Bitcoin lately flashed some key bullish indicators, however low quantity means that large merchants are nonetheless cautious.

Bitcoin is lastly displaying some bullish indicators. On Thursday, April 18, Scott Melker, generally known as The Wolf Of All Streets to his many followers, identified that Bitcoin (BTC) closed above the 50-day easy transferring common with a robust candle. Whereas the worth corrected to $84,349, it’s nonetheless above the 50-day SMA stage of $84,202.

$BTC DAILY

Bitcoin lastly closed a robust each day candle properly above the 50-day transferring common – a notable technical growth, particularly since that transferring common is starting to curve upward once more. It’s the primary convincing shut above the 50 MA in months, signaling a… pic.twitter.com/JhERbZPmgp

— The Wolf Of All Streets (@scottmelker) April 18, 2025

This motion hasn’t occurred since February 3, indicating a possible optimistic shift in momentum. Nevertheless, different indicators increase doubts. For one, whereas Bitcoin is buying and selling above the 50-day SMA stage, it’s nonetheless beneath the 50-day exponential transferring common, which is at $85,328.

You may additionally like: Bitcoin at a crossroads: will this key resistance set off a breakdown or breakout?

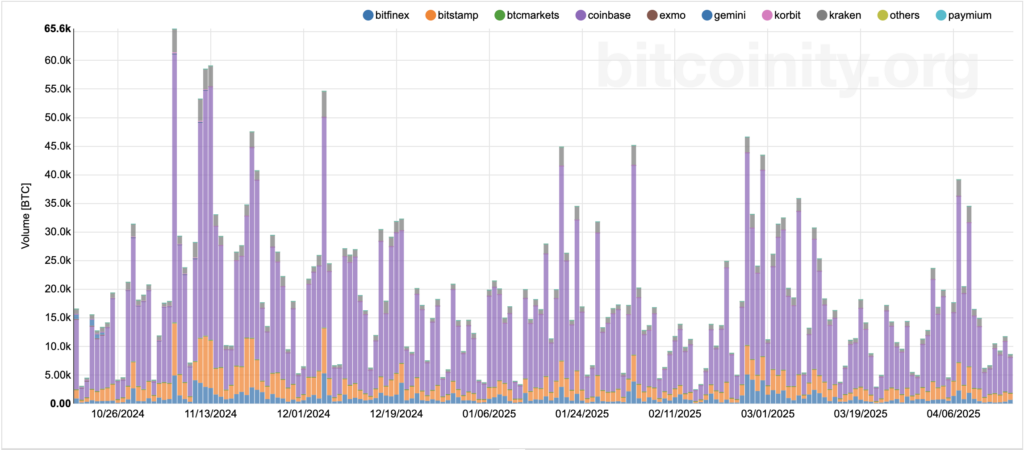

Low volumes imply dangerous information for Bitcoin

The token broke by means of this stage a number of instances over the previous week however was unable to maintain the momentum. On the identical time, Melker factors out that low buying and selling quantity means that patrons are nonetheless reluctant to affix the market.

As an illustration, buying and selling quantity on main exchanges amounted to about 8,000 BTC on April 17, considerably down from final week’s ranges. On April 9, for instance, buying and selling quantity on main exchanges was round 26,000 BTC.

You may additionally like: Morgan Stanley exec says Trump’s threats to Fed chief Powell is ‘noise’

This implies that buyers are possible ready for optimistic macro information, which has been missing in latest weeks. Notably, the continuing commerce struggle with main U.S. companions is inflicting fears over a possible financial recession. On the identical time, the Federal Reserve is sluggish so as to add help, fearing that U.S. tariffs, particularly on China, would give rise to home inflation.

In any case, Bitcoin will face resistance on the $85,000 stage, which corresponds to a long-term descending channel forming from its January all-time excessive. And if volumes proceed to say no, the asset dangers falling to the channel’s midline at round $75,000.

You may additionally like: Bitcoin worth continues to be in a bullish development, long-term chart reveals