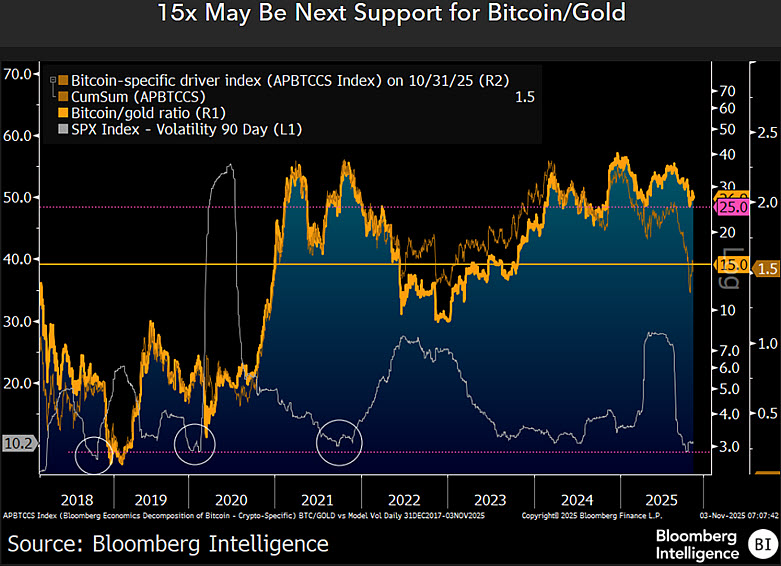

Mike McGlone of Bloomberg Intelligence warns that Bitcoin could possibly be coming into its weakest interval relative to gold since 2018. In line with his newest mannequin, the Bitcoin-to-gold ratio might probably break down under the 25 ground.

This is able to open the trail towards 15, erasing almost 60% of Bitcoin’s relative energy towards the valuable metallic it as soon as outperformed.

The ratio, which measures what number of ounces of gold equal one Bitcoin, peaked close to 60 in late 2021. Since then, it has remained flat, mirroring Bitcoin’s problem in establishing a transparent pattern, whereas gold has quietly set new report highs.

McGlone notes that the ratio has been stagnant for about 5 years, and the current downward pattern signifies renewed bearish strain.

Ugly reality

Charts from Bloomberg present the ratio bouncing off 25 a number of occasions this 12 months, with every restoration weaker than the earlier one. The most recent take a look at occurred alongside a gentle rebound in U.S. Treasury yields, with the 10-year yield rising above 4%, and a rise in fairness volatility.

Gold’s resilience within the face of charge cuts, mixed with Bitcoin’s underreaction, suggests fading demand for the cryptocurrency. McGlone describes this as a possible “inflection level for threat belongings.” If the sample breaks decrease, he initiatives a structural change by which gold reclaims its safe-haven dominance.

After years of competing for a similar narrative, Bitcoin’s digital gold comparability might quickly endure its most difficult actuality examine since its creation.