Bitcoin’s rally to a brand new all-time excessive of $122,054 has triggered a wave of profit-taking throughout the market. On-chain information reveals indicators that institutional urge for food may additionally be cooling.

After a powerful six-week streak of internet inflows into US-listed spot Bitcoin ETFs, this week has seen a reversal, with a number of funds recording outflows.

Institutional Buyers Pull $199 Million From BTC ETFs

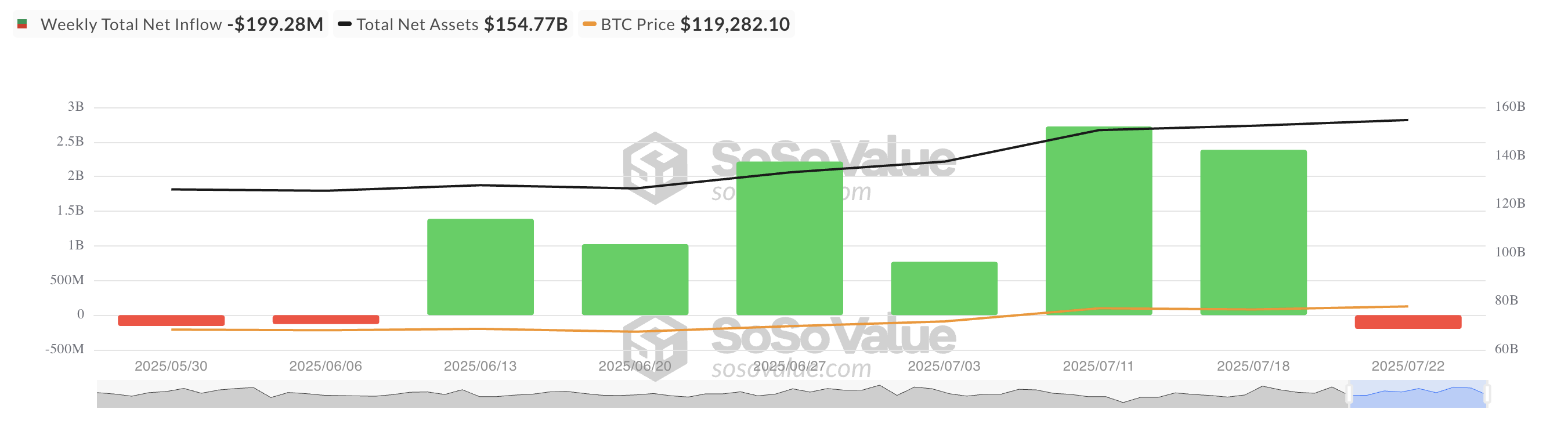

In line with information from SosoValue, spot Bitcoin ETFs have reversed their six-week streak of internet inflows, recording outflows totaling $199 million this week. The shift marks a big sentiment change amongst institutional traders, who had steadily amassed BTC publicity by means of ETFs all through a lot of the latest rally.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

Bitcoin Spot ETF Web Influx. Supply: SosoValue

This pullback follows the coin’s surge to a brand new all-time excessive of $122,054 on July 14. A number of traders who had been eyeing a decisive breakout above $120,000 seem to have seized the chance to exit positions and lock in beneficial properties.

ETF flows are broadly thought to be a key indicator of institutional confidence. A pointy drop in inflows, particularly following sustained accumulation, means that institutional danger urge for food is cooling. It signifies that even seasoned holders—typically seen as having “diamond arms”—look like taking earnings.

Whereas this isn’t essentially an indication of long-term bearishness, it does mirror rising short-term warning available in the market.

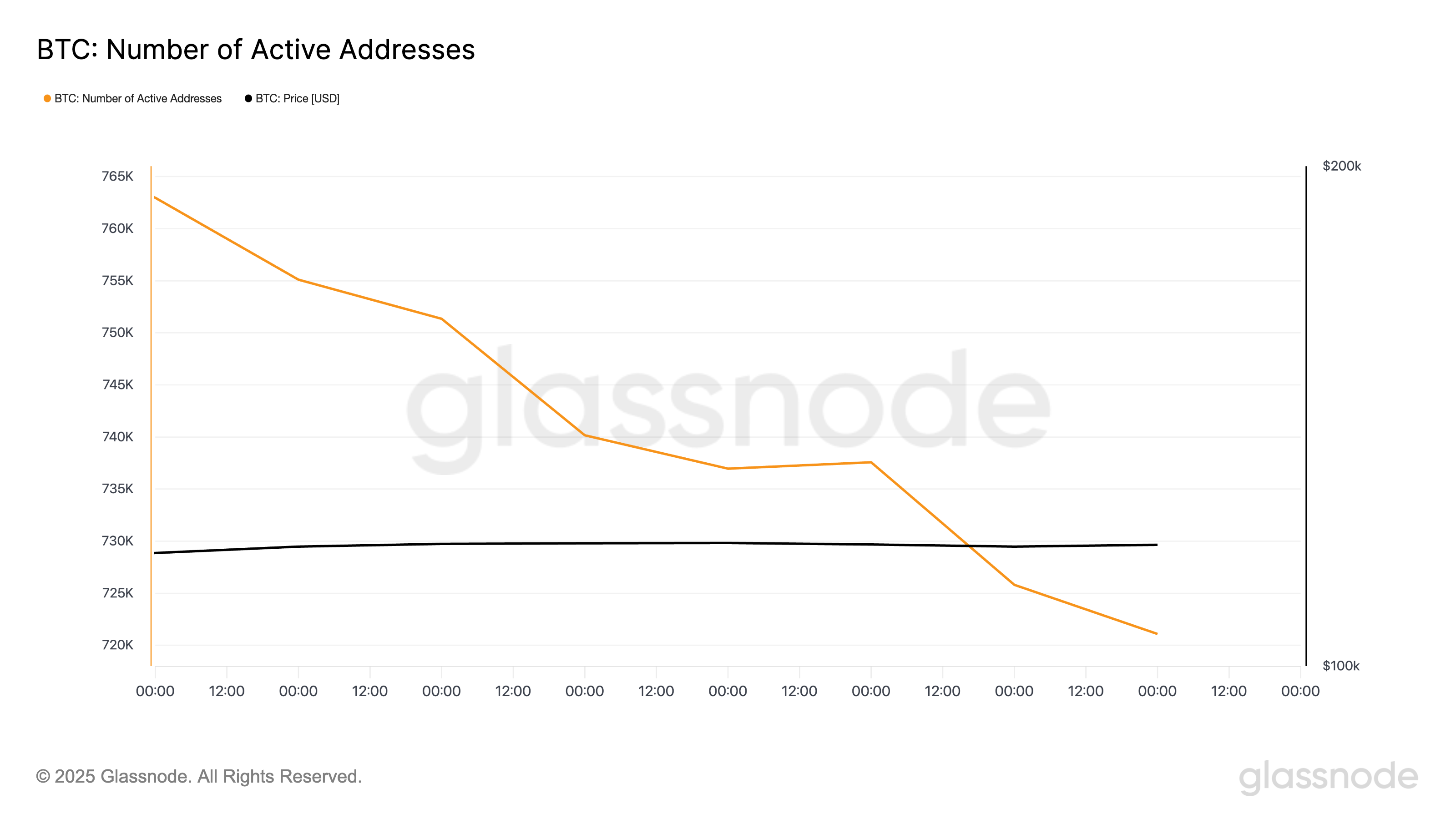

Moreover, Glassnode information reveals weakening on-chain exercise, which might exacerbate BTC’s draw back dangers. In line with the information supplier, the variety of energetic distinctive addresses on the Bitcoin community has plummeted progressively over the previous seven days. Yesterday, it closed at a weekly low of 721,086 addresses.

BTC Variety of Energetic Addresses. Supply: Glassnode

When institutional capital begins to drag again and retail exercise slows concurrently, it signifies a broader market pause, rising the probabilities of a near-term BTC worth correction.

BTC Eyes $120,000 Breakout, However Weak Demand Threatens Drop

Readings from the BTC/USD one-day present that the king coin has largely trended inside a variety since reaching an all-time excessive of $122,054 on July 14. It now faces resistance at $120,811, with a help flooring shaped at $116,952.

With waning demand, the coin dangers testing this help degree. BTC’s worth dangers falling to $114,354 if it fails to carry.

BTC Worth Evaluation. Supply: TradingView

Nevertheless, if new demand enters the market, the coin might breach the $120,811 barrier and try and reclaim its all-time excessive.