Bitcoin’s value efficiency stays subdued, with the cryptocurrency buying and selling above $97,000 on the time of writing—a roughly 6.5% decline over the previous week. The crypto asset has but to reclaim the $100,000 degree it misplaced earlier this week, leaving market members unsure in regards to the near-term route.

Amid this backdrop, one CryptoQuant contributor, referred to as caueconomy, offered an evaluation of a big growth involving Bitcoin’s trade withdrawals.

Largest Alternate Withdrawals Since FTX Collapse

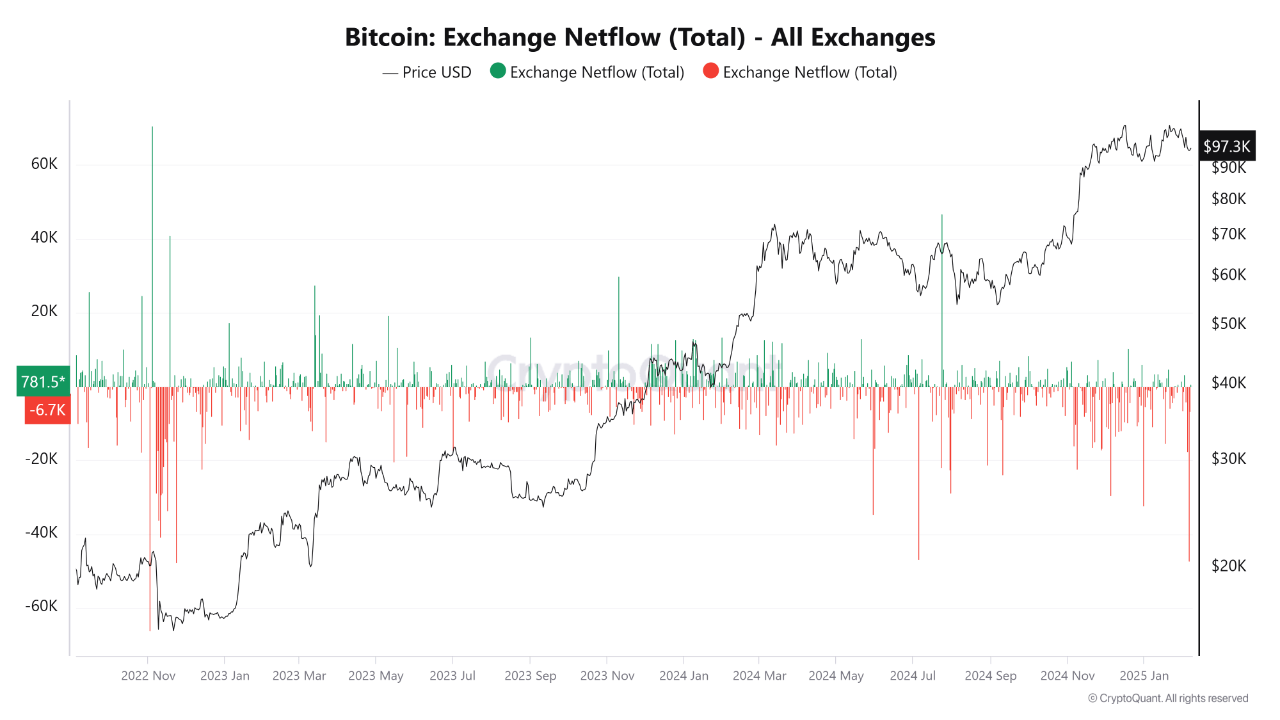

In a current put up, caueconomy highlighted the biggest quantity of trade withdrawals because the FTX collapse. In line with the information, over 47,000 BTC had been faraway from trade reserves.

Whereas a few of these actions could also be inner, additionally they point out potential accumulation by a big market participant or institutional entity. This pattern of Bitcoin shifting off exchanges sometimes indicators a long-term bullish perspective, as fewer cash accessible for buying and selling might result in diminished sell-side strain over time.

Nevertheless, the analyst clarified that this shift doesn’t produce an instantaneous provide shock able to impacting Bitcoin’s value within the quick time period. As an alternative, it factors to a gradual accumulation part that might present assist for future value appreciation.

The most important quantity of trade withdrawals because the collapse of FTX

“Whereas these withdrawals don’t mirror an instantaneous “provide shock” to the value of bitcoin… it nonetheless reveals a pattern of accumulation by giant gamers.” – By @caueconomy

Full put up 👇https://t.co/ZjYBijDOZp pic.twitter.com/ZEWj95wtfD

— CryptoQuant.com (@cryptoquant_com) February 7, 2025

Bitcoin Breakout On The Horizon?

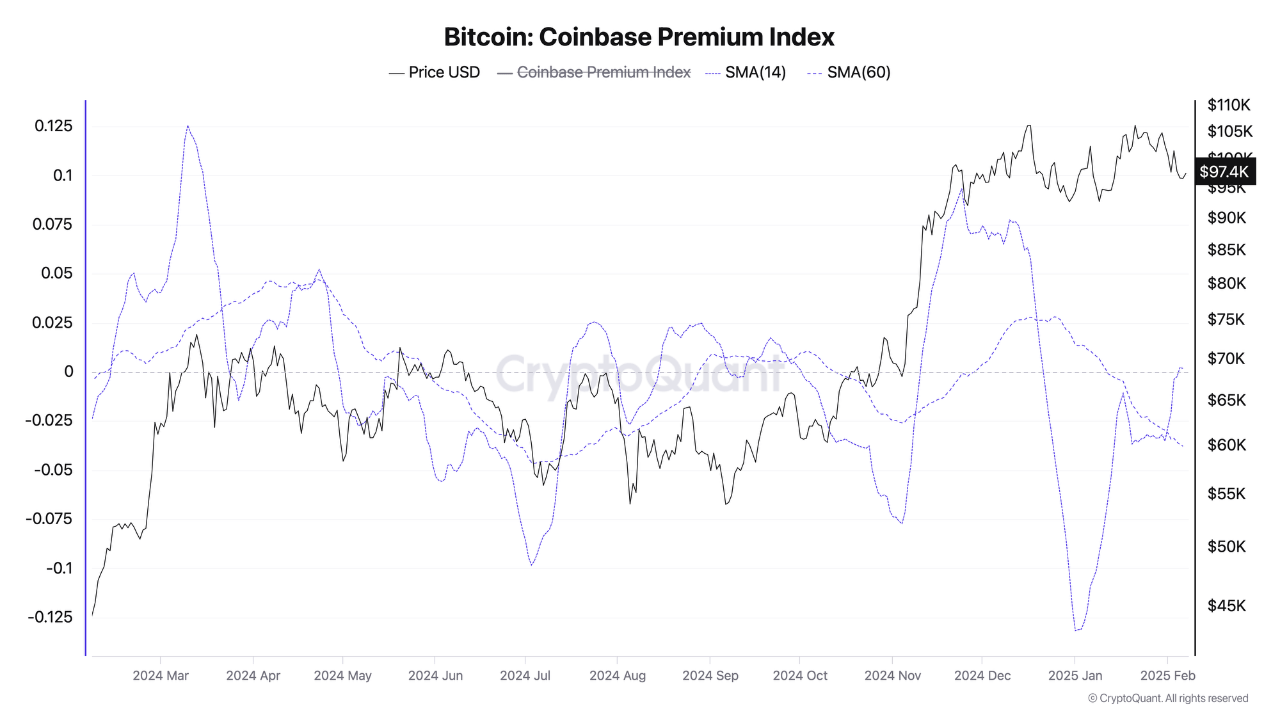

In the meantime, one other CryptoQuant analyst, Onatt, provided insights into potential breakout situations for Bitcoin. Onatt pointed to the robust shopping for curiosity captured within the Coinbase Premium Index, a measure that compares Bitcoin’s value on Coinbase to different exchanges.

A optimistic premium usually displays heightened demand from institutional buyers, suggesting that the market’s upward potential is undamaged. Onatt additionally famous the crossover of key shifting averages—SMA14 and SMA60—indicating a doable build-up of bullish momentum.

The analyst additional highlighted Bitcoin’s rising correlation with gold and the S&P 500, indicating that the cryptocurrency’s efficiency might align extra carefully with conventional danger belongings. If the broader monetary markets undertake a “risk-on” sentiment, Bitcoin may see an upward pattern.

Moreover, Federal Reserve Chairman Jerome Powell’s current feedback concerning the restricted affect of employment knowledge on inflation have helped stabilize market expectations. So long as financial knowledge stays inside forecasted ranges, optimistic sentiment towards Bitcoin and different danger belongings might proceed to develop.

Featured picture created with DALL-E, Chart from TradingView