The cryptocurrency has recovered from the tumble brought on by the Center East battle almost two weeks in the past, nevertheless it’s been largely flat since yesterday.

BTC Largely Flat as Shares Soar

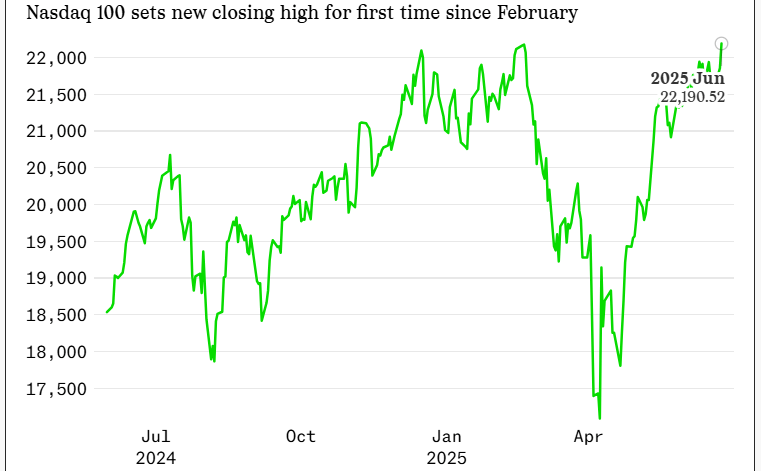

The tech-focused Nasdaq index reached a report closing on Tuesday, rallying all the best way to 22,190.52, and the S&P 500 can be hovering mere inches away from its personal all-time excessive, however bitcoin seems to have stalled at $107K after rebounding from the sub-$100K costs seen within the wake of the Israel-Iran conflict on June 13.

Inventory markets have proven shocking resilience within the face of compounding macroeconomic adversity. First it was tariffs, then it was the Fed’s reluctance to chop charges, and most lately it has been the unfolding battle within the Center East which nonetheless isn’t totally resolved.

(The Nasdaq reached closed at all-time excessive of twenty-two,190.52 on June 24,2025 / Sherwood Information)

However regardless of fears of a worldwide commerce conflict after the Trump administration launched its controversial tariff coverage and the potential of a spike in oil costs after Israel and the U.S. attacked Iran, inventory markets have continued to rally. Bitcoin nonetheless, has been on the sidelines, holding regular at $107K.

Overview of Market Metrics

Bitcoin was buying and selling at $107,217.18 on the time of reporting, down barely by 0.15% over the previous 24 hours. The worth has moved inside a comparatively slim vary of $106,666.35 to $108,305.54 since yesterday. The cryptocurrency stays up 2.77% on the week.

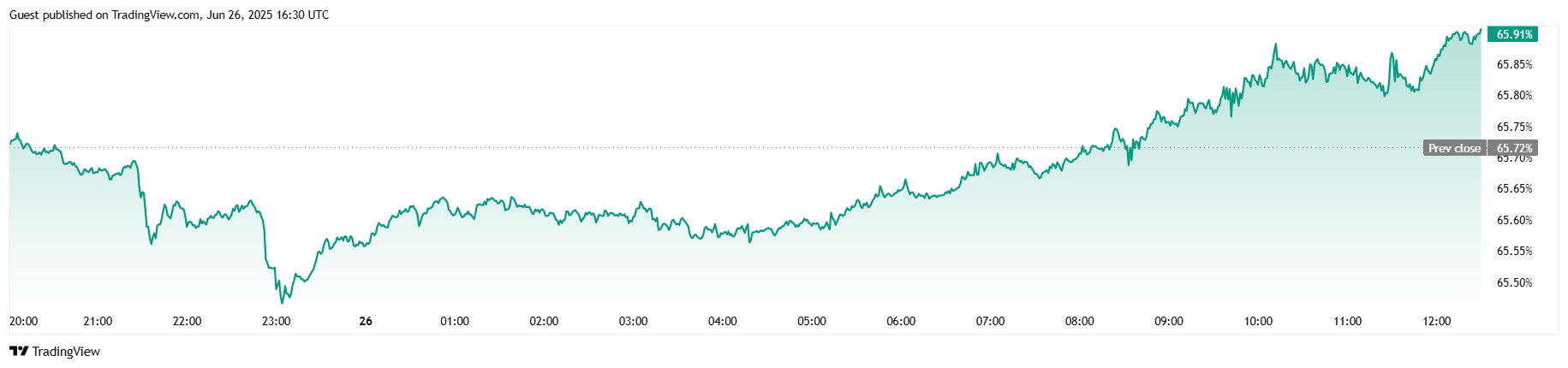

( BTC worth / Buying and selling View)

Buying and selling quantity over 24 hours slipped 15.46% to $44.03 billion, indicating cooling market exercise. Bitcoin’s whole market capitalization edged decrease to $2.13 trillion, down 0.16% from yesterday. BTC dominance nonetheless, has been rising for the previous few days and at present stands at 65.91%, a 0.30% achieve from yesterday.

( BTC dominance / Buying and selling View)

BTC futures open curiosity dipped barely by 0.72% to $73.82 billion, and Coinglass liquidation knowledge reveals a grand whole of $42.75 million in liquidations. Roughly $27.45 million of that was from bearish quick positions and the remainder, $15.30 million, was from overeager longs.