- Bitcoin’s value fell practically 6.50% this week, largely pushed by liquidations in lengthy positions.

- Analysts give attention to the $109,000 help stage, with potential draw back if it’s damaged.

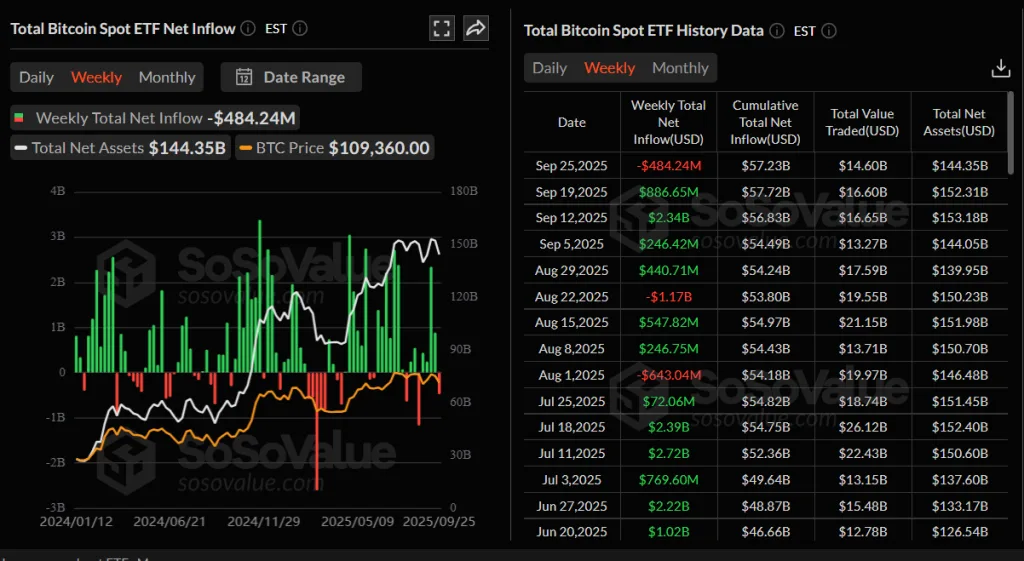

- A $484 million outflow from Bitcoin ETFs highlights weakened institutional demand this week.

The market is witnessing a large change with Bitcoin slumping all the way down to $109,000, which is a 6.50% drop this week. This dip follows a large liquidation occasion within the cryptocurrency market. A lot of the losses had been in lengthy positions, reflecting a shift in market sentiment. Crypto analyst Ted highlighted the $109,000 help stage as a key level of focus. If Bitcoin maintains this stage, a rebound could possibly be attainable.

Analysts recommend that if this help holds, Bitcoin might goal upward ranges of $112,000 and $115,000. Nevertheless, if the worth breaks by way of this help, additional declines to $107,000 and $106,000 would possibly comply with.

Supply: X

Bitcoin’s False Breakout and Key Help Ranges

Crypto Robotics noticed Bitcoin’s motion on Thursday, noting a false breakout. Bitcoin examined the $113,800 zone earlier than rapidly reversing. The value then dropped to the $111,600-$110,500 space, the place vital quantity had collected. This value motion confirmed market imbalance and a scarcity of sustained momentum above key ranges.

The present market outlook suggests a possible resumption of shopping for if sure ranges maintain. A crucial quantity zone shaped between $112,000 and $111,300. A break up from this area would assist improve the probabilities for Bitcoin to rally into some increased resistance. Based on the analyst, a protracted could possibly be taken on some consolidation above the zone or if the worth reacts as such.

Supply: X

But when it fails to keep up this stage, there are extra potential dangers on the draw back. The following help stage merchants are watching is round $108,000. A failure right here might lead to one other spherical of promote strain and value fluctuations.

Bitcoin’s Sharp Decline and Market Shifts

Bitcoin opened the week with a decline of greater than 2% on Monday. The drop spurred the most important one-day liquidation occasion of the 12 months — $1.65 billion price of longs had been liquidated. Solely $145.83 million price of brief positions had been liquidated, signalling that the market is just too bullish. This flip available in the market quickly modified merchants’ expectations for the week.

Associated: Crypto Market Hit by $1.65B Liquidation as Ethereum Leads

The decline endured, and Bitcoin fell to lower than $109,000 on Thursday. Greater than $1.09 billion in positions had been liquidated throughout one other sell-off. The market’s persistently bearish sentiment all through the week indicated doubts as as to whether present value ranges are viable and if market help was robust.

Supply: Coinglass

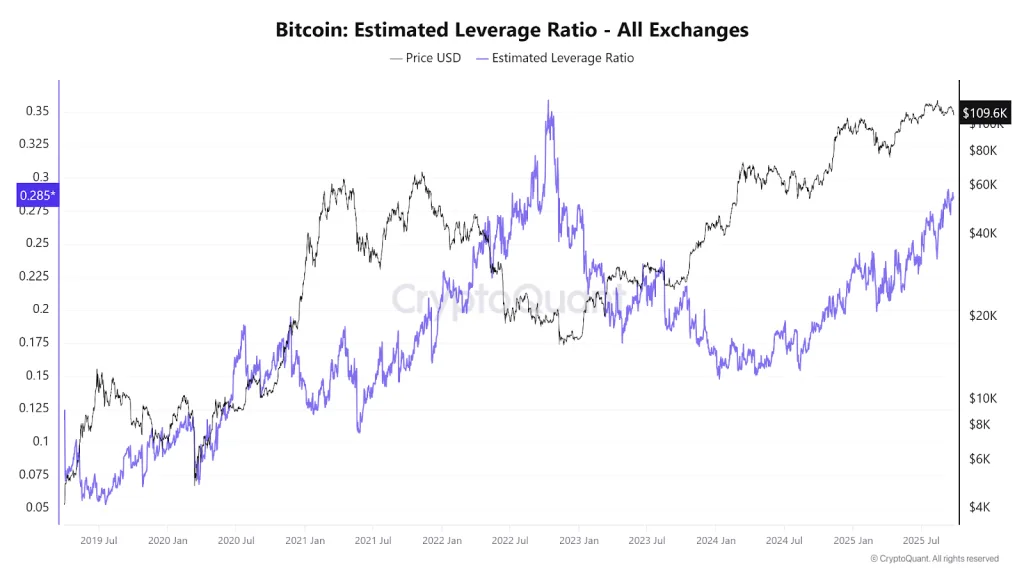

Even after the mass liquidations, Bitcoin’s ELR on Friday remained at 0.285. That was close to the annual excessive of 0.291 set on September 11. But it surely was decrease than the all-time excessive of 0.358 set in 2011. This is a sign that (whereas they’re leveraged positions) merchants aren’t stretched in such a means that might act because the catalyst for one more debilitating drop.

Supply: CryptoQuant

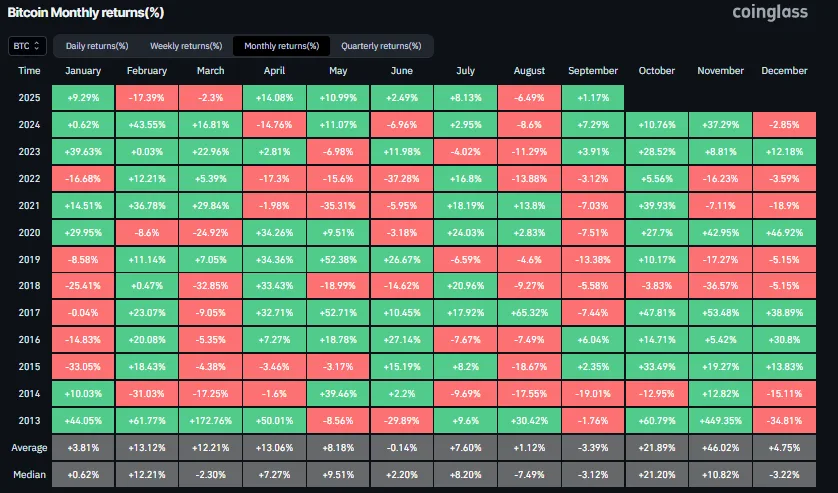

CoinGlass historic information exhibits September has historically been a troublesome month for Bitcoin, registering -3.39% common returns. Bitcoin is up 1.17% this month, however be careful. The month would possibly nonetheless finish in damaging territory, as is typical at this level within the calendar.

Supply: Coinglass

Weakening institutional demand additionally contributed to the drop in Bitcoin’s value. In the meantime, Bitcoin spot ETFs noticed an outflow of $484.24 million by Thursday. This ended a four-week stretch of optimistic inflows and suggests investor sentiment is altering. Additional outflows might lead to extra value volatility and deeper corrections close to time period.

Supply: SoSo Worth

With traders watching Bitcoin’s rise and fall, the outlook is murky. The ratio between shopping for and promoting strain might outline Bitcoin’s subsequent transfer within the brief time period. The important thing help and resistance ranges must be noticed carefully by merchants when taking future positions.

Disclaimer: The knowledge offered by CryptoTale is for instructional and informational functions solely and shouldn’t be thought-about monetary recommendation. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any funding choices. CryptoTale isn’t answerable for any monetary losses ensuing from the usage of the content material.