The Bitcoin market has skilled a big value correction in the previous couple of hours, with costs dropping to round $110,000 because the commerce conflict between the US and China might but recommence. Earlier than this decline, the crypto market chief led a powerful rally to set a brand new all-time excessive of $126,198.17 on October 6, 2025. Apparently, current information on the Bitcoin Choices market indicated a wave of cautious positioning amongst institutional traders amid this value surge forward of the present market downturn.

Establishments Step Again As Bitcoin’s Rally Turns Euphoric – Glassnode

In an X submit on October 10, blockchain analytics agency Glassnode lays out some attention-grabbing insights in its weekly choices market replace. Notably, Glassnode analysts report that whereas Bitcoin costs surged greater than 10% within the current ascent to a brand new all-time excessive, institutional merchants seem to have maintained a peaceful market strategy, opting to lock in income and defend draw back somewhat than chase the rally.

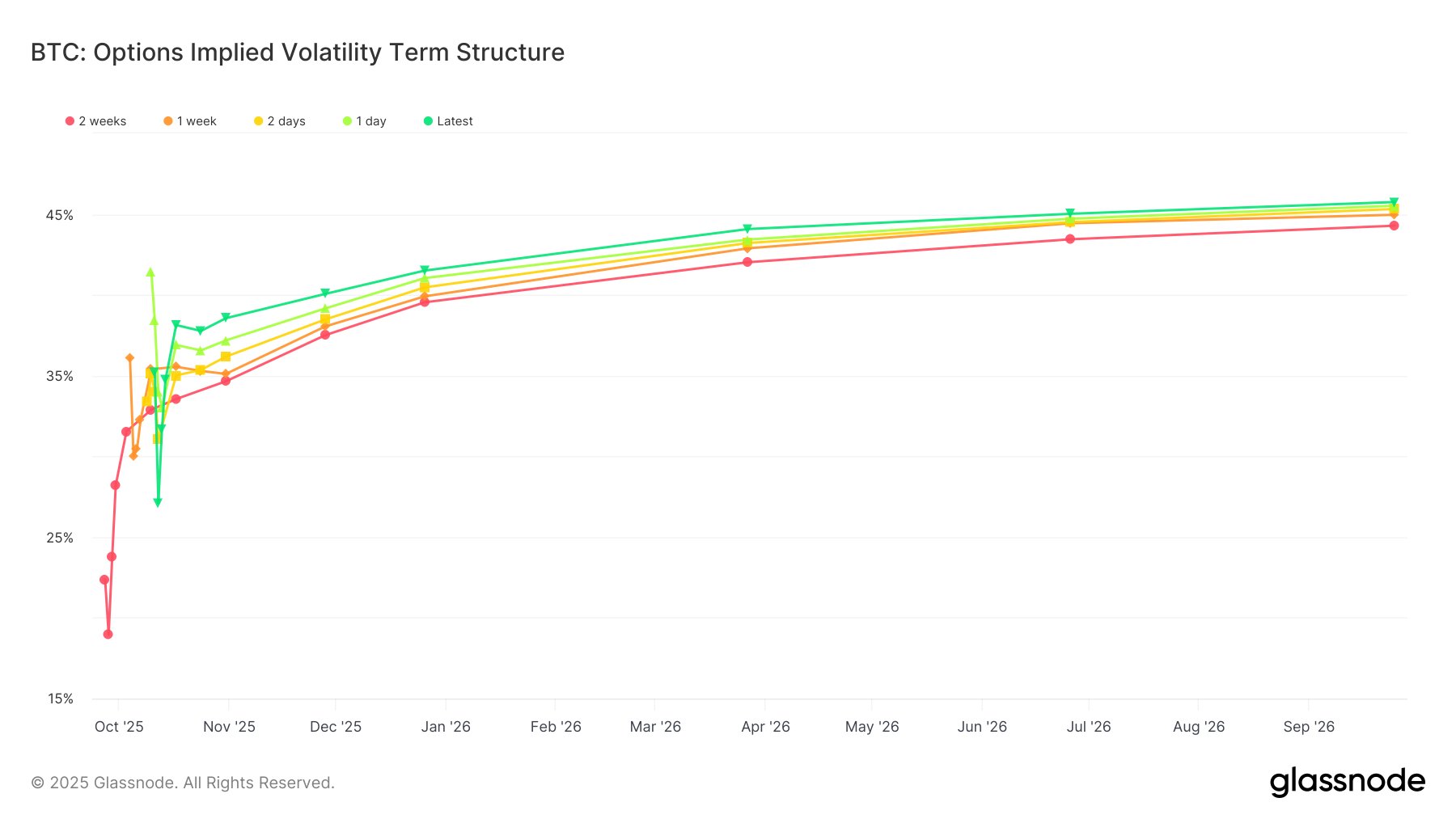

Regardless of the steep transfer greater, implied volatility, i.e., a gauge of anticipated value swings, barely budged, hovering round 38–40%. Usually, a rally of that measurement would push volatility greater as merchants hurriedly name and amplify their publicity. Nevertheless, the silent response suggests composure from institutional traders who have been already positioned for the transfer or just unwilling to pay up for extra upside.

Glassnode analysts additionally draw consideration to a different delicate however telling check in choice skew. Even on the top of the rally, demand for put choices remained robust, holding the market elevated. This means that many massive gamers have been promoting calls, successfully capping potential upside, via the choices market, whereas sustaining insurance coverage in case the market reversed.

As well as, the put-call ratio additionally reinforces this cautious sample amongst establishments. Amidst the choice expiry on Friday, October 9, the ratio climbed above 1.0, indicating extra places traded than calls as merchants have been busy hedging positions forward of the present downturn somewhat than chasing momentum and locking in current positive factors.

Typically, Glassnode describes the Bitcoin market as having adopted a distinct habits this cycle, pushed by institutional self-discipline somewhat than surging volatility and retail exuberance as seen in earlier cycles. The dominance of institutional funding pushed by spot ETFs and the current creation of crypto treasury firms might have added a thick layer of maturity to the $2 trillion market.

BTC Market Overview

On the time of writing, Bitcoin is buying and selling at $110,805 after a 7.54% decline previously 24 hours. In the meantime, day by day buying and selling quantity has surged 150.37%, indicating an increase in market exercise as merchants react to the sharp pullback.

Featured picture from Flickr, chart from Tradingview

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.