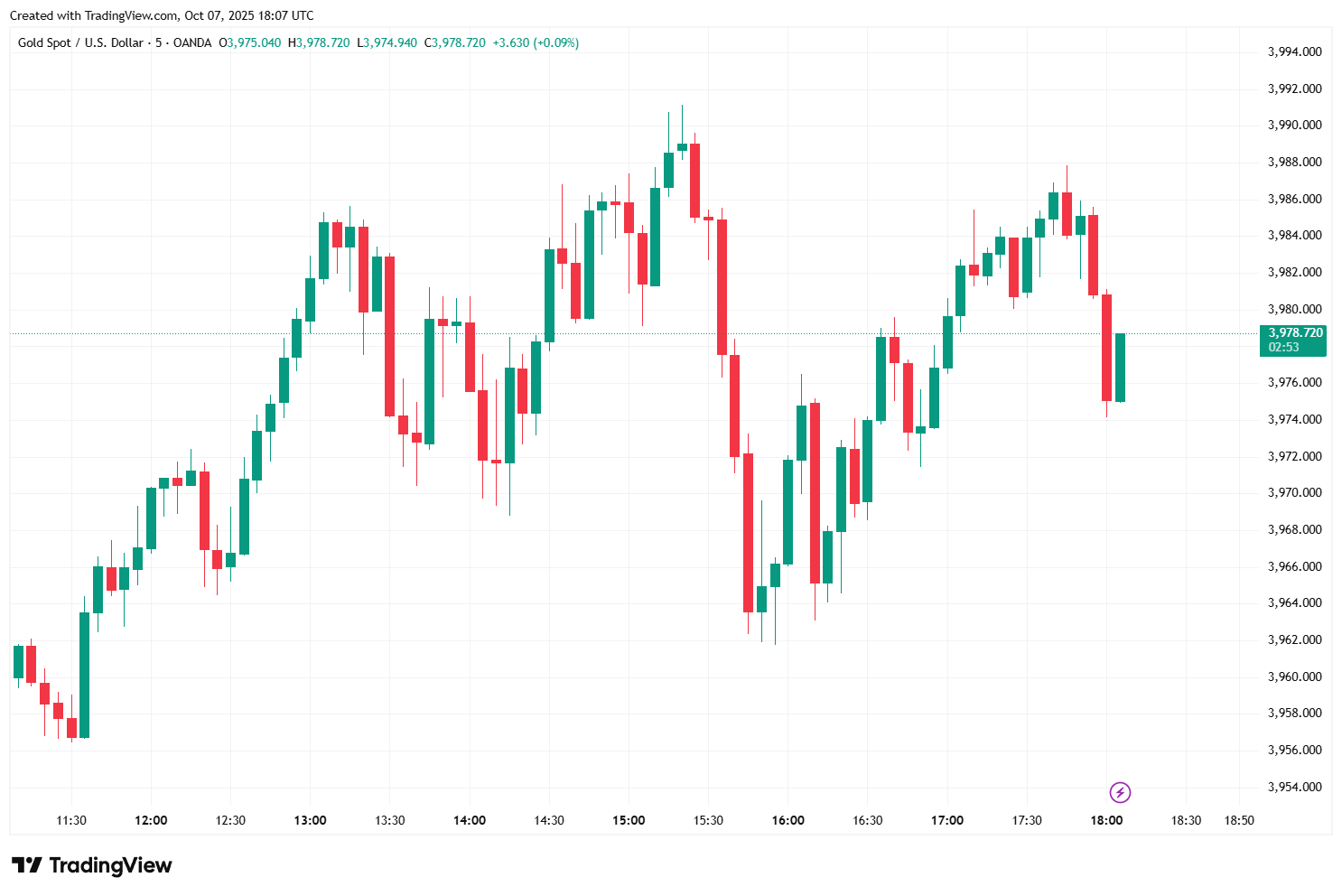

(Gold topped $4,000 per ounce for the primary time ever on Tuesday as traders flee treasuries and even perhaps bitcoin, in favor of bullion / Buying and selling View)

Maybe shrewd traders determined to diversify their holdings by shifting capital from BTC to gold. The dear metallic soared to $4,000 per ounce for the primary time ever at present. However both means, the overarching catalyst for all these strikes is probably going a drop in confidence within the U.S. authorities, which at this level can’t even present jobs knowledge required by its central financial institution to set rate of interest coverage on the finish of the month.

Overview of Market Metrics

Bitcoin was priced at $121,288.44 on the time of writing, down 3.5% for the day however nonetheless up 7.19% on a weekly foundation, in line with knowledge from Coinmarketcap. The cryptocurrency reached a low of $120,941.32 lower than 24 hours after surging to a contemporary excessive of $126,198.07.

( BTC value / Buying and selling View)

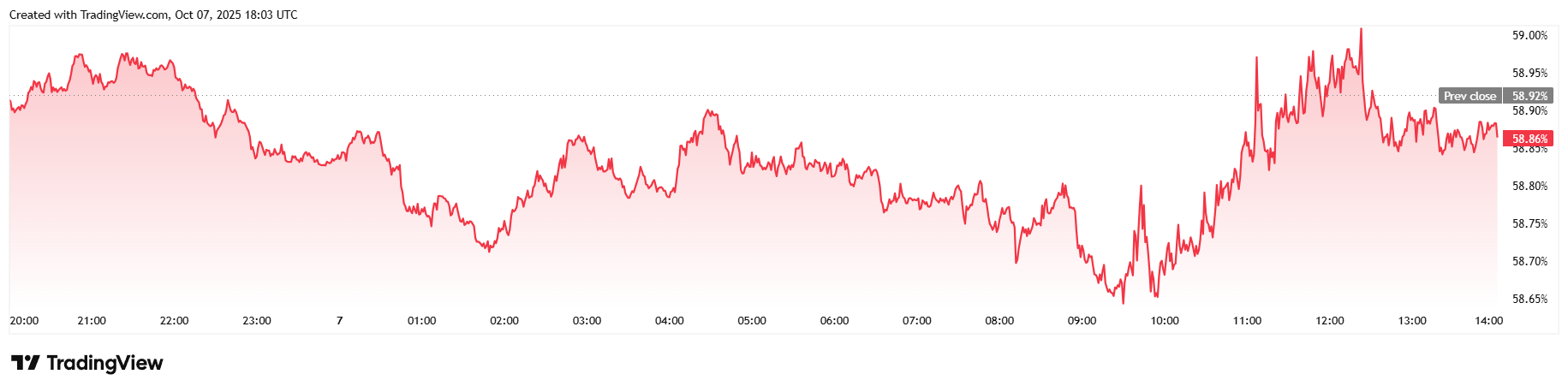

Twenty-four-hour buying and selling quantity jumped 22.18% to $79.15 billion, however market capitalization fell to $2.42 trillion, a 3.22% lower. Bitcoin dominance additionally dipped barely by 0.06% and now sits at 58.86%.

( BTC dominance / Buying and selling View)

Complete bitcoin futures open curiosity tumbled 3.75% to $91.90 billion, in line with knowledge from Coinglass. Bitcoin liquidations, nonetheless, jumped to $151.31 million as bulls with leveraged lengthy positions suffered $111.45 million in liquidations. Shorts accomplished the liquidation image with a smaller $39.87 million of margin worn out.