- Bitcoin should keep above $82K to keep away from $1.13 billion in liquidations and elevated volatility following Bitcoin reserve

- Investor sentiment weakened after Trump’s Bitcoin reserve plan excluded new BTC purchases.

- Upcoming U.S. financial knowledge, together with CPI and job studies, might influence Bitcoin’s worth.

The worth trajectory of Bitcoin is in peril because it hovers across the vital $82,000 assist stage. Analysts warn {that a} weekly shut beneath this stage can set off over $1.13 billion price of leveraged lengthy liquidations on exchanges. Which is resulting in heightened volatility for the crypto market.

Trump’s Bitcoin Reserve and Market Response

The current worth weak spot follows an government order signed by then U.S. President Donald Trump on March 7. The order outlined proposals to determine a U.S. Strategic Bitcoin Reserve utilizing seized Bitcoin from legal circumstances.

This transfer upset buyers who had been eagerly awaiting outright federal Bitcoin purchases as an indication of institutional endorsement. Bitfinex analysts said that the dearth of lively authorities funding led to short-term bearish sentiment, contributing to the decline in Bitcoin’s worth.

“Traders needed federal accumulation to be an indication of strong institutional assist, possibly to push costs greater. However utilizing holdings which are based mostly on at present allowed expectations to stay in verify,” Bitfinex analysts defined.

Macroeconomic Developments

Aside from the regulation selections, Bitcoin’s worth continues to be influenced by macroeconomic developments. Nexo analyst Iliya Kalchev talked about that Bitcoin’s short-term costs shall be influenced by future U.S. releases.

Everybody shall be holding their breath subsequent week for the Shopper Value Index (CPI) and job openings report. These numbers will inform us of inflation traits and labor market well being, and that shall be one thing that may affect investor sentiment,” Kalchev mentioned.

If inflation slows down and labor market situations worsen, expectations for rate of interest cuts might enhance, which might be useful for Bitcoin as a diversification car. Alternatively, stronger-than-anticipated financial information might proceed to position downward stress on the worth of Bitcoin.

Technical Indicators

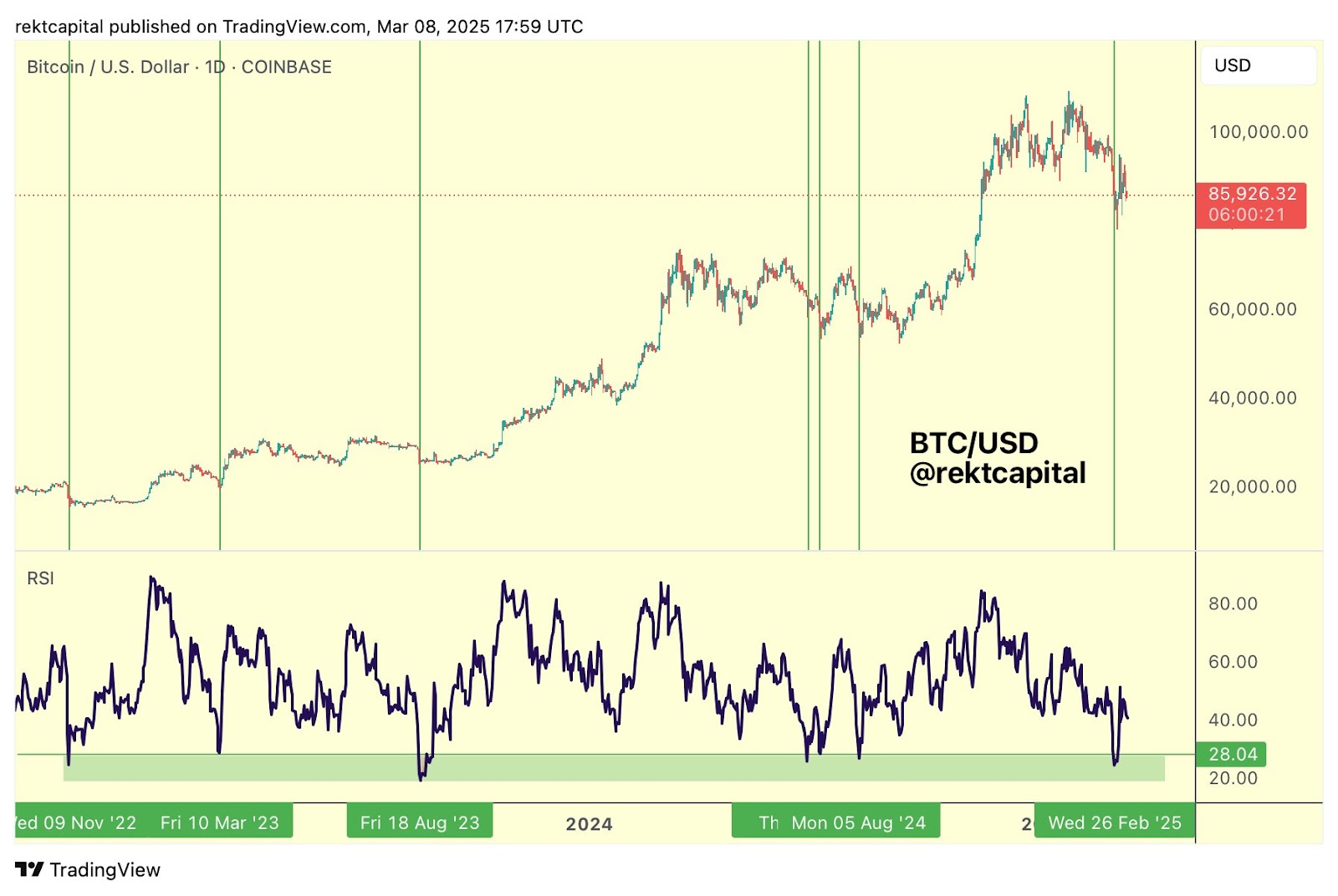

Regardless of the bearishness, some technical indicators say that Bitcoin is close to an area backside. Relative Power Index (RSI), or a measurement of whether or not or not an asset is overbought or oversold, reads 28 on the day by day chart. Traditionally, at any time when the RSI for Bitcoin is round this quantity, the worth bottomed or got here inside 2%–8% of doing so.

If Bitcoin ends the week greater at above $82,000, it may well ship a message to vary sentiment and assist mend investor confidence. However a break beneath will deliver extra volatility to the decrease facet, and so merchants and buyers maintain their breath for that to occur.

Because the market is processing Trump’s reserve method to Bitcoin and macroeconomic developments. Thus, everybody sits and waits and observes if Bitcoin maintains its vital assist stage for the subsequent a number of days.