At this second, the Bitcoin market at present exhibits a section of respiration under $92,000, with short-term weak spot however the general image nonetheless set to rise.

EMA20, EMA50 and volumes”

EMA20, EMA50 and volumes”loading=”lazy” />

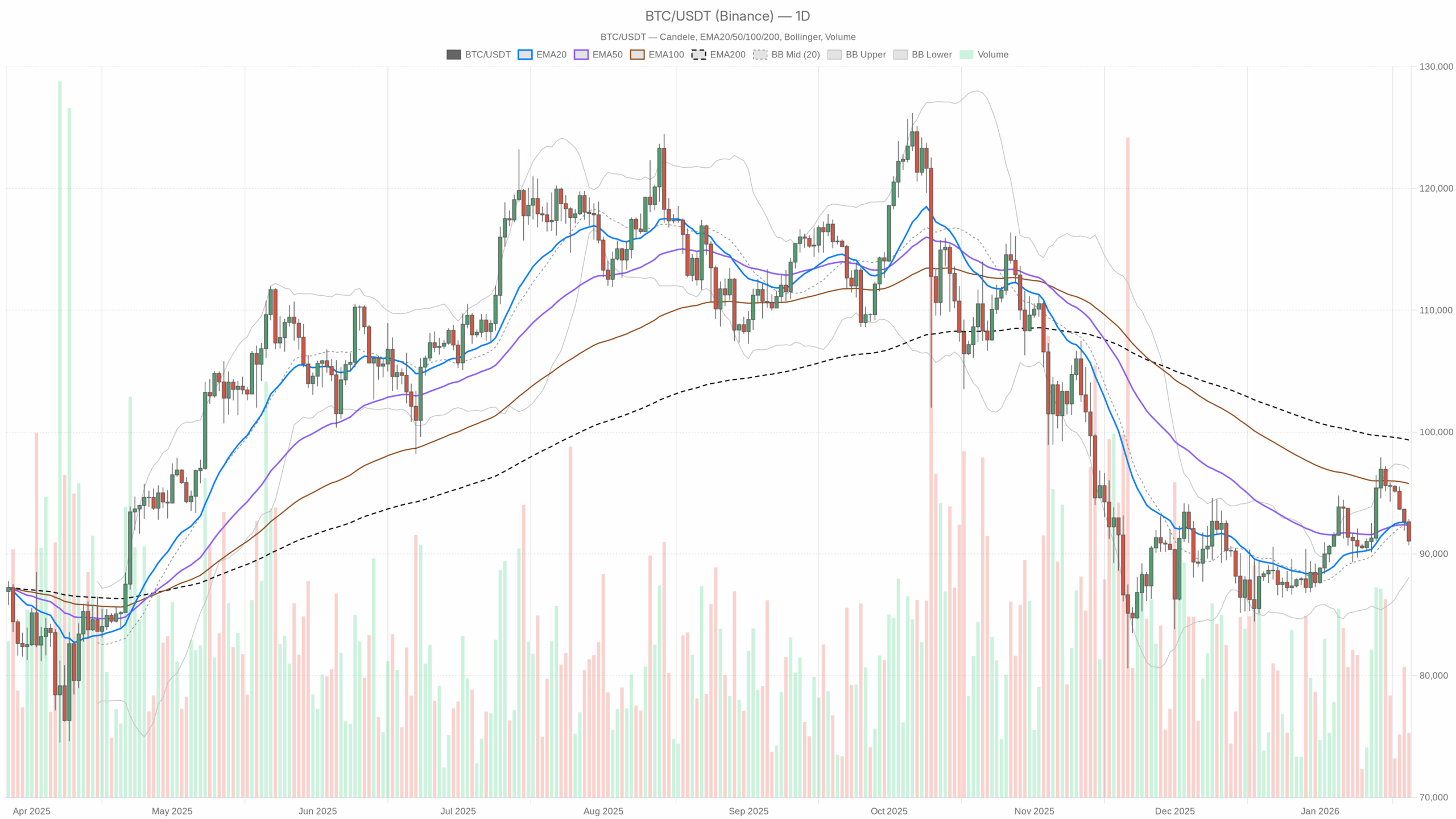

Each day Context: Bitcoin at present between $90,000 and $93,000, orderly however fragile respiration

On the each day (D1) timeframe, the value of Bitcoin at present is transferring round $91,054, barely under the primary each day pivot at $91,538. There may be not but a structural break within the underlying development, however promoting stress is growing in comparison with current days.

Each day Transferring Averages (EMA): worth under the short-term, removed from the long-term

- EMA 20 D1: $92,438.93

- EMA 50 D1: $92,338.20

- EMA 200 D1: $99,351.85

The worth is barely under the 20 and 50 each day averages, however has not but decisively deserted them. This implies a lack of bullish momentum within the quick time period, reasonably than a real bearish development. The space from the EMA 200 above $99,000 signifies that the long-term development stays upward, however we’re in a zone of potential short-term distribution. So long as BTC stays under $92,500–$93,000, consumers are on the defensive.

Each day RSI: stability barely tilted in the direction of sellers

RSI 14 D1: 46.47

There may be neither euphoria nor panic right here: we’re barely under the complete neutrality threshold. This means a market the place promoting stress is doing its job, however with out extremes. It’s not a transparent exhaustion level, extra of a cooling of the development after the current rally.

Each day MACD: shortness of breath sign on the rise

- MACD Line: 969.84

- Sign Line: 1,100.91

- Histogram: -131.07

With the MACD line slightly below the sign line and a barely damaging histogram, we have now an image of bullish momentum in a discharge section. It’s not but an aggressive decline, however a sign per a market that’s consolidating after working too quick.

Each day Bollinger Bands: central consolidation, average volatility

- Mid BB: $92,527.33

- Higher Band: $96,990.79

- Decrease Band: $88,063.87

The worth of Bitcoin at present is slightly below the central band, in the midst of the $88,000–$97,000 vary. This outlines a broad lateral section after the earlier rally. We’re not compressing on the decrease band, which might sign aggressive promoting, however we’re shedding the higher a part of the channel. In observe: medium consolidation, short-term bearish stress.

Each day ATR: volatility in keeping with a “regular” correction

ATR 14 D1: $2,188.04

Common each day oscillations simply above $2,000 are constant however not excessive for BTC at these worth ranges. Which means 2–3% corrections in a single day fall inside normality. The chance is actual, however we aren’t but seeing panic promoting.

Each day Pivot Level: space $91,500 as short-term middle

- Pivot (PP): $91,538.87

- Resistance R1: $92,384.74

- Help S1: $90,207.74

The Bitcoin worth at present is barely under the each day pivot. This positioning displays a extra cautious intraday sentiment. The $90,200–$91,500 vary is the hall to observe: above the pivot, some confidence returns, whereas under S1, the danger is of accelerations in the direction of the decrease Bollinger band.

Quick time period: H1 and M15 present bearish stress and native oversold

H1: short-term development within the fingers of sellers

On H1, BTC is quoted round $91,062 with a regime outlined as bearish by the system.

Hourly Averages (H1): worth crushed under all EMAs

- EMA 20 H1: $92,201.20

- EMA 50 H1: $93,133.39

- EMA 200 H1: $93,767.65

The worth is under all key intraday averages, with a typical short-term bearish development construction. So long as BTC stays under $92,200 on hourly shut, each rebound dangers being offered.

RSI H1: oversold, however with out a decisive rebound but

RSI 14 H1: 23.35

The image right here is evident: intense promoting has introduced the RSI into full oversold space. This opens the door to technical rebounds within the coming hours, however so long as the averages stay above the value, rebounds are to be thought of counter-trend.

MACD H1: bearish momentum nonetheless lively

- MACD Line: -622.69

- Sign Line: -488.52

- Histogram: -134.17

The MACD line is under the sign and the histogram stays damaging: the promoting momentum continues to be prevalent. The mixture with a really low RSI signifies a section the place sellers dominate, however additionally they begin to danger overdoing it within the very quick time period.

Bollinger Bands H1: worth glued to the decrease band

- Mid BB: $92,416.69

- Higher Band: $93,972.80

- Decrease Band: $90,860.58

The worth of BTC oscillates within the decrease a part of the channel, close to the decrease band. This confirms the intraday bearish stress and will increase the likelihood of false breakouts to the draw back, with potential spikes under $90,800–$90,500 adopted by fast rebounds.

ATR H1: nervous however not explosive intraday vary

ATR 14 H1: $462.38

Common hourly actions of virtually $500 point out a full of life intraday market: sufficient motion for buying and selling alternatives, however not but capitulation situations. Stops which are too tight danger being simply triggered.

Pivot H1: battle round $91,050

- Pivot (PP): $91,052.89

- R1: $91,124.99

- S1: $90,989.77

The citation is virtually glued to the hourly pivot. This highlights a section of micro-equilibrium after the decline: the market is deciding whether or not to show the correction into one thing extra critical or to shake off quick sellers with a rebound in the direction of $91,500–$92,000.

M15: technical rebound hinted, however nonetheless inside a weak context

On quarter-hour, the value is at $91,062, with the regime nonetheless assessed as bearish.

M15 Averages: worth under all, however with indicators of slowing descent

- EMA 20 M15: $91,391.74

- EMA 50 M15: $91,962.20

- EMA 200 M15: $93,195.30

Right here too, the value stays under all main short-term averages. Nonetheless, the gap is just not excessive: this typically anticipates lateral phases or small technical rebounds. To speak about an intraday reversal, a minimum of a secure restoration above the 20 after which the 50, due to this fact above $91,400 and $92,000, could be wanted.

RSI M15: weak spot, however now not in extra

RSI 14 M15: 37.05

In comparison with H1, right here we see a slight unloading of the oversold: sellers are slowing down, however management stays theirs. That is the standard context the place the value can float upwards with out actual power, leaving many merchants unsure.

MACD M15: first indicators of slowing decline

- MACD Line: -349.69

- Sign Line: -368.99

- Histogram: 19.30

The histogram has turned barely optimistic, indicating that the very short-term bearish momentum is shedding power. It’s not a structural reversal sign, however of potential consolidation or small squeeze upwards.

Bollinger Bands M15: worth approaching the common

- Mid BB: $91,375.48

- Higher Band: $92,212.75

- Decrease Band: $90,538.20

The Bitcoin at present 15-minute chart exhibits the value attempting to rise in the direction of the central band after a passage on the decrease band. This confirms the stabilization try, however so long as we don’t see closures above $91,400–$91,500, it stays a easy rebound in a weak development.

ATR M15: excessive intraday noise

ATR 14 M15: $308.87

A median tour over $300 in quarter-hour signifies a noisy operational context: these working with excessive leverage danger being thrown out by pure noise actions earlier than the actual motion takes course.

Crypto market and sentiment: excessive BTC dominance, managed concern

- Bitcoin Dominance: 57.5%

- Complete Market Cap: ~3.159 trillion $

- 24h Market Cap Change: -2.18%

- Concern & Greed Index: 32 (Concern)

Bitcoin stays on the middle of the market, with excessive dominance. Altcoins are struggling comparatively extra, typical of a average risk-off section. The sentiment in concern, however not excessive, is per the technical image: profit-taking, stops on overly aggressive longs, however nothing but resembling a generalized capitulation.

Bullish state of affairs for Bitcoin at present

To speak a couple of believable bullish state of affairs within the quick time period, a step-by-step path is required:

- Step 1 (intraday): protection of the $90,200–$90,800 zone (S1 each day and decrease band H1). Right here consumers should cease the extra aggressive bearish pushes.

- Step 2 (H1 affirmation): restoration and upkeep of the value above the H1 pivot at $91,050 and subsequent assault on $91,500–$92,000, with H1 RSI rising steadily above 40.

- Step 3 (each day validation): each day closure past $92,500–$93,000, i.e., above EMA 20/50 D1 and the central Bollinger band.

On this state of affairs, the value of BTC would remodel the present section right into a easy pullback inside a broader bullish development. The following technical targets would grow to be:

- Space $95,000–$97,000: higher a part of the each day Bollinger channel.

- Psychological zone $100,000: close to the EMA 200 D1 at about $99,350, a stage that separates medium-term volatility from a possible new impulsive leg.

The invalidation of the bullish state of affairs would include a decline and each day closure under $88,000–$88,500, equivalent to the decrease Bollinger band each day. This might remodel the pullback into an actual structural change, opening area for a deeper correction.

Bearish state of affairs for Bitcoin at present

The bearish state of affairs leverages the weak spot already evident on quick timeframes.

- So long as BTC stays under $92,200–$92,500 (EMA 20 H1 and each day pivot/R1 zone), each rebound dangers being offered.

- A decisive break under $90,200 (S1 each day) with growing volumes may set off a slide in the direction of $88,000–$88,500, the place the decrease Bollinger band D1 passes.

- If the final market sentiment have been to deteriorate additional, with crypto market cap falling over -5% each day and Concern & Greed within the 20 space, BTC may push in the direction of a deeper help vary within the $85,000–$86,000 space.

On this framework, the value of Bitcoin would stop to be a easy consolidation and grow to be a post-rally distribution section, with consumers compelled to reposition decrease.

The invalidation of the bearish state of affairs would as a substitute come from a fast restoration, accompanied by volumes, above $93,000 and a each day closure above the EMA 20/50, which might drastically cut back the draw back potential and shift the bias in the direction of the bullish state of affairs.

Learn how to learn the market context on BTC

Bitcoin is in that grey space that always causes extra harm to merchants than actual crashes: underlying development nonetheless wholesome, however short-term within the fingers of sellers. The each day speaks of orderly consolidation, whereas the intraday exhibits bearish stress with native promoting excesses.

What this means, in observe:

- Quick-term merchants should settle for that the present context favors false breakouts and volatility spikes, particularly close to $90,000–$90,500 and $92,000–$92,500.

- Place merchants see a market that’s merely cooling the rally: so long as each day closures stay above $88,000, the macro image is just not compromised.

- Getting into aggressively with leverage in these zones means exposing oneself to the danger of being hit by market noise earlier than the actual motion takes course.

In such a context, it makes extra sense to let the value present its hand: both a transparent restoration of short-term averages, thus a rebound state of affairs, or a transparent break of key helps with quantity affirmation, thus a structural decline state of affairs. Till then, a number of motion and little clear course.

If you wish to monitor the markets in real-time with superior charts {and professional} instruments, you’ll be able to open an account on Investing.com!:

Open your Investing.com account

This part accommodates a sponsored affiliate hyperlink. We might earn a fee however at no extra price to you.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely and doesn’t represent monetary recommendation or a solicitation to public financial savings. Buying and selling in crypto markets includes a excessive stage of danger: at all times rigorously consider your danger profile and, if obligatory, seek the advice of a professional skilled.