Bitcoin’s sharp decline over the weekend has doubtless pushed the mixture investor place within the largest spot Bitcoin exchange-traded fund (ETF) into destructive territory, underscoring the severity of the current downturn.

In response to Bob Elliott, chief funding officer at asset supervisor Limitless Funds, the typical greenback invested in BlackRock’s iShares Bitcoin Belief (IBIT) is now underwater following Friday’s shut. The shift coincided with a steep drop in Bitcoin’s (BTC) value, which slid into the mid-$70,000 vary.

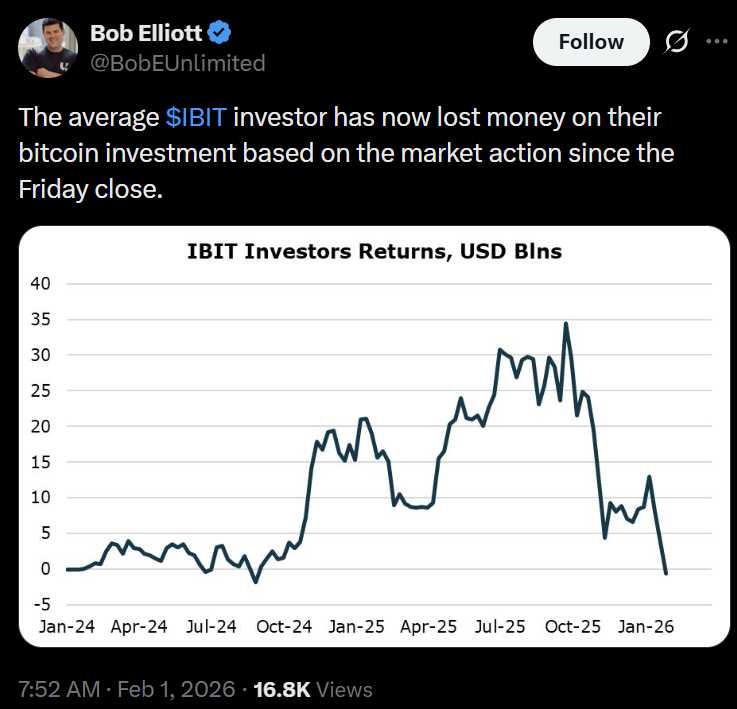

Supply: Bob Elliott

Elliott shared a chart monitoring combination, dollar-weighted investor returns, exhibiting cumulative positive aspects slipping barely into destructive territory as of late January.

The information counsel that whereas early IBIT traders should still be in revenue, heavier inflows at increased value ranges have pulled total dollar-weighted returns beneath zero. In impact, cumulative positive aspects because the fund’s launch have now been erased on a dollar-weighted foundation.

By comparability, IBIT’s dollar-weighted returns peaked at roughly $35 billion in October, when Bitcoin was buying and selling at document highs.

IBIT is considered one of BlackRock’s most profitable ETF launches, turning into the quickest fund to achieve $70 billion in belongings beneath administration. In October, studies confirmed that IBIT generated about $25 million extra in charges than the asset supervisor’s second-most worthwhile ETF.

Unbiased information on Yahoo Finance reveals that IBIT’s web asset worth has declined in current weeks, aligning with the broader Bitcoin sell-off. The decline helps clarify why combination, dollar-weighted investor returns have shifted into destructive territory.

Associated: Crypto’s 2026 funding playbook: Bitcoin, stablecoin infrastructure, tokenized belongings

Bitcoin ETF outflows speed up

The deterioration in dollar-weighted returns for Bitcoin ETFs is unfolding alongside a broader pullback from crypto funding merchandise, as traders cut back publicity amid declining costs.

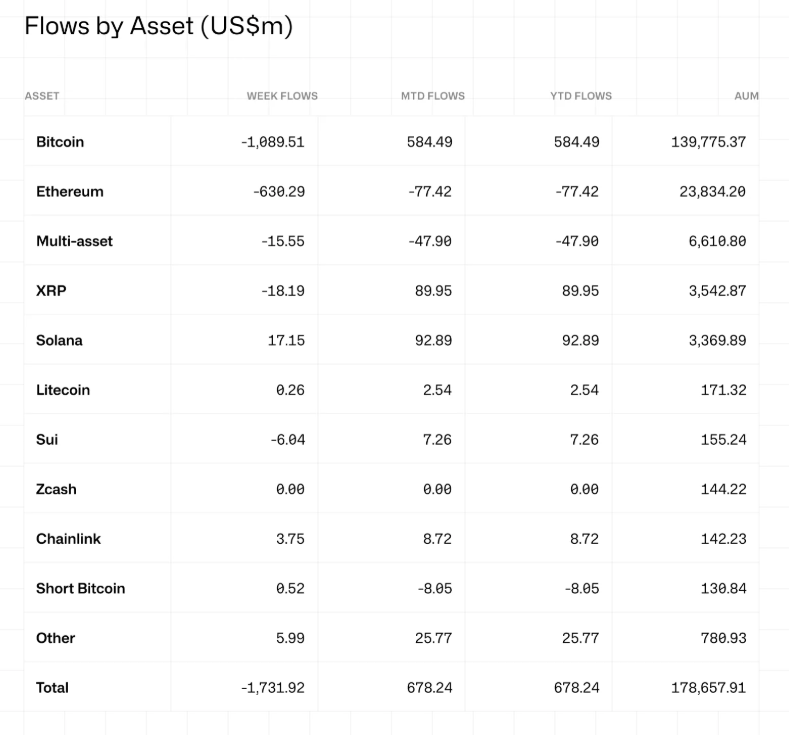

Within the week to Jan. 25, digital asset funding merchandise recorded almost $1.1 billion in outflows from Bitcoin funds alone, whereas complete crypto fund outflows reached $1.73 billion — the biggest weekly withdrawal since mid-November, in response to CoinShares. The outflows had been closely concentrated in the USA.

“Dwindling expectations for rate of interest cuts, destructive value momentum and disappointment that digital belongings haven’t participated within the debasement commerce but have doubtless fuelled these outflows,” CoinShares stated.

Weekly fund outflows, as reported on Jan. 26. Supply: CoinShares

The “debasement commerce” refers to positioning in belongings anticipated to protect worth amid inflation and foreign money dilution. Bitcoin was broadly seen as a candidate for that function due to its fastened provide and financial design.

Nonetheless, it has but to draw these flows to the identical extent as gold. Regardless of a current pullback, gold has remained in a sustained uptrend for greater than a yr and lately reached document highs above $5,400 per troy ounce.

Associated: $1.82B pulled from spot Bitcoin and Ether ETFs amid metals rally