The value motion of Bitcoin has been fairly robust over the previous week, exhibiting good indicators of restoration from final weekend’s low. Whereas the premier cryptocurrency travelled as excessive as $108,000 in the previous couple of days, it’s now hovering across the $107,000 mark. The newest on-chain information suggests {that a} group of traders has stayed out of the market regardless of the value resilience of Bitcoin in current months.

BTC Retail Demand Falls By 10% In June: Analyst

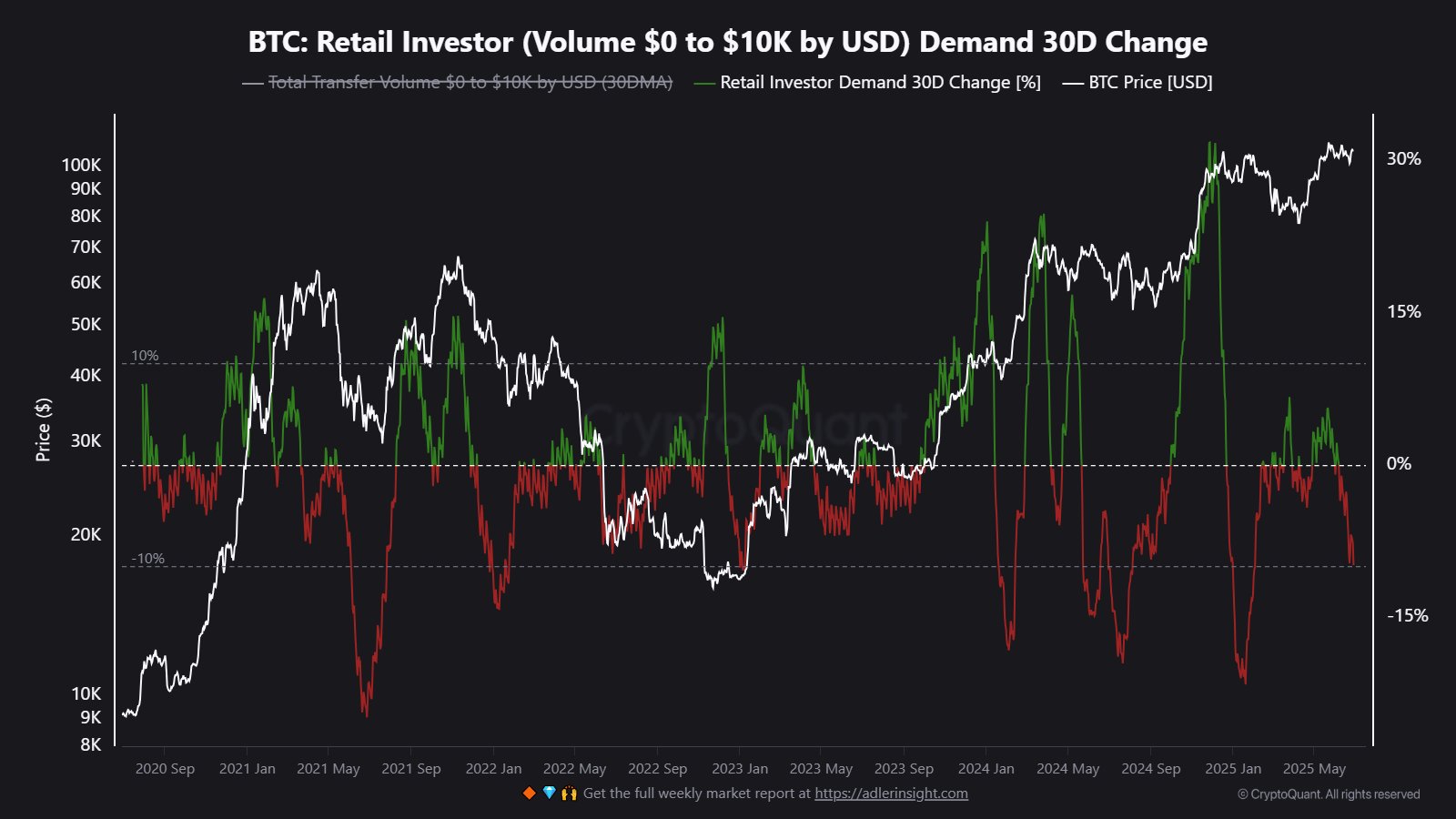

In a June 28 put up on social media platform Z, on-chain analyst Maartunn revealed {that a} cohort of market individuals referred to as retail traders has been comparatively inactive over the previous few months. This on-chain revelation relies on the Retail Investor Demand metric, which estimates the demand for BTC amongst small-scale traders.

In essence, this on-chain metric tracks the exercise of small wallets usually concerned in transfers of small sizes. Particularly, this Retail Investor Demand indicator measures the share change within the cumulative quantity of small transactions (price $10,000 or much less) over a 30-day interval.

Supply: @JA_Maartunn on X

Within the chart highlighted by Maartunn, the 30-day change within the Bitcoin Retail Investor Demand plunged into the unfavourable territory and has remained within the purple since early June. Extra lately, the metric fell to the ten% stage, which represents the bottom stage in additional than six months.

Contemplating that the Bitcoin value motion has been pretty regular on this interval, it’s fairly stunning that small-scale traders have shunned coming into the market. The market appears to be moderately dominated by institutional traders — primarily by way of the spot Bitcoin exchange-traded funds.

Institutional And Bitcoin ETF Buyers Take Cost

This development of falling retail demand was additionally spotlighted by on-chain analyst Burak Kesmeci on the X platform, saying that institutional traders and spot ETF traders appear to at present have a robust urge for food for accumulating Bitcoin. Previously week, the US-based BTC exchange-traded funds posted a major weekly whole web influx of $2.2 billion.

Moreover, Kesmeci talked about that if the decline in retail demand continues, it might imply that the Bitcoin value is nearing a backside. Therefore, the flagship cryptocurrency might get pleasure from some bullish momentum and upward value motion over the approaching weeks.

As of this writing, the value of BTC stands at round $107,244, reflecting a mere 0.1% improve previously 24 hours. In keeping with information from CoinGecko, the market chief is up by greater than 4% on the weekly timeframe.

The value of BTC on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.