Crypto markets slumped on Monday morning, with seven of the highest ten cryptocurrencies within the pink, together with bitcoin.

Market Dip Drags Bitcoin Below $94K Whereas Equities Maintain Regular

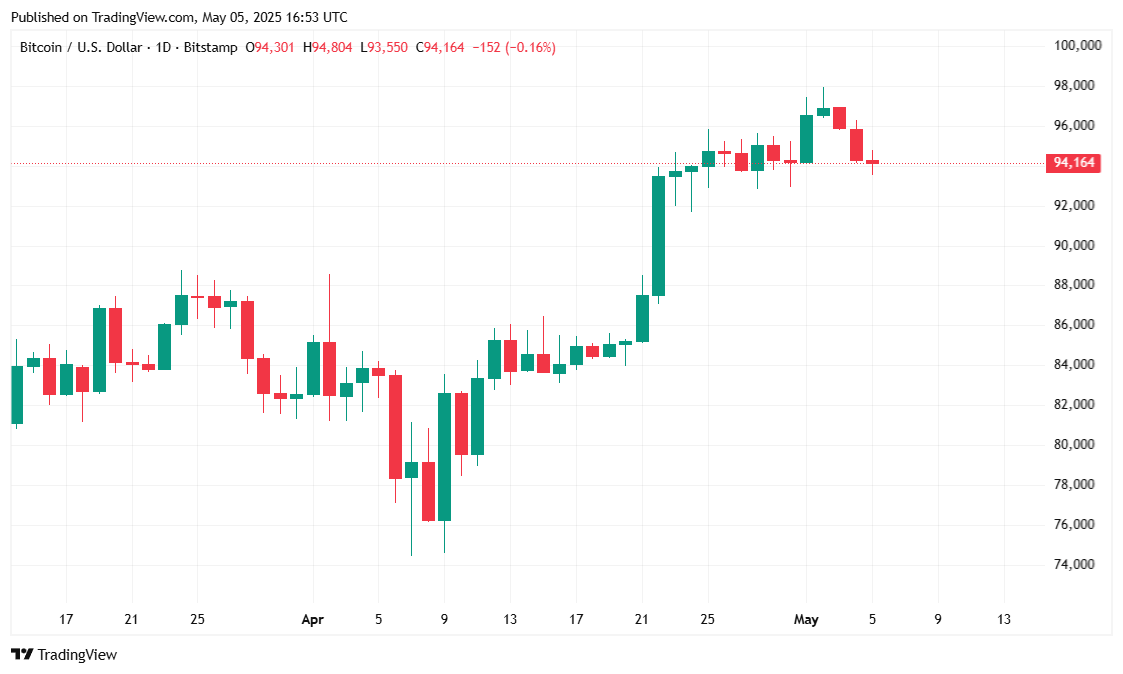

Bitcoin (BTC) fell to $94K on Monday morning as crypto markets tumbled 1.06% to a market capitalization of $2.93 trillion, in accordance with knowledge from Coinmarketcap. Shares traded largely sideways with the foremost indices barely budging, though gold climbed 2.38% to $3,320.60 per ounce on the time of reporting.

The cryptocurrency’s pullback, comes within the wake of final week’s rally that noticed BTC surge all the best way to $97,905.90 on Friday after the U.S. Division of Labor printed stronger-than-expected April employment knowledge.

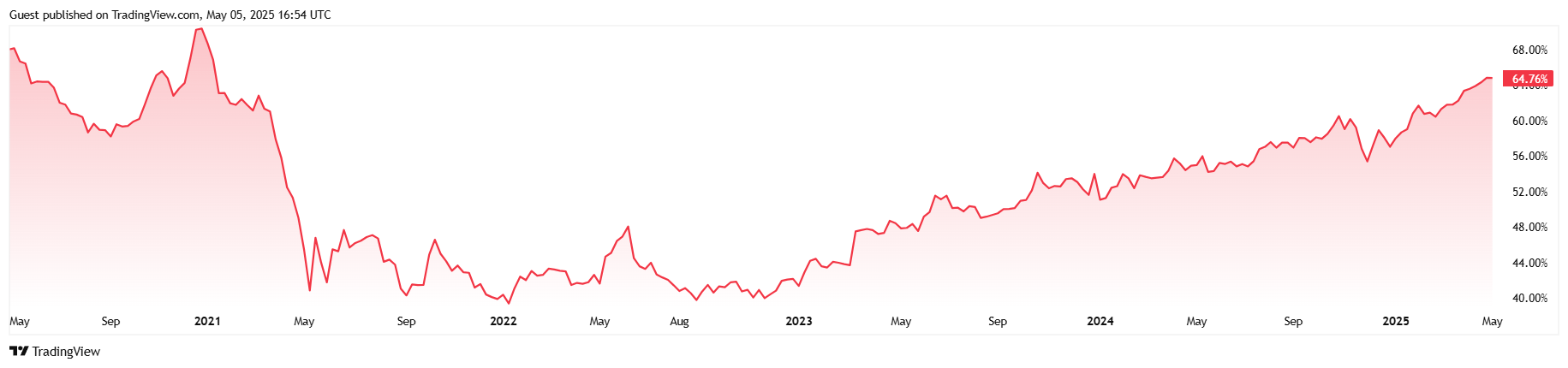

President Donald Trump’s unprecedented tariff polices have sowed chaos, resulting in financial uncertainty and triggering a flight to non-U.S. belongings as buyers search the soundness of safe-haven shops of worth akin to gold and bitcoin. And though BTC is down roughly 1.5% as we speak, it nonetheless accounts for almost 65% of all the crypto market.

The drop within the cryptocurrency’s value is sort of definitely momentary. Michael Saylor, chairman of bitcoin treasury agency Technique, introduced on Monday, a 1,895 BTC buy for roughly $180.3 million, bringing the agency’s whole holdings to 555,450 BTC. The transfer suggests Saylor views bitcoin’s pullback as a shopping for alternative quite than a sign of the digital asset’s weak point.

Overview of Market Metrics

Bitcoin declined 1.45% over the previous 24 hours, falling to $94,132.64 on the time of reporting, in accordance with Coinmarketcap. Regardless of the dip, BTC stays up 0.65% over the previous seven days, exhibiting continued energy on a broader time-frame. The cryptocurrency traded between $93,566.26 and $95,762.18, indicating gentle volatility in a largely sideways market.

( BTC value / Buying and selling View)

Buying and selling quantity adopted the standard post-weekend sample, climbing 56.38% to $24.58 billion. Nonetheless, the elevated exercise got here alongside a drop in market capitalization, which declined 1.38% to $1.87 trillion. Bitcoin’s dominance within the general crypto market additionally edged down by 0.11 share factors to 64.75%, hinting that merchants could also be shifting some consideration towards altcoins.

( BTC dominance / Buying and selling View)

Within the derivatives sector, BTC futures open curiosity dipped 1.04% to $63.18 billion, suggesting a slight cooling in speculative positioning. In accordance with Coinglass, whole liquidations over the previous 24 hours reached $697,890, with lengthy positions accounting for $359,070 and shorts totaling $338,820. The comparatively balanced liquidations between bulls and bears indicate indecision available in the market as merchants look ahead to stronger directional indicators.